Introduction: From Loyalty Insights to CX Execution

If you read our recent blog on customer loyalty in the insurance industry, you’ll remember the key takeaway: customers aren’t all the same, and loyalty depends heavily on how insurers communicate with them. Some want more frequent, multi-channel touchpoints; others prefer less contact but still expect clarity and trust.

However, here’s the challenge: knowing this insight and acting on it are two very different things. Many insurers find themselves stuck. They have the strategies on paper, but when it comes to delivering the right communication at the right time, their technology isn’t built to keep up.

This is where the conversation shifts from loyalty strategies to customer experience (CX) platforms. The term “CX platform” might sound broad, but in insurance, it really boils down to one thing: communication. In practice, that platform is modern Customer Communication Management (CCM) software—the core of any insurance CX platform. Every customer experience in insurance, whether it’s a claims update, a policy renewal, or a billing reminder, is delivered through communication.

In this blog, we’ll break down exactly what insurers should look for in a CX platform and how the right choice can make the difference between a frustrated policyholder and a loyal customer.

CCM vs CX Platform: Are They the Same?

Before we get to what insurers should look for in a CX platform, one question comes up again and again: “Isn’t CCM just a communications tool? How is it a CX platform?” The short answer: not exactly the same, but in insurance, they’re closely related.

Here’s the distinction:

- CX Platform is a broader concept. It’s the strategy and technology used to manage customer experience across channels, touchpoints, and journeys. Think of it as the “what”—what you want your customer experience to be.

- CCM is the software that makes that experience a reality. It’s the “how”—how you actually deliver communications that are timely, personalized, and compliant.

In insurance, communication drives almost every customer interaction: policy updates, claims notifications, renewals, billing reminders, and onboarding messages. Because of this, a modern CCM solution effectively functions as the insurance CX platform. It turns CX strategy into action.

To put it simply: a CX platform without CCM is a plan on paper. CCM without a CX strategy is just a tool. But together, CCM powers the insurance CX platform, enabling insurers to deliver experiences that build trust, loyalty, and efficiency at scale.

An Excellent Guide to Choosing and Implementing the Right CCM Solution

Download the guide to find a CCM that offers peace of mind, flexibility, and real results.

10 Key Features to Look for in an Insurance CX Platform

We’ve clarified how CCM powers the insurance CX platform. The next question is: what should insurers look for when evaluating a CX platform? Since communication drives nearly every customer interaction, the right platform is critical for delivering a personalized customer experience in insurance while ensuring compliance. Here’s a detailed checklist to guide your evaluation:

True Omnichannel Experience

A modern CX platform must do more than just support multiple channels; it needs to orchestrate them seamlessly. In insurance, your customers interact across letters, emails, SMS, mobile apps, and even web portals. The platform should:

- Deliver consistent messaging across all channels to reinforce trust and brand voice.

- Automatically adapt to each customer’s preferred channel.

- Enable cross-channel tracking so you know which interactions occurred where, avoiding duplicate or conflicting messages.

Data Integration & Centralization

Customer data is scattered across policy administration, CRM, claims, billing, and other systems. A CX platform must:

- Integrate seamlessly with existing enterprise systems.

- Provide a unified customer view, consolidating preferences, history, and touchpoints.

- Act as a centralized content repository, storing templates, assets, and branding elements in one place.

Personalization & Customer Journey Support

Insurers deal with highly diverse customer segments. Your digital customer experience platform for insurance should allow you to:

- Segment customers dynamically based on behavior, lifecycle stage, and preferences.

- Deliver context-aware, personalized messages at scale.

- Automate customer journeys, from onboarding and policy updates to renewal reminders and claims follow-ups.

Regulatory Compliance & Security

Compliance isn’t optional in insurance. It protects your company from fines, reputational damage, and legal risk while building customer trust. Your insurance CX platform should:

- Meet local, national, and international regulations (GDPR, HIPAA, and state-specific rules).

- Include robust access controls, audit trails, versioning, and retention policies.

- Enable automatic legal holds and secure storage of sensitive documents.

Ease of Use & Empowerment for Business Teams

Even the most capable digital insurance tools fail if your teams struggle to use them. Look for:

- Intuitive interfaces that reduce reliance on IT.

- Drag-and-drop templates and workflow builders to create communications quickly.

- Self-service capabilities for marketing, service, and operations teams.

Flexibility: Batch & On-Demand Communications

Insurance communications vary from predictable high-volume tasks to unpredictable, individualized interactions. Customers expect timely responses. Delays or errors in communications can lead to frustration or churn. A CX platform must:

- Handle batch communications like policy renewals, annual statements, or campaign emails.

- Support on-demand, real-time communications such as claim updates or customer inquiries.

- Maintain speed and accuracy regardless of volume.

Scalability & Future-Readiness

A scalable platform protects your investment and ensures that customer experience keeps pace with your business growth. Therefore, your CX platform must grow with your business. Consider:

- Can it handle increasing customer volumes and complex workflows?

- Can it add new channels, products, or regions without major upgrades?

- Can it adapt to evolving customer expectations like mobile-first communications or data-powered personalization?

Analytics & Reporting

A reliable digital customer experience platform for insurance should provide actionable insights:

- Track open rates, delivery success, and channel effectiveness.

- Measure customer engagement, satisfaction, and journey completion.

- Enable continuous optimization of communications and journeys.

Brand Consistency & Template Management

Maintaining brand integrity is critical, especially for multi-region insurers, because it builds trust and reinforces professionalism, ensuring customers recognize and value every interaction. Your insurance CX platform should:

- Ensure all communications reflect consistent branding and tone across channels.

- Allow easy updates of templates without disrupting workflows.

- Support multi-language capabilities for global operations.

Cost Efficiency & Operational Impact

Efficient operations save costs, free up teams to focus on high-value activities, and ensure timely, accurate, and compliant communications. A top-tier digital customer experience platform for insurance should deliver tangible business value. It should:

- Automate repetitive tasks to reduce operational overhead.

- Minimize errors and rework through centralized workflows.

- Accelerate time-to-market for all communications.

The ROI of an Insurance CX Platform

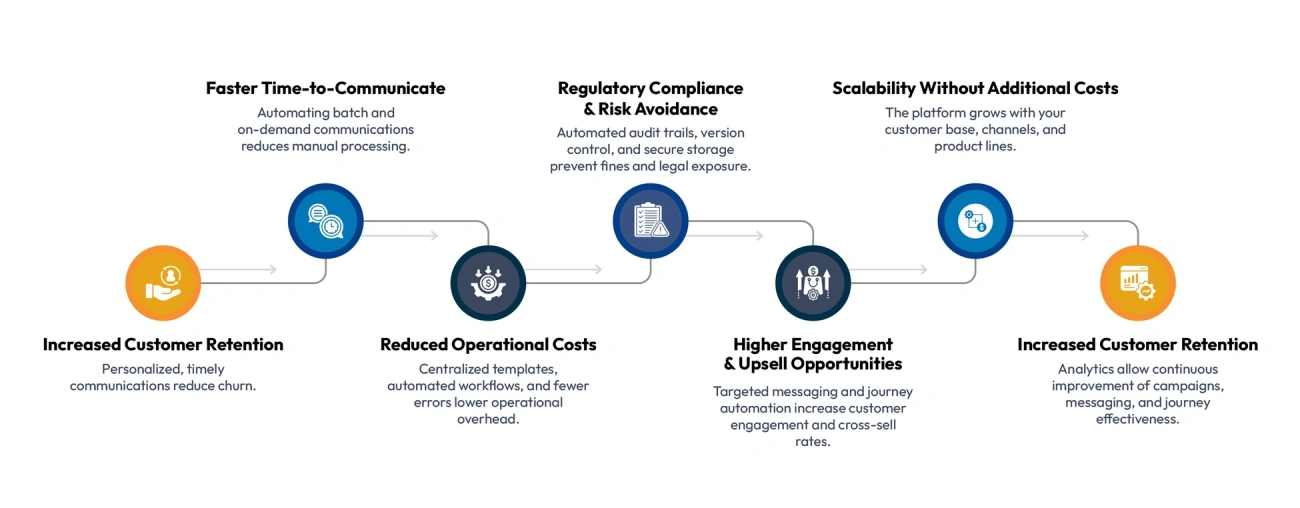

The benefits of a relevant insurance CX platform extend far beyond smoother communication. Here’s how investing in the right digital customer experience platform for insurance delivers measurable ROI:

The ROI of a CCM-powered CX platform is measurable, tangible, and multi-dimensional. By improving customer experience in insurance, reducing operational costs, ensuring compliance, increasing engagement, and scaling with your business, it delivers value across the board. Every dollar invested in these digital insurance tools is returned through greater efficiency, stronger loyalty, and sustainable growth.

Conclusion: Turning Insights into Action

Our recent research on customer loyalty made one thing clear: customers aren’t all the same, and understanding their preferences is just the start. In insurance, every interaction is a communication opportunity. With the right insurance CX platform, these interactions are no longer manual, fragmented, or generic—they become personalized, omnichannel, and strategically aligned with customer preferences.

The payoff is tangible: higher retention, more efficient operations, regulatory compliance, stronger engagement, and a platform ready to scale as your business grows. That’s where Cincom Eloquence makes the difference. Designed to automate and personalize every customer communication, it enables insurers to deliver compliant, high-impact interactions at scale—without adding complexity for IT teams.

Ready to transform your customer experience in insurance? Explore how Cincom Eloquence can power loyalty, efficiency, and growth for your business today.

FAQs

1- What is an insurance CX platform?

An insurance CX platform is a technology solution that manages and optimizes every policyholder interaction. A modern Customer Communication Management (CCM) platform acts as its core, powering personalized, multi-channel communications at scale.

2- How does a CX platform help with insurance regulatory compliance?

A top-tier insurance CX platform has built-in features to ensure compliance in the USA and Europe. It provides robust access controls, detailed audit trails, and version control for documents. This protects your business from legal risks and builds customer trust.

3- How can a digital CX platform improve customer loyalty and retention?

A digital CX platform boosts loyalty and retention by delivering timely, personalized, and relevant communications. This reduces friction in the customer journey and strengthens relationships, leading to increased satisfaction and a reduction in churn.

4- What kind of integrations should I look for in a CX platform?

A top-tier CX platform should seamlessly integrate with your existing systems. Key integrations to look for include:

- CRM: For a unified customer view and data-driven personalization.

- Policy & Claims Systems: To automatically generate policy and claims-related documents.

- Billing Systems: For sending accurate invoices and payment reminders.

5- Is an insurance CX platform suitable for both small and large insurers?

Yes. A modern, scalable insurance CX platform can benefit insurers of all sizes. For smaller companies, it provides the automation needed to compete, while for large insurers, it offers the scalability to handle millions of communications while maintaining a consistent, personalized experience.