Regulators are watching financial institutions more closely than ever, and communication is right at the center of that scrutiny.

In 2024, the Securities and Exchange Commission (SEC) handed out more than $600 million in fines tied to messaging violations. These weren’t cases of fraud or market manipulation; they were penalties for something as basic as using the wrong channels to talk to clients. That’s how high the stakes have become.

Every disclosure, account statement, or policy update isn’t just a touchpoint with a customer; it’s also a compliance event. Yet many firms still rely on outdated systems, scattered processes, or even unauthorized apps to manage this flow of information. It only takes one missed update or unrecorded message to trigger regulatory action.

This is where Customer Communications Management (CCM) software changes the equation. CCM isn’t just another communication tool—it’s a compliance risk management engine. It embeds rules, controls, and security into every message you send, ensuring that what leaves your institution is accurate, consistent, and audit-ready.

In this blog, we’ll break down how CCM helps financial services firms reduce compliance risk, protect customer trust, and move forward with confidence in a high-stakes regulatory environment.

The Rules Shaping Financial Communications

Before diving into how CCM software reduces compliance risk, let’s quickly look at the key regulations that shape financial communications across the U.S. and Europe.

United States

- Consumer Financial Protection Act (CFPA) – Requires clear, accurate, and transparent customer communication. Misleading or deceptive messaging is strictly prohibited.

- Securities and Exchange Commission (SEC) – Regulates investor communications to ensure accurate disclosures, transparent reports, and market integrity.

- Know Your Customer (KYC) – Mandates secure processes to verify customer identity and collect information, reducing fraud and suspicious activity.

- Gramm-Leach-Bliley Act (GLBA) – Sets rules for handling financial data, including customer consent, security safeguards, and clear privacy policy communication.

- Federal Trade Commission (FTC) – Governs marketing and advertising across all channels, requiring that all claims are accurate and not misleading.

- FINRA Notices (10-06 & 07-59) – Establish policies for supervising electronic and social media communications, ensuring proper oversight and training.

Europe

- General Data Protection Regulation (GDPR) – Requires secure, transparent, and consent-driven use of customer data in all communications.

- Digital Operational Resilience Act (DORA) – Focuses on secure and resilient digital communication and reporting in the face of cyber risks.

In addition to these, both the US and the EU also have regulations regarding accessibility. European Accessibility Act (EAA) & Americans with Disabilities Act (ADA), which ensure communications are accessible to all customers, including those with disabilities.

Together, these regulations highlight the complex landscape of risk and compliance in financial services, where every communication carries potential compliance risk if not managed properly.

Safeguard Your Client Relationships: Mitigate Risks with a Modern Customer Communication Compliance Solution

Don’t let legacy systems slow you down. Download the whitepaper to reduce communication risks.

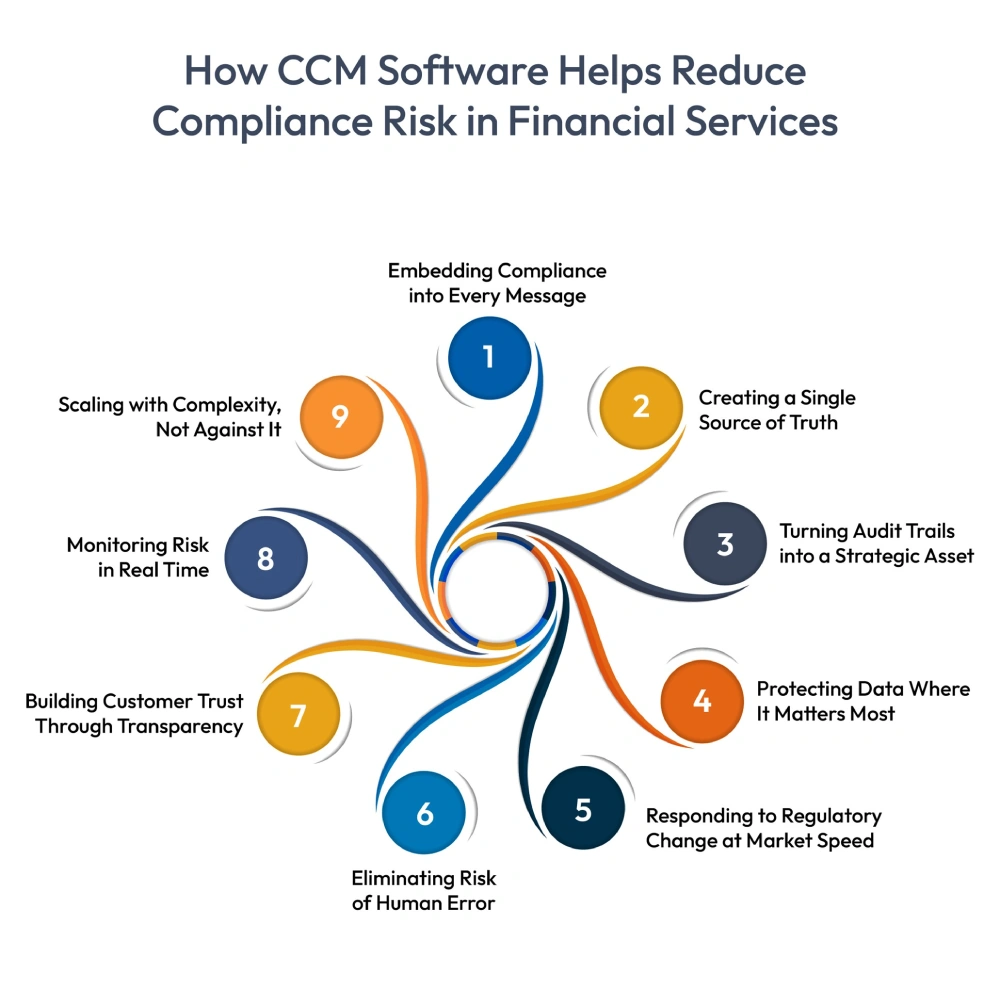

9 Ways CCM Helps Reduce Compliance Risk in Financial Services

In financial services, communications are no longer “just messages.” They are compliance artifacts; every disclosure, every statement, and every update is subject to scrutiny. That’s why the conversation around compliance risk is no longer just about avoiding fines; it’s about building resilience, protecting trust, and ensuring agility in a market where regulations shift overnight.

Customer Communications Management (CCM) software transforms this challenge into a strength. Here’s how:

Embedding Compliance into Every Message

Traditional communication relies on manual checks that are prone to oversight. CCM hardwires compliance rules directly into templates and workflows, ensuring accuracy by design—not as an afterthought.

Creating a Single Source of Truth

Scattered communication systems often produce conflicting information, a major compliance liability. CCM centralizes content, so disclosures, terms, and policy updates are consistent across every channel and every customer interaction.

Turning Audit Trails into a Strategic Asset

Audits are no longer fire drills. With CCM, every communication is logged, time-stamped, and easily retrievable. Instead of scrambling to prove compliance, institutions can demonstrate control with confidence, supporting stronger risk compliance management.

Protecting Data Where It Matters Most

With rising cyber threats, communications aren’t just about what you say, but how securely you deliver it. CCM enforces encryption, permissions, and secure delivery protocols that align with international, national, and state regulations and other privacy frameworks. This makes it a vital tool in modern compliance risk management.

Responding to Regulatory Change at Market Speed

When a regulator issues a new mandate, speed is everything. CCM platforms allow institutions to roll out updated disclosures, terms, and policy communications in hours—not weeks—reducing exposure to fines and strengthening risk and compliance in financial services.

Eliminating Risk of Human Error

Manual processes—copy-pasting disclosures, emailing drafts for approval, or uploading the wrong version—are among the biggest sources of compliance breakdowns. Automation within CCM removes these vulnerabilities, reducing both errors and delays.

Building Customer Trust Through Transparency

Compliance isn’t just about regulators; it’s about people. When customers receive clear, consistent, and timely communication, it reinforces credibility. CCM turns compliance-driven messaging into an opportunity to deepen relationships while supporting long-term risk compliance management.

Monitoring Risk in Real Time

Rather than waiting for something to go wrong, CCM equips compliance teams with dashboards, alerts, and analytics. This proactive oversight helps identify issues before they escalate into violations.

Scaling with Complexity, Not Against It

As institutions expand products, geographies, and digital channels, communication complexity multiplies. CCM scales seamlessly, ensuring that growth doesn’t amplify risk and compliance in financial services.

Reducing compliance risk isn’t only about avoiding fines; it’s about protecting customer trust in an era of constant scrutiny. By embedding compliance into every message, CCM helps financial institutions deliver communications that are secure, consistent, and transparent, strengthening both regulatory standing and client loyalty.

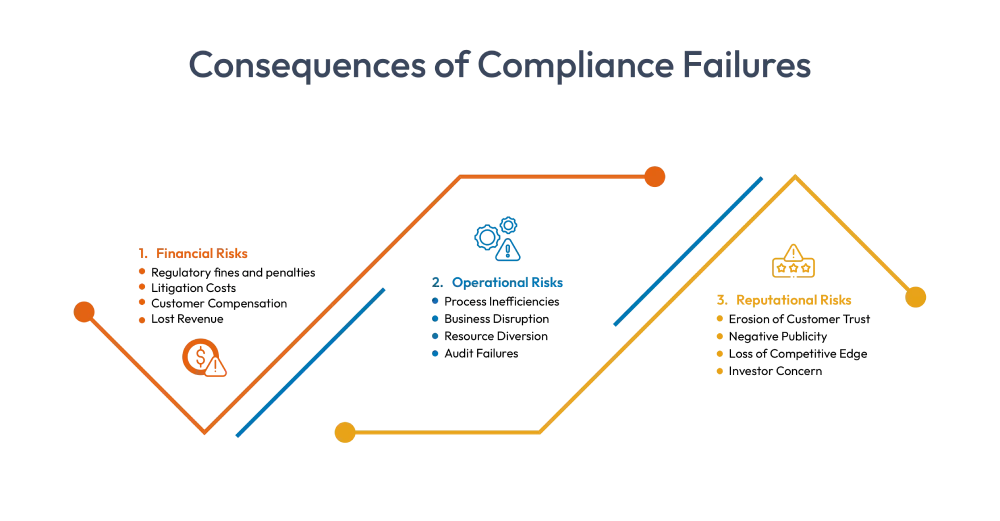

Financial, Operational, and Reputational Risks of Compliance Gaps

Now that we’ve seen how CCM can embed compliance, streamline workflows, and strengthen oversight, it’s important to understand the risks it helps mitigate. Financial institutions operate in an environment where every message—whether a disclosure, account update, or policy change—carries compliance risk. Missing even a single regulatory requirement can have far-reaching consequences.

Financial Risks

- Regulatory fines and penalties

Non-compliance with rules like GDPR or SEC requirements can result in costly fines. - Litigation Costs

Data breaches or miscommunications may lead to lawsuits and settlements. - Customer Compensation

Errors in disclosures or account updates may require reimbursements or corrective payouts. - Lost Revenue

Compliance failures can delay product launches or restrict business operations, impacting profits.

Operational Risks

- Process Inefficiencies

Manual corrections and re-communications consume time and resources. - Business Disruption

Investigating breaches or errors can halt normal workflows and delay services. - Resource Diversion

Staff may need to focus on compliance remediation rather than strategic initiatives. - Audit Failures

Gaps in documentation or processes increase the complexity and cost of internal and external audits.

Reputational Risks

- Erosion of Customer Trust

Inconsistent messaging or data breaches undermine client confidence. - Negative Publicity

Publicized compliance failures can damage the institution’s brand and market perception. - Loss of Competitive Edge

Perceived unreliability can push clients toward competitors. - Investor Concern

Weak compliance and risk management can affect investor confidence and stock performance.

According to the IBM Cost of a Data Breach Report (2024), the global average cost of a data breach has increased to USD 4.88 million, a 10% rise from the previous year. In addition, GDPR violations can result in fines of up to 4% of global revenue, underscoring the high cost of lapses in risk and compliance in financial services.

Beyond financial penalties, security failures or inconsistent communication create ripple effects—slowed digital transformation, loss of market confidence, and declining customer loyalty. In a landscape where transparency and security define competitive advantage, institutions can’t afford to overlook these risks.

Final Verdict

In the dynamic and highly regulated world of financial services, CCM is a cornerstone of compliance risk management and customer trust. Institutions that adopt a structured, secure, and automated approach to communications can reduce exposure to regulatory penalties, protect sensitive data, and maintain operational resilience.

Cincom Eloquence, a leading Customer Communications Management (CCM) software, provides financial institutions with the tools to centralize, automate, and secure every interaction, turning compliance into a strategic advantage rather than a challenge. By embedding governance into every message, organizations can enhance transparency, ensure consistency, and respond swiftly to regulatory changes—all while improving the client experience.

Now is the time for financial institutions to assess their CCM strategies and explore how solutions like Cincom Eloquence can help them navigate the complexities of modern finance. Proactive management of communications today lays the foundation for stronger compliance, greater customer confidence, and sustainable growth in the digital era.

Streamline compliance, protect customer trust, and deliver a better client experience—today. Explore Cincom Eloquence: Schedule a Demo Now!

FAQs

1- What are the compliance risks financial institutions face in communications?

Beyond regulatory fines, financial institutions face risks like inconsistent messaging, delayed disclosures, unauthorized access to sensitive information, and audit failures. These risks can lead to financial loss, reputational damage, and operational disruptions if not properly managed.

2- How does CCM improve oversight and accountability in financial communications?

CCM centralizes content and automates workflows, creating audit trails and enforcing governance rules. This ensures all communications are accurate, consistent, and traceable, making compliance oversight more efficient and reducing the likelihood of human error.

3- Can CCM help institutions respond faster to changing financial regulations?

Yes. By integrating compliance rules directly into templates and workflows, CCM allows rapid updates to disclosures, policies, and client messaging, ensuring financial institutions remain agile and fully aligned with evolving regulations.

4- What role does secure CCM play in protecting customer data?

Secure CCM platforms provide encryption, access controls, and secure storage, reducing the risk of data breaches. This helps institutions meet data privacy requirements, maintain customer trust, and mitigate financial and reputational risk.

5- Why is CCM considered a strategic tool rather than just a communications system?

Beyond sending messages, CCM ensures compliance, strengthens operational resilience, and supports customer trust. By reducing compliance risk and enabling consistent, secure communications, it becomes a strategic asset that enhances overall risk and compliance in financial services.