Introduction

Policyholder loyalty in property and casualty insurance is often attributed to better experiences or faster service. In reality, it is more frequently shaped by how consistently insurers communicate over time. Small breakdowns in communication accumulate. A policy change explained one way in a letter and another way in a portal does not create frustration immediately, but it introduces doubt. Over time, doubt becomes disengagement.

P&C insurers operate within long policy tenures, infrequent interactions, and strict regulatory boundaries. Communication is therefore not episodic. It is continuous and consequential. As engagement spans agents, service teams, digital interfaces, and automated notifications, continuity is easily compromised. When context is lost between touchpoints, trust weakens, even when individual interactions appear adequate.

This makes omnichannel engagement in the P&C industry less about expanding access and more about preserving coherence. Loyalty endures when communication remains intelligible, reliable, and aligned across every interaction that carries legal or financial weight.

Omnichannel Failure in P&C Is a Governance Problem

Omnichannel engagement in P&C fails because communication ownership is fragmented. In a regulated environment, inconsistency is not a cosmetic issue. It is a governance lapse. When policyholders receive different explanations of coverage, obligations, or next steps depending on the channel used, confidence erodes. Over time, that erosion surfaces as disputes, complaints, and avoidable regulatory attention. Engagement becomes channel-led rather than policy-led, and loyalty deteriorates quietly.

P&C insurers cannot afford channel-led engagement models because every communication carries contractual and regulatory weight. Insurance omnichannel communication only works when it is governed as a shared institutional responsibility. Without that discipline, additional channels do not increase loyalty. They multiply risk.

4 Ways Omnichannel Engagement Future-Proofs P&C Policyholder Loyalty

Future-proofing loyalty in property and casualty insurance requires designing for instability rather than comfort. Unlike life or health insurance, P&C operates in an environment where pricing volatility, coverage recalibration, and external risk factors are persistent. Omnichannel engagement in P&C insurance matters because it enables insurers to maintain loyalty under these changing conditions.

Omnichannel engagement future-proofs P&C loyalty in four specific ways.

It preserves continuity across long, low-touch policy lifecycles

P&C policies often span years with minimal interaction. When engagement is infrequent, continuity becomes fragile. Omnichannel engagement ensures that policy context, prior communications, and decisions remain accessible and aligned across touchpoints. This continuity prevents policyholders from experiencing each interaction as isolated or contradictory, which is a common precursor to disengagement at renewal.

It stabilizes understanding during periods of change

Change is structural in P&C. Premium increases, underwriting adjustments, and coverage limitations are not exceptions. Insurance omnichannel communication allows insurers to communicate consistently across formal notices, agent conversations, and digital interfaces. When explanations remain aligned regardless of channel, policyholders are more likely to accept unfavorable outcomes without attributing them to unfair treatment or opacity.

It reduces interpretive risk in regulated communication

P&C communication is often declarative rather than conversational. Policyholders interpret messages as authoritative statements about rights and obligations. Omnichannel engagement reduces interpretive risk by ensuring that different channels do not convey divergent explanations of the same policy event. A seamless insurance customer experience in this context is defined by clarity and alignment, not by speed or novelty.

It strengthens loyalty through predictability rather than satisfaction

Loyalty in P&C is not driven by delight or emotional affinity. It is sustained by predictability. Omnichannel engagement reinforces predictable behavior by ensuring that timing, language, and intent remain consistent over time. When policyholders know what to expect from communication, loyalty becomes less sensitive to price pressure and market volatility.

In P&C, loyalty survives disruption when communication remains coherent. Omnichannel engagement future-proofs that loyalty by preserving context, stabilizing understanding, and enforcing consistency across years of regulated interaction.

Compliance, Trust, and Loyalty Are Interdependent

In P&C insurance, loyalty is rarely emotional. What keeps them renewing is predictability and clarity. That predictability is only possible when compliance and communication are intertwined. In other words, compliance is not a checkbox; it is a prerequisite for P&C policyholder engagement.

Omnichannel expansion can paradoxically increase loyalty risk if governance is ignored. Multiple channels amplify inconsistencies. When letters, digital notifications, and agent scripts tell slightly different stories, policyholders interpret gaps as unfairness or opacity. A truly seamless insurance customer experience is not convenient; it is coherent.

Where loyalty breaks without disciplined compliance:

- Disjointed explanations of coverage

Policyholders may receive formal notices that differ from agent conversations. Even small discrepancies can trigger disputes or escalate complaints. - Misaligned timing of communications

A premium change communicated digitally before an agent call can create confusion. Coordinated timing across channels reduces misinterpretation. - Hidden regulatory exposure

Fragmented channels make it difficult to demonstrate consistent messaging during audits or complaints. Insurance omnichannel communication is only defensible when it is governed and auditable.

Embedding compliance into every interaction does more than reduce risk. It reinforces the invisible architecture of trust. Policyholders may not notice every perfectly aligned letter or portal message, but they perceive the difference when inconsistencies appear. Over time, consistent, regulated communication strengthens confidence, stabilizes P&C policyholder engagement, and protects loyalty even during premium increases or coverage adjustments.

Simplifying Compliance and Efficiency for a 150-Year-Old Property and Casualty Insurance Provider

CCM: The Invisible Engine Behind P&C Loyalty

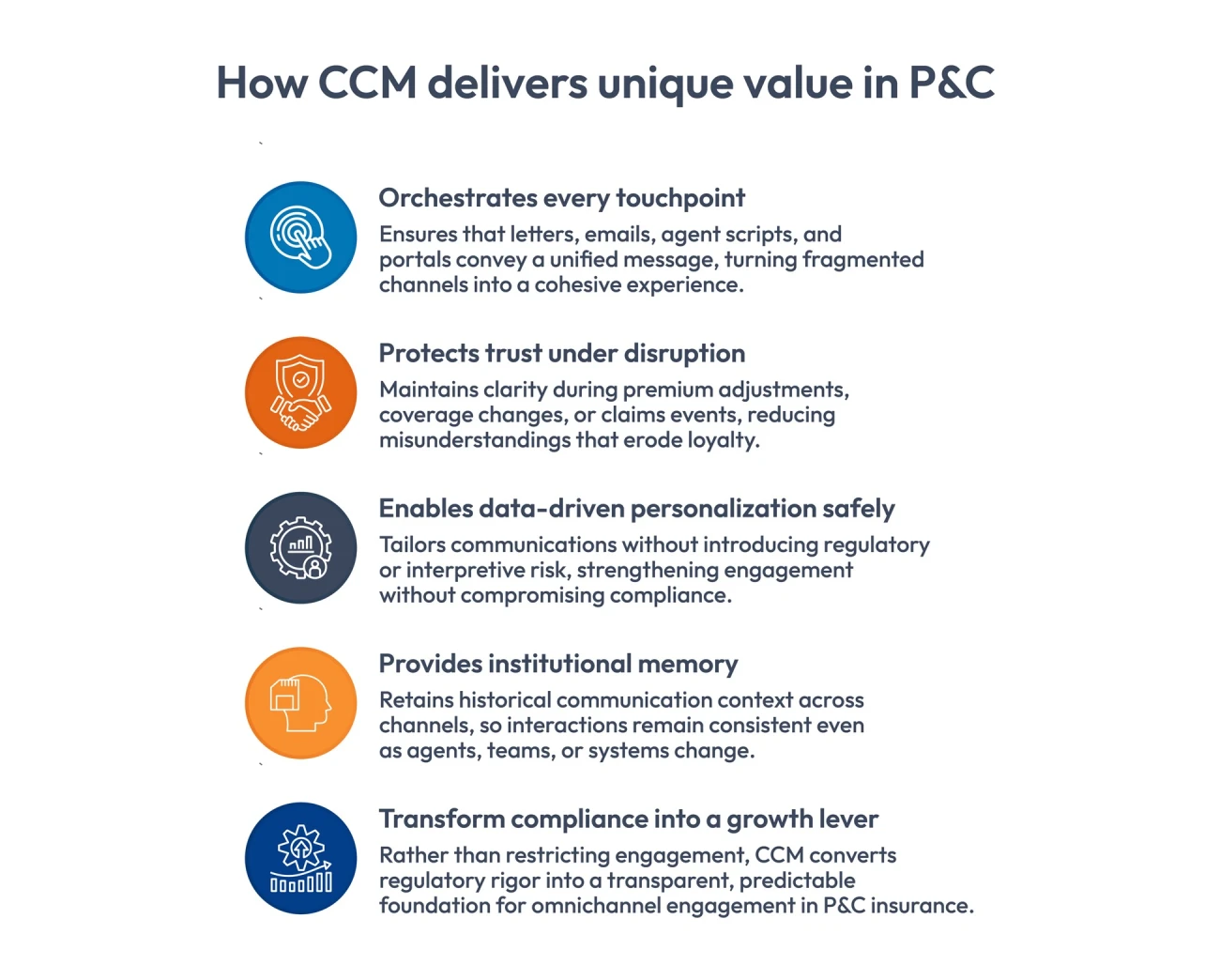

In P&C insurance, omnichannel expansion alone does not create loyalty. Without oversight, more channels mean more risk. Customer Communication Management (CCM) transforms omnichannel engagement into a strategic advantage, making loyalty predictable rather than accidental. It is the backbone of any forward-looking insurance customer retention strategy.

In short, CCM makes omnichannel engagement not just a capability but a reliable instrument for long-term policyholder trust and retention.

Conclusion

Loyalty in P&C insurance does not emerge from charm or convenience. It grows where communication is steady, intelligible, and aligned. Every letter, email, agent call, and portal notice carries significance. When these points diverge, trust frays quietly, often unnoticed until renewal.

Omnichannel engagement is the scaffolding that holds loyalty in place. Its value is not in the novelty of channels but in their orchestration. When touchpoints speak the same language, policyholders understand their coverage, obligations, and changes without doubt or hesitation.

Governed communication, powered by customer communication management, embeds discipline into every interaction. Context travels, explanations remain consistent, and personalization can coexist with compliance. The result is a seamless insurance customer experience that is credible, predictable, and enduring.

For P&C insurers, the lesson is clear. Treat compliance as the foundation. Align every channel. Preserve context across years. Only then does omnichannel engagement in P&C insurance become more than a capability and become a durable instrument for trust, retention, and policyholder confidence.

Explore how your P&C insurance communications can drive loyalty and start optimizing your omnichannel strategy today.

FAQs

1. How can insurers measure the effectiveness of omnichannel engagement in P&C insurance?

Effectiveness can be gauged by tracking consistent message delivery across all channels, reduction in disputes or complaints, and longitudinal retention patterns. Metrics should focus on clarity, coherence, and the ability to preserve context, rather than simply adoption rates.

2. Why is P&C policyholder engagement different from life or health insurance?

P&C engagement is episodic and largely triggered by change events, such as claims or premium adjustments. Maintaining loyalty requires predictable, consistent interactions rather than emotional attachment, which makes governance and alignment critical.

3. What role does communication continuity play in an insurance customer retention strategy?

Continuity ensures policyholders experience a unified narrative across letters, agent interactions, and digital touchpoints. It prevents confusion, builds trust, and reduces the risk of churn, forming the backbone of a robust insurance customer retention strategy.

4. How does CCM contribute to a seamless insurance customer experience?

By centralizing content, approvals, and delivery, CCM maintains consistency across channels. Policyholders experience interactions that feel coherent and reliable, even during policy changes or high-stakes claims events, enhancing the seamless insurance customer experience.

5. Can insurance omnichannel communication help manage regulatory risk?

Yes. When communications are governed and auditable, insurers can demonstrate consistency across all channels. Insurance omnichannel communication mitigates misinterpretation, reduces complaints, and reinforces trust without sacrificing agility or personalization.