Insurance digital transformation has long been associated with core system modernization. Policy administration, claims platforms, and billing engines have dominated technology roadmaps for years. Now, as CCM and the future of InsureTech is becoming a central theme, many insurers reach, attention is shifting to what comes next.

Aite-Novarica discusses the next wave of digital transformation in InsureTech (from core systems to CCM).

This article explores insights from leading life, health and property and casualty insurance executives of their priorities, challenges and outlook on the future of customer communications and the impact of digital transformation.

From Core Systems to Connected Experiences

As science fiction writer William Gibson once famously said, “The future is here—but it’s not evenly distributed.” The same can be said for the CCM and the Future of InsureTech industry, where there has been a steady, though uneven, march toward better systems, better processes and more empowered workers.

For many carriers, the past decade has been defined by modernizing insurance core systems. These initiatives were complex, expensive, and necessary. But core platforms alone do not define customer experience. Communications do.

Policy documents, billing notices, claims correspondence, regulatory disclosures, and service communications are still the most frequent touchpoints between insurers and their customers. This is where the future of CCM in insurance comes into focus.

CCM Investment Trends Signal the Next Wave of InsureTech

In the next five years, insurers will be investing heavily in improvements to their customer communications management (CCM) solutions at a rate of 10% per year. This means that by 2027, it’s likely that over half of all insurers will have made the move to replace or upgrade their current CCM platforms.

In a recent webinar hosted by Cincom, Eric Weisburg, Insurance Executive Partner Services with Aite-Novarica Group, pointed out how the data supports the extension of a broader trend of InsureTech transformation.

“Now that most insurance carriers have upgraded and modernized their core systems, the next wave of transformation lies in the other connected solutions within their technology ecosystem,” Weisburg said.

The best part is carriers don’t need to wait to get moving into the digital space for the big decisions to be made. “Insurers are clearly recognizing it’s time to refresh their current CCM portals to take advantage of some of the new features and capabilities in the marketplace today,” Weisburg added.

Weisburg says that for businesses that are just exploring core upgrades, one of the advantages of replacing their CCM systems prior to a core transformation is that “the new policy forms you are able to generate will be able to be used in any new policy administration system by decoupling those forms from any current platform, furthermore, reducing risk of lost information.” And it represents a fairly simple, but powerful, transformation of core provider CCM activities.

“Survey Says… CCM Delivers Enterprise-Wide Value”

In a recent insurance industry survey conducted by Aite-Novarica, nearly all insurers surveyed believe that the benefits of a CCM system are important parts of their operations across business units. Of the insurers that reported:

- 87% believe that increasing customer loyalty and retention are an important or very important top priority

- Cost reduction through lower printing and mailing expenses remains a strong driver

- Regulatory compliance continues to influence technology decisions

- Faster document creation supports quicker go-to-market timelines

- Reduced dependence on IT teams is becoming increasingly critical

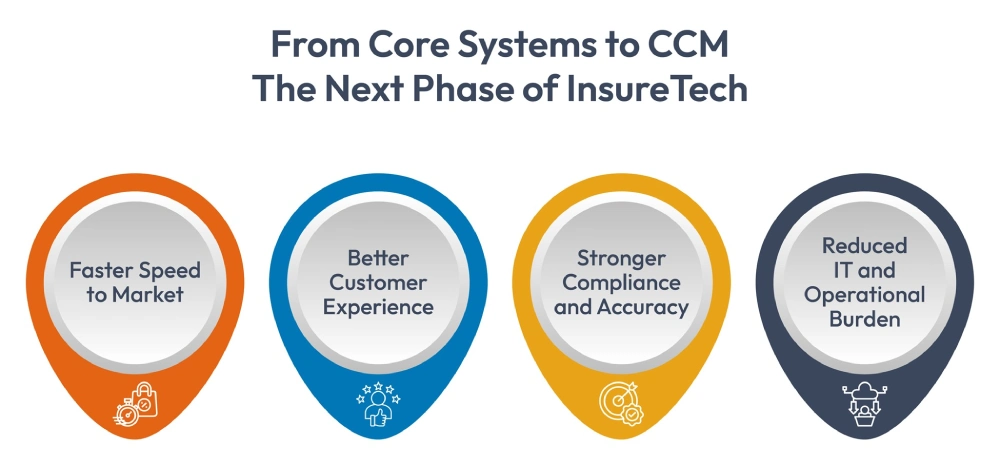

These findings reinforce a key point. CCM and the Future of InsureTech extend beyond infrastructure upgrades to enable faster adaptation across the insurance technology ecosystem.

Upgrading ancillary systems like customer communications management (CCM) platforms have gone from “fun” to “fundamental,” according to Weisburg, and the data supports this. Among businesses’ top three priorities for 2023 and beyond, seven out of 10 insurers overwhelmingly have as their highest priority to achieve greater speed to market by having IT deliver either product changes or new products.

This is where the future of CCM in insurance becomes tightly linked to competitiveness.

From the vendor’s perspective, this trend comes as no surprise. In a recent online conversation with Weisburg, Cincom Product Marketing Manager, Will Stagl, reflected on the trends that are driving insurers to streamline and consolidate their tech stacks and look for ways to empower end-users and relieve some of the burden on IT.

Recently, Stagl has observed this important shift when talking with insurers about the need to streamline, consolidate and manage legacy systems and “Frankenstein” platforms that are cobbled together over sometimes as many as 30 different interfaces. Stagl has also observed that it’s become very important for insurers to get beyond the core and integrate their CCMs more fully.

Conclusion: CCM as a Cornerstone of Insurance Digital Transformation 2027

The next phase of insurance digital transformation will not be defined by core systems alone. It will be defined by how effectively insurers communicate.

CCM and the future of InsureTech are now tightly connected. As insurers look toward 2027, modern CCM platforms offer a practical way to improve customer experience, accelerate speed to market, reduce compliance risk, and simplify complex technology environments.

For carriers that have already modernized their cores, CCM represents the logical next step. For those still planning core upgrades, it offers a lower-risk entry point into meaningful transformation.

In both cases, the message from Aite-Novarica and industry leaders is clear. The future of CCM in insurance is no longer optional. It is foundational to how insurers compete, comply, and connect with customers in the years ahead.

FAQs

1. Why are insurers prioritizing Customer Communications Management (CCM) now

Most insurers have already modernized core systems. The next phase of digital transformation focuses on connected platforms like CCM to improve speed to market, compliance, and customer experience.

2. How does upgrading CCM support broader InsureTech transformation?

Modern CCM platforms decouple communications from core systems. This allows insurers to update documents, workflows, and channels without disrupting policy administration systems.

3. What business outcomes do insurers expect from CCM modernization?

Insurers cite higher customer retention, faster document delivery, improved regulatory compliance, lower print costs, and reduced dependence on IT as key benefits.

4. Can CCM upgrades be done before core system replacement?

Yes. In fact, upgrading CCM first reduces risk. New policy forms can be reused across future core systems, preserving data integrity, and accelerating transformation timelines.

5. How are legacy systems influencing CCM investment decisions?

Many insurers operate fragmented “Frankenstein” platforms. Consolidating CCM helps simplify integrations, reduce maintenance overhead, and empower business users.