It’s that point in the year when everyone starts tossing around predictions about where insurance is headed. And sure, those conversations matter. But 2026 has layers that go way beyond the usual buzz.

Think about how fast things can shift. A policy rule changes across the border, and suddenly your pricing model needs a second look. A new cyber threat pops up, and the whole idea of “risk” moves a few steps forward. Meanwhile, customers aren’t just hunting for protection anymore; they want speed, relevance, and signs that their insurer isn’t stuck in 2012.

So instead of throwing another shiny-tech forecast into the mix, let’s look at what’s actually reshaping the industry under the surface. These are the changes you feel inside everyday workflows—the way you clean up data, the way you rethink insurance customer communication, and the way global events quietly nudge decisions inside local markets.

These trends aren’t theoretical. They’re already showing up in decisions, workflows, and the way companies connect with their customers. If you pay attention, they’ll tell you exactly where insurance is heading in 2026 and who is likely to keep up when everything else keeps moving.

Trend 1: Hyper-Personalized Customer Engagement

In 2026, customers aren’t just expecting personalization. They notice when it’s missing. Generic emails or random alerts won’t cut it. They want interactions that feel like someone actually thought about them.

Some companies are stepping up their insurance customer communications. They are using cloud systems, APIs, and real-time data, and they can suggest coverage that fits a person’s situation or alert them to gaps before the customer realizes it.

The J.D. Power survey found that only about half of life insurance customers rate their insurer highly for trust. For some carriers, that number drops to a third. Thus, a helpful heads-up or a small insight can make a big difference because people remember when they are understood, not just processed.

Trend 2: Omnichannel, But Smarter About Where Conversations Happen

Most insurers already support multiple channels. That part is nothing new. The real shift in 2026 is that customers are getting picky about where they want the conversation to happen. They expect the insurer to respect that choice instead of pulling them into whatever channel works best for the company.

People are tired of bouncing between apps, emails, bots, and call centers. They want one simple thing: talk to me in the place that actually fits what I’m trying to do.

That’s why some insurers are moving from “every channel everywhere” to something more thoughtful. Each channel has a purpose. Quick tasks stay inside the app. Sensitive moments move to a human. Complex questions get routed to someone who can actually solve them.

A clearer way to look at this shift:

| What Customers Want | What Insurers Are Building |

| If I switch channels, don’t make me start over | Shared context is updated in real time, so the next person or system already knows what happened |

| Put me in the channel that actually helps | Rules that match tasks with the channel that finishes them fastest |

| Consistent answers everywhere | One knowledge source replacing scattered notes and outdated scripts |

| A conversation that feels continuous | Cloud systems and APIs that sync data across every touchpoint |

Trend 3: Data Steps Up as the Real MVP

We’ve been talking about personalization for years, but here’s the thing—if your data is poor, nothing else matters. In 2026, insurers are finally realizing that messy, siloed, outdated data is the silent killer of insurance digital customer experience. You can build all the apps, dashboards, and fancy platforms for modernizing insurance communication you want, but if the info behind them is wrong or incomplete, customers notice. And trust? Forget it.

Some of the ways this is playing out:

- Real-time, verified customer data replaces the old “once-a-year update” model.

- Unified info across policies, claims, and messages means fewer oops moments.

- Data-driven segmentation actually feels personal instead of robotic.

- CCM platforms can finally shine when they’re fed clean, reliable data.

Bottom line? In 2026, data isn’t just another line in the budget. It’s the gatekeeper that decides whether your personalization actually lands—or falls flat.

Trend 4: Cybersecurity and Proactive Risk Management

Cybersecurity is now a part of the insurance digital customer experience. Before someone even thinks about buying a policy or handing over their personal details, they want to feel sure their data won’t end up in the wrong place.

This is why insurers are now pulling security into their communication workflows. Everything from policy updates to onboarding emails is being checked for privacy risks. Compliance teams are reviewing the language, digital teams are tightening access points, and CCM platforms are being used to flag anything that could expose sensitive data.

Cybersecurity is turning into an insurance customer communication standard. If customers feel safe every time they open a message, log in, or share information, that becomes part of the digital experience they remember. In 2026, that level of quiet reassurance is just as important as any product you offer.

Trend 5: Compliance and Customer Communication

Regulations are quietly shaping how insurers talk to customers. Between tax updates in the US, GDPR in Europe, HIPAA in healthcare, and accessibility rules like PDF/UA and ADA, insurers need to keep customers informed without drowning them in legal jargon.

Carriers carefully need to carry out insurance compliance communication to make sure customers understand what changes mean for their policies, their privacy, and their coverage.

Some ways this shows up in 2026:

- Clear, concise messages that explain regulatory changes in plain language.

- Multi-channel delivery—apps, emails, SMS—so customers actually see the updates.

- Integrating compliance communication into onboarding, claims updates, and policy alerts.

- Dynamic content that adjusts based on the customer’s location and applicable regulations.

Global rules often collide. A privacy rule in Europe might require one approach, while a US tax update demands another. The winners will be the insurers who treat compliance messages as part of the insurance digital customer experience, not as an afterthought.

Trend 6: Empathy and Trust to Take the Lead

Insurance isn’t just about policies; it’s about people. When someone’s home is damaged in a storm or a loved one falls seriously ill, they aren’t thinking, “I need an app notification.” They’re thinking, “Someone please get me through this.”

Even as digital channels and alerts take on more routine work, the human touch is what really counts. Advisors who have good data, clear insights, and the right communication tools can step in exactly when empathy matters.

Here’s what that looks like in action:

| What Matters | How It Actually Works |

| Metrics That Count | Staff is tied to satisfaction scores and response times, not just productivity numbers. |

| Being Ready | Advisors get real-time insights before big calls, so they don’t wing it. |

| Human + Digital | Alerts reach the customer, but a person follows up to make sense of it all. |

| Clear, Honest Talk | Policies and claims are explained without jargon, so people feel understood. |

Personalization gets attention. Empathy and trust make people remember you. 2026 will favor carriers who can mix tech with human care, without losing either.

Trend 7: Strategic Partnerships and Ecosystem Collaboration

By 2026, insurers are realizing they can’t build everything on their own. Not fast enough, at least. So, the smartest moves this year aren’t coming from new tools. They’re coming from partnerships that fill the gaps.

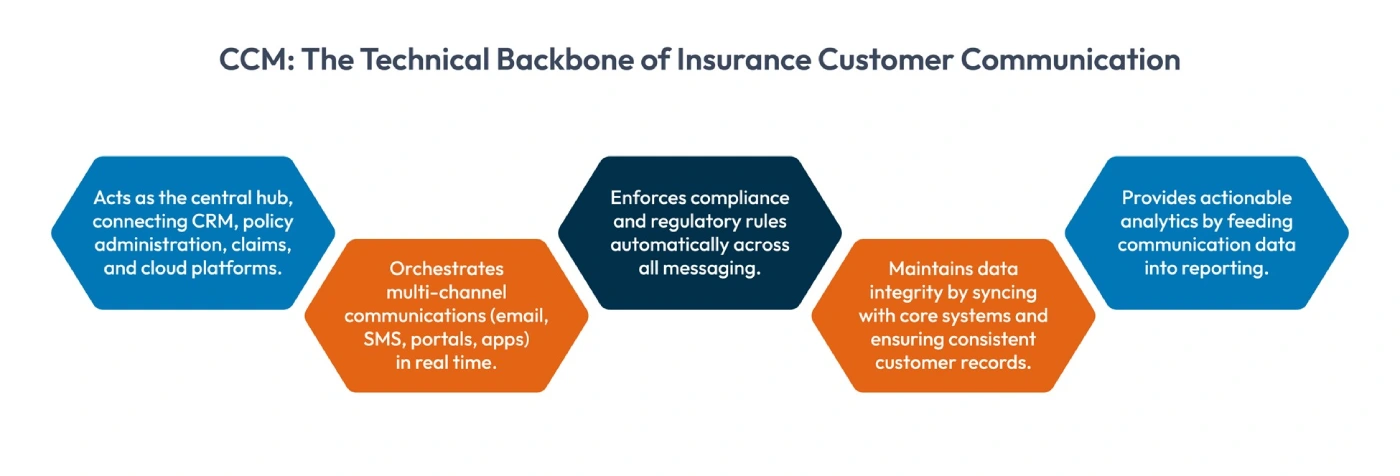

Some teams are teaming up with tech providers for cloud or API work. Others are leaning on insurtechs for things like faster onboarding or smarter data checks. A few are working with third-party administrators, so operations don’t slow down when volume spikes. And CCM platforms are quietly becoming the glue in these setups because they keep the customer communication part from getting messy.

Strategic partnerships and ecosystem collaboration help insurers move faster without overbuilding. And in a year where insurance digital customer experience can switch with one click, speed is starting to matter as much as pricing.

Trend 8: Dynamic Climate and Risk-Based Modeling

Climate change isn’t some distant headline anymore. It’s in your inbox, on your app, and yes, on the policies people actually rely on. Take the Los Angeles wildfires in January 2025; over 16,000 homes were destroyed, with $40 billion in insured losses. Research says climate made it 35% more likely. That’s not just a stat; it’s a wake-up call.

By 2026, insurers will not be waiting around. They are required to use parcel-level geospatial data, predictive modeling, and dynamic risk scores to:

- Price policies for the exact property, roof type, or local flood risk.

- Adjust coverage mid-term when risks spike unexpectedly.

- Offer practical tips or incentives to make homes more resilient.

CCM platforms tie it all together. The same insights that drive pricing can be pushed directly to customers—alerts, guidance, and coverage updates—through apps, portals, or email. It’s not generic messaging; it’s information that actually matters.

Put simply, this trend isn’t just about keeping insurers profitable. It’s about making the insurance digital customer experience smarter, faster, and genuinely useful.

Bringing It All Together

So, that’s the lay of the land for 2026. We’ve got hyper-personalized customer engagement, smarter right-channel strategies, partnerships that actually work, data foundations that finally make sense, trust as a differentiator, cybersecurity baked into everything, and climate-driven risk modeling that hits your inbox and app notifications.

The point isn’t to chase every shiny new tool. It’s about how all these trends connect, from tech infrastructure to customer communications, from compliance to real-time risk insights. When insurers get that right, they’re not just surviving. They’re making insurance feel relevant, responsive, and even a little human again.

Because at the end of the day, it’s not just about policies. It’s about helping people feel seen, informed, and protected while staying one step ahead of whatever 2026 throws at us.

If you’re ready for a CCM platform that actually makes the work lighter (and keeps the customer experience consistent even on the messy days), we can help you get there.

Schedule a Cincom Eloquence Demo Now!

FAQs

1. How does modernizing insurance communications actually help day-to-day teams?

Modernizing insurance communications isn’t just a tech upgrade. It reduces manual work, cuts down on rechecks between departments, and helps teams send accurate information the first time. It also creates fewer service tickets because customers get clearer updates.

2. What’s the biggest challenge insurers face when improving insurance customer communications?

Surprisingly, it’s not the messaging itself. It’s the messy, outdated data sitting behind the scenes. Without fixing that, even the best tools struggle to deliver a strong insurance digital customer experience.

3. Are insurance CCM trends only relevant for large carriers?

Not at all. Smaller insurers, MGAs, and TPAs often see even faster wins because CCM removes manual templates, scattered PDFs, and inconsistent processes that slow small teams down.

4. How does compliance fit into insurance compliance communication today?

Compliance isn’t just about legal approval anymore. It now includes accessibility rules, data privacy expectations, retention requirements, and regional differences in what can or cannot be sent. A modern CCM system helps teams keep all those details aligned without slowing down communication.

5. Will customers actually notice these changes in the insurance digital customer experience?

Yes. They notice when messages arrive faster, when updates make sense, and when they don’t have to repeat the same information across channels. Even small improvements in insurance customer communications can change how trustworthy and responsive an insurer feels.