The Reality of Modern Banking Compliance

Regulation sets the rhythm of modern banking. Every action, product, and message sits inside its reach.

Across the United States and Europe, authorities such as the Securities and Exchange Commission (SEC), Financial Industry Regulatory Authority (FINRA), General Data Protection Regulation (GDPR), and Markets in Financial Instruments Directive (MiFID II) expect complete clarity in how banks record and protect information.

Each email, chat, and transaction must leave a trace that proves control. At scale, that demand becomes a daily test of structure and accuracy. However, many banks still rely on tools that work in pieces. Records live in different systems. Human checks fill the gaps. These habits slow down decisions and weaken proof.

Technology rebuilds that process from the ground up. When systems connect and data flows in real time, a banking compliance solution turns regulations into routine. Information aligns itself. Proof exists before it is needed. That is how control looks in today’s banking world: built, connected, and visible at every step.

The Structural Gaps That Weaken Banking Compliance

Compliance does not fail because banks ignore rules. It fails when the structure cannot keep up with the speed. In most institutions, the weakness is built into the design.

Legacy Systems Built for a Slower Market

Legacy platforms in many banks were designed to process transactions, not evidence. Every new rule must pass through old code and layered integrations. Updates that should take weeks stretch into months. By the time they are complete, another change has already arrived.

Fragmented Data Networks

Information flows across regions, products, and third-party systems with little alignment. A single record of communication can travel through multiple tools without a unified trail. When regulators ask for proof, teams spend days connecting fragments that should have been one line of evidence.

Manual Oversight at Scale

Compliance still relies on people to close gaps that systems leave open. They review logs, tag exceptions, and reconcile reports. This brings care but not endurance. As data expands, the process bends under its own weight.

Regulations That Move Faster Than Systems

Regulation has become a living system of its own. Each update shifts how banks must define, capture, and present proof. The challenge is not in knowing the rules but in converting them into code fast enough to stay ahead of audits. Many banks still treat compliance as documentation when it now functions as engineering.

Shared Responsibility Without Single Ownership

In most banks, compliance belongs to everyone and to no one. Risk, operations, and technology each hold a part of the process, yet none owns the full chain of control. This lack of accountability turns every audit into a reconstruction exercise.

These problems do not arise from intent but from design. Control scattered across systems cannot deliver trust. To rebuild that trust, a banking compliance solution is required that creates one version of the truth and keeps it visible at all times.

Key Technology Driving Compliance: CCM Software

Modern compliance cannot depend on isolated systems or manual reports. It needs a single structure that collects, connects, and explains every action. That structure is Customer Communication Management (CCM) software—a banking compliance solution built to unify control, transparency, and accountability.

Choose the Right CCM Solution for 2025

Learn how to pick, implement, and measure a platform that keeps your bank compliant and connected.

CCM is a digital platform that brings every compliance function into one controlled space. It connects monitoring, case tracking, reporting, and audit management so that banks can see the full picture of activity at any moment. As one of the most effective compliance solutions for banks, it ensures that all operations stay aligned with industry standards and internal policies.

Instead of chasing records across tools, teams work inside one system where information builds itself into a complete story: who did what, when, and why.

How CCM Helps Banks Solve Compliance Challenges

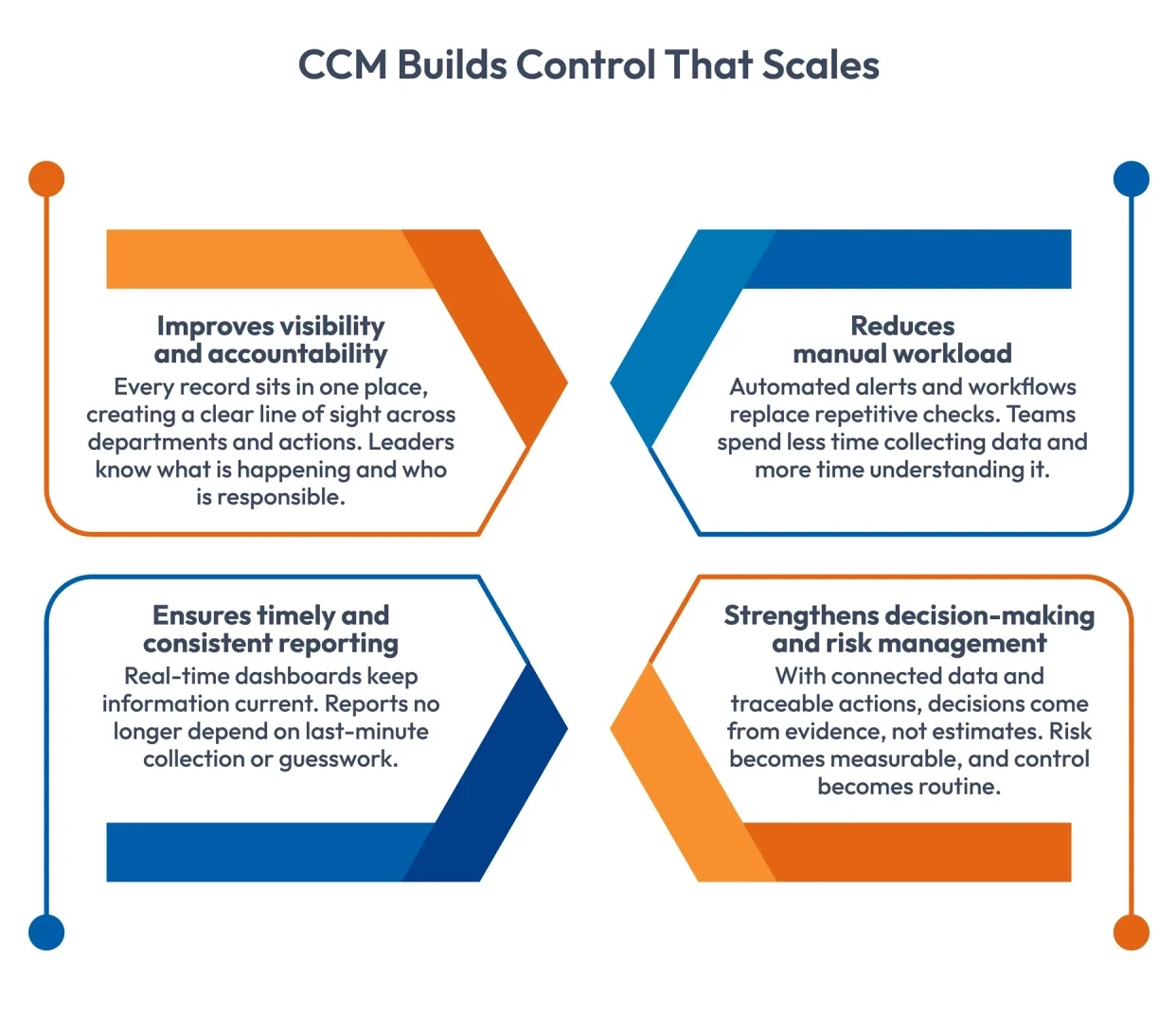

Technology does not replace control; it provides a structure that enables control to keep pace with scale. CCM software turns compliance from a reactive process into a built-in discipline, a true compliance solution for banks that simplifies governance and risk oversight.

Creating One Source of Proof

Banks store information across dozens of systems. Each update adds complexity and weakens traceability. CCM gathers all compliance data into one defined space. Every record connects to its origin and context. When regulators request evidence, it is already organized, complete, and ready for review, helping institutions meet banking industry regulations consistently.

Building Continuous Awareness

Compliance fails when monitoring depends on people catching exceptions. CCM creates constant awareness. It reviews communication and transaction data in real time, flags unusual behavior, and routes alerts to the right teams. This steady flow of insight allows banks to act before an issue grows into a violation.

Turning Reporting into Visibility

Most compliance reports describe the past. CCM makes reporting an active function. Dashboards show open cases, pending reviews, and ongoing investigations. Every decision is logged automatically, creating a trail that stands as proof. Visibility stops being an outcome and becomes a condition of work.

Linking Policy with Action

Policies only work when they are consistently put into action. CCM defines roles, assigns tasks, and tracks every step of a compliance event. Each action has a clear owner, and every outcome is supported by evidence. Instead of creating documents after the fact, CCM builds proof directly into the process, strengthening banking data compliance solutions that help institutions meet regulatory standards.

Adapting to Constant Change

Regulations shift often and without warning. CCM connects directly with AML, KYC, and external reporting systems, so new requirements can be adopted without redesigning the entire process. It keeps compliance stable even when the rules evolve.

Measured Impact

CCM gives banks what manual control never could—rhythm.

Work moves in order. Records build themselves. Audits turn from interruptions into confirmations.

Compliance stops being a cycle of catch-up and becomes a steady state of readiness.

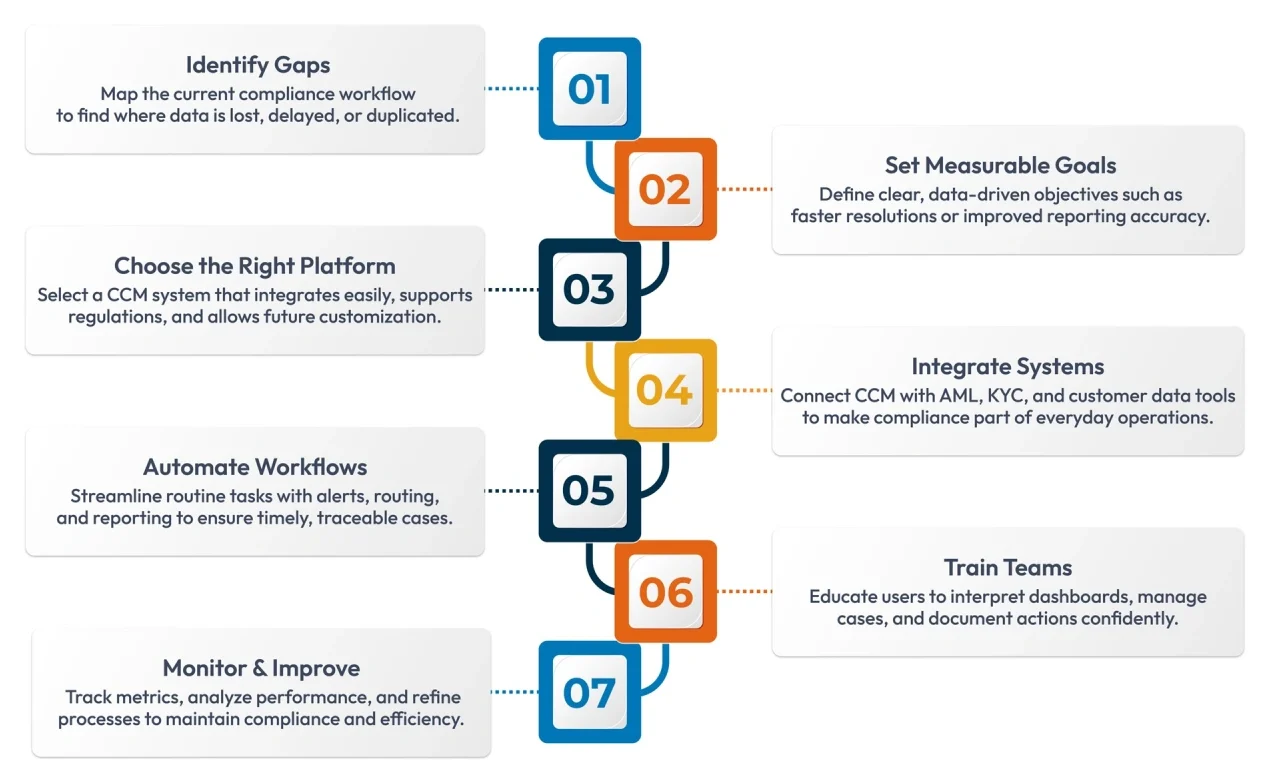

How to Use CCM Software to Solve Compliance Challenges: Step by Step

We have seen how CCM software helps banks bring structure to compliance. But technology alone cannot deliver results. The impact comes from how it is used. No system can add control unless the people using it understand the process that gives it meaning. The steps below turn the tool into a method that produces visible, measurable outcomes.

The value of CCM lies in how it is practiced. Each step adds precision to the next, creating a structure that strengthens with use. When banks follow this rhythm, compliance stops being a task and becomes a standard. It stands as quiet, steady proof that control is built into every decision.

Best Practices for Strong Implementation of Banking Compliance Solution

Implementation is not a checklist; it is a discipline that demands structure, attention, and steady leadership. The best practices below ensure that CCM strengthens control instead of adding complexity.

- Start with Leadership Clarity

Every system needs direction. Define what success means in measurable terms. Leadership must set clear goals for audit readiness, case resolution, and reporting accuracy. When expectations are fixed, execution stays steady. Clear leadership also ensures that the banking compliance solution aligns with organizational objectives and regulatory priorities. - Build a Cross-Functional Core Team

Bring together people from compliance, technology, and operations. This team should own the rollout and stay involved from setup to adoption. A united group reduces confusion and keeps progress visible. Such collaboration helps institutions make the most of compliance solutions for banks. - Prioritize Data Readiness

Clean data builds trust. Review each data source, fix inconsistencies, and confirm ownership before connecting to the CCM system. When information is accurate, automation delivers real value. A strong data foundation supports banking data compliance solutions that maintain accuracy and transparency across all records. - Focus on Usability and Adoption

A tool is effective only when people use it with ease. Keep dashboards simple, automate repetitive steps, and design alerts that lead to action. Early training and open feedback help users gain confidence quickly. - Keep Implementation Modular

Begin with the most critical workflows, prove they work, and expand from there. Smaller, controlled phases allow faster learning and fewer disruptions. This modular approach helps banks stay compliant with evolving banking industry regulations while maintaining stability and focus. - Establish a Continuous Review Cycle

Compliance never stands still. Schedule regular system reviews to measure performance, adjust rules, and align with new regulations. Consistency keeps control alive and dependable. Continuous evaluation ensures that your compliance solutions for banks evolve with new standards and maintain long-term effectiveness.

Conclusion

Compliance in banking is not about meeting rules. It is about proving control with clarity and consistency. The rise of CCM software shows that technology can create order where manual effort once struggled. But systems alone do not build trust. The strength lies in how they are designed, used, and refined.

Banks that treat compliance as a living system, supported by data and guided by discipline, gain more than regulatory security. They gain visibility, confidence, and the ability to move without hesitation.

The future of banking will belong to institutions that make control a built-in habit, not a periodic exercise. Technology can guide that change, but leadership must sustain it.

The future of compliance will not be written in reports but in the systems that prove order every day. Start by building that order today. Explore more with Cincom Eloquence.

FAQs

1. How does CCM differ from traditional compliance management tools?

Traditional tools often focus on reporting and documentation. CCM unifies communication, case tracking, and audit management within one framework. It does not just record activity; it builds traceable proof across every interaction, making it a more advanced bank compliance solution compared to traditional systems.

2. Can CCM software adapt to region-specific regulations?

Yes. Modern CCM platforms support configuration for local and global frameworks such as GDPR in Europe or SEC and FINRA in the United States. This flexibility allows banks to maintain a single structure while meeting diverse banking industry regulations. As a result, CCM acts as one of the most adaptable compliance solutions tools for banks, suitable for both domestic and international compliance needs.

3. How can small or mid-sized banks benefit from CCM without large budgets?

Smaller institutions can start with core modules like communication capture and case tracking. Many CCM providers now offer scalable or cloud-based models, allowing banks to expand features as their needs and budgets grow. This modular approach enables even smaller organizations to implement effective banking data compliance solutions that scale alongside business growth.

4. What metrics should leadership track to measure CCM success?

Key indicators include case resolution time, audit readiness scores, number of repeat incidents, and overall compliance response rate. Consistent improvement across these metrics signals a mature and effective CCM practice. Tracking these outcomes also helps determine whether the compliance solutions software for banks is delivering measurable value and supporting long-term compliance stability.