Communication as a Driver of Customer Value

Every message an insurer sends is a touchpoint. It might be a welcome email, a policy schedule, a renewal reminder, or an update during a claim. Each interaction is a small test of whether the customer feels informed and respected.

Trust is what accumulates when those tests are passed. It is the confidence a policyholder has that the insurer will act accurately, clearly, and when it matters most. Trust shows up as fewer complaints, higher retention, and greater willingness to buy more products.

This article explains the link between touchpoints and trust and how insurers can design policyholder communications that deliver measurable value. We will examine the risks of poor communication, define the attributes of effective messaging, and walk through how Customer Communication Management drives better outcomes across the policyholder lifecycle, including the critical claims phase. Finally, we will offer practical principles to keep your communications consistent, compliant, and customer-centered.

What Are the Risks of Inaccurate or Delayed Policyholder Communications?

Policyholder communication is one of the most visible reflections of an insurer’s reliability. When it falters, the impact is immediate and far-reaching.

Lost Customer Trust and Retention

Customers expect their insurer to be responsive and accurate. When information is missing, delayed, or inconsistent, it sends a signal that the insurer isn’t in control.

The result:

- Erosion of confidence and credibility

- Higher chances of policy cancellations or non-renewals

- Increased customer complaints and negative reviews

Master Compliance Before It Masters You

See how leading insurers are turning communication compliance into a competitive edge.

Missed Revenue Opportunities

Unclear or poorly timed communication can mean lost sales. For instance, a generic renewal notice or an outdated product message may fail to highlight new coverage options or discounts.

The cost:

- Missed cross-sell and upsell opportunities

- Lower policy renewal rates

- Reduced customer lifetime value

Compliance and Regulatory Risks

Insurance communication is governed by strict regulations. Even small errors, like missing disclosures or inaccurate policy details, can result in compliance breaches.

Potential consequences include:

- Financial penalties and regulatory scrutiny

- Reputational damage

- Operational costs associated with reissuing corrected communications

Increased Operational Costs

When errors occur, teams spend time fixing mistakes instead of focusing on value-adding work. Manual corrections, repeated customer outreach, and unnecessary follow-ups all increase expenses.

Operational strain looks like:

- Duplicate work and inefficiencies

- Higher service center volumes

- Delayed responses to other customers

Damaged Brand Perception

Customers don’t separate one letter or email from the brand as a whole. Every message reflects the company’s professionalism and directly impacts customer loyalty in insurance communications. A confusing policy update or a tone-deaf claim letter can make a well-established insurer appear disorganized.

What Key Attributes Define “Great Communication” in Today’s Digital Environment?

Great communication goes beyond delivering information. Personalized insurance policy communications embody the five essential attributes of great communication that separate high-performing insurers from the rest.

Here’s how these attributes drive real business outcomes:

- Customer satisfaction improves because messages are clear, relevant, and reassuring.

- Loyalty strengthens as customers feel recognized and informed throughout their policy journey.

- Brand advocacy grows when customers associate your communications with reliability and care.

- Internal efficiency increases as teams spend less time correcting errors and more time improving experiences.

How Does CCM Improve Communication Across the Full Policyholder Lifecycle?

A policyholder’s relationship with their insurer is built through a series of interactions. Each stage, from onboarding to renewal to claims, shapes perception and loyalty. Effective policyholder communications are essential in maintaining this connection. Customer Communication Management (CCM) connects these stages. It ensures every message reflects the insurer’s brand and intent, creating a smooth and reliable experience throughout the lifecycle, helping to improve policyholder experience with CCM.

Welcome Kits: Setting the Tone Early

The first message sets the expectation for everything that follows. A well-designed welcome kit shows professionalism and attention to detail.

With CCM, insurers can:

- Automatically generate welcome kits with correct product and regional details.

- Apply approved branding and templates consistently.

- Personalize messages to make new policyholders feel recognized and valued.

Policies and Endorsements: Clarity Meets Compliance

Policy documents are often lengthy and complex, but clarity is essential for customer understanding and compliance.

CCM helps insurers:

- Standardize and simplify document formats without losing legal accuracy.

- Include dynamic content and visuals for better readability.

- Maintain consistent branding and tone across every policy document.

Renewal Notices: Turning Routine Into Retention

Renewals are key touchpoints that can either secure loyalty or risk attrition. Generic reminders often go unnoticed, but targeted communication can make renewal a positive experience.

CCM enables insurers to:

- Personalize renewal messages with coverage updates and offers.

- Clearly outline changes in premiums or benefits.

- Deliver timely notifications across preferred customer channels.

Coverage Changes and Scheduled Items: Reinforcing Trust

Policy updates, such as adding a new vehicle or insured item, are small but important interactions. They reassure customers that their insurer is attentive and responsive.

CCM ensures:

- Every update reflects accurate coverage details.

- Customers receive confirmations promptly.

- The tone remains professional yet personal.

Claims: The Moment of Truth

Claims are the ultimate test of an insurer’s promise. Customers may forget a welcome kit, but they will always remember how they were treated during a claim.

CCM transforms claim communication by:

- Automating claim status updates and acknowledgments.

- Sending clear next-step instructions and document requests.

- Maintaining an empathetic tone throughout the process.

Other Correspondence: Strengthening Every Connection

Every touchpoint, from beneficiary updates to policy statements, shapes perception. Even the smallest piece of correspondence carries your brand’s voice.

CCM supports this by:

- Consolidating information from multiple systems into a single communication flow.

- Ensuring accuracy and compliance for all document types.

- Delivering consistent visuals, tone, and structure.

Across the policyholder lifecycle, CCM creates a unified communication experience.

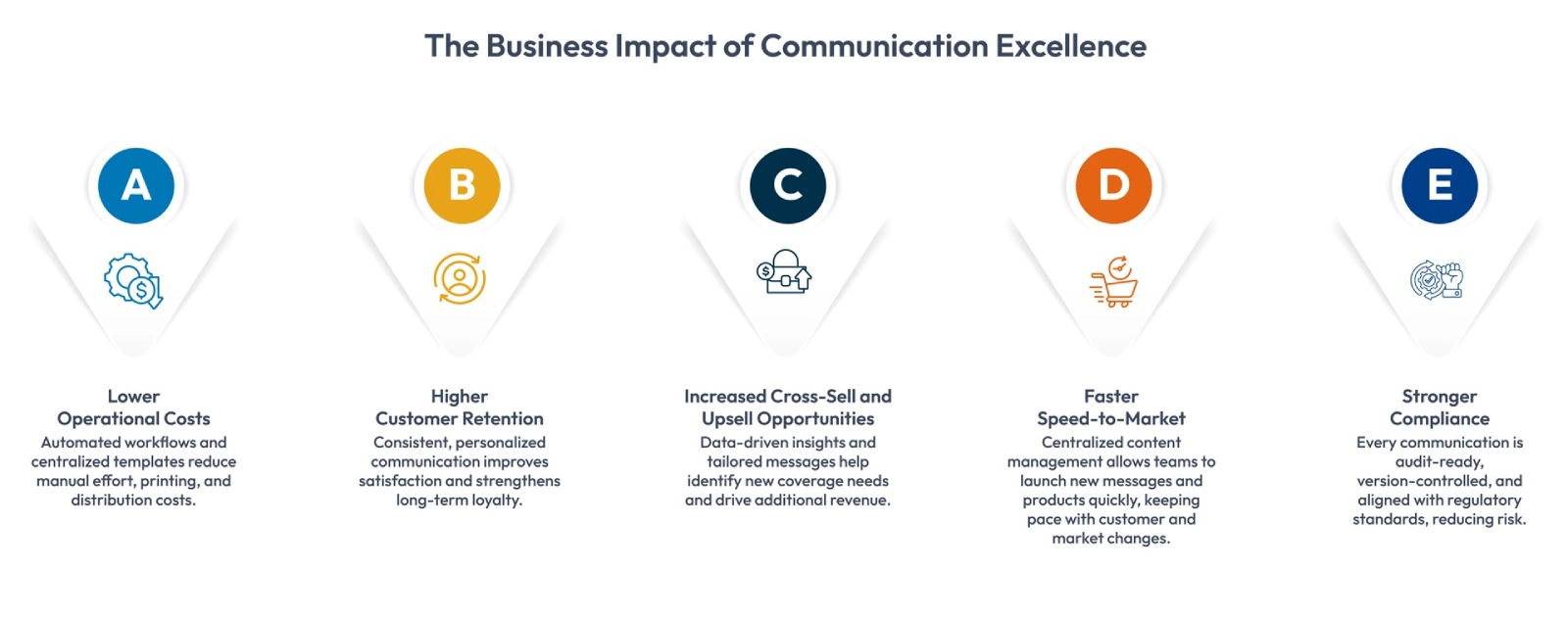

Effective CCM Delivers Measurable Business Value

When communication becomes accurate, timely, and personalized, it creates value beyond the message itself. The impact is visible across both customer experience and operational performance, highlighting key CCM benefits for insurance companies.

Key Things to Keep in Mind: Building a Communication-First Strategy

CCM delivers real value only when paired with the right intent. It is an enabler, not a replacement for human understanding or thoughtful strategy.

Lead with Empathy and Customer Understanding

Every policyholder interaction carries emotion. A claim, a renewal, or even a coverage update is more than a transaction. Personalized insurance policy communications that acknowledge context and tone can turn ordinary exchanges into trust-building moments.

Keep Communication Clear, Concise, and Relevant

Avoid jargon or unnecessary details. Customers value transparency and clarity, especially when decisions affect their protection or premiums.

Maintain Consistency in Tone and Branding

A unified voice across every channel creates recognition and reliability. Consistency builds customer loyalty in insurance communications and reinforces your brand promise at every touchpoint.

Empower Teams to Use Technology Effectively

Technology is only as good as the people using it. Equip teams with tools and training to leverage CCM for personalization, compliance, and faster delivery.

Continuously Monitor and Improve Communication Processes

Collect feedback, measure response times, and analyze communication performance. Continuous improvement ensures CCM remains aligned with both customer expectations and business goals.

Conclusion: From Communication to Connection

At its core, insurance is a business of trust. Policies, claims, and renewals are simply the moments where that trust is tested. What truly defines an insurer’s strength is how clearly, consistently, and compassionately it communicates through those moments.

Customer Communication Management is a framework to humanize them. When technology amplifies empathy instead of replacing it, communication becomes more than a process; it becomes a bridge between promise and experience.

The insurers that thrive in the digital era will be the ones who see every interaction as an opportunity to connect, not just to inform. Because in the end, great communication does more than deliver messages.

Turn every policyholder touchpoint into an opportunity for trust

Experience how Cincom Eloquence can simplify communication, enhance accuracy, and improve policyholder experience.

FAQs

1. What role does technology play in modern policyholder communications?

Technology streamlines how insurers connect with customers. CCM platforms centralize templates, automate messaging, and ensure accuracy across all channels for a consistent experience.

2. How do CCM benefits for insurance companies go beyond efficiency?

Beyond saving time and cost, CCM strengthens compliance, builds brand consistency, and deepens customer trust through clear, reliable communication.

3. How can insurers improve policyholder experience with CCM?

By automating personalized messages and delivering them at the right time, CCM helps insurers make every interaction simple, relevant, and reassuring.

4. Why are personalized insurance policy communications essential today?

Customers expect tailored experiences. Personalized insurance policy communications show understanding, simplify complex details, and strengthen relationships.

5. How does great communication improve customer loyalty in insurance communications?

Consistent, empathetic communication builds confidence. When customers feel informed and valued, loyalty naturally follows.