What is “Customer Journey” in Insurance?

When we talk about a customer journey in insurance, we’re not just talking about a series of isolated events. It’s much more than that. It is the continuous, cohesive experience a policyholder has with your brand, from their very first inquiry to every interaction thereafter.

To put it simply, it’s the difference between a series of unconnected transactions and a guided, personalized tour of the insurance process.

This journey is unique in the world of customer relationships. Here’s a quick look at how it differs from a more traditional one.

| Typical Customer Journey | The Insurance Customer Journey | |

| Product | A tangible item or service with immediate, visible benefits. | A promise of future protection. The value is felt in the moment of need, not at purchase. |

| Communication Flow | Consistent, two-way engagement driven by product use and feedback. | Intense, two-way dialogue pre-purchase, which then shifts to a one-way, insurer-initiated model. |

| Customer Engagement | Often active and frequent, based on using the product. | Primarily passive; active engagement only occurs during critical events like a claim or renewal. |

At first glance, the insurance customer journey might seem a bit disconnected. After the initial intense back-and-forth, communication often becomes one-way, initiated only by the insurer. However, this is precisely where a strategic approach provides a definitive advantage. By correctly mapping a personalized customer journey based on each policyholder’s preferences, you can transform a passive relationship into an active, valuable one.

This is where customer journey automation becomes a game-changer. It bridges the gap between one-way communication and continuous interaction, creating a seamless experience across every stage.

This proactive approach not only drives superior retention but also creates unparalleled opportunities for cross-selling and up-selling, solidifying the long-term value of every policyholder.

Safeguard Your Client Relationships: Mitigate Risks with a Modern Customer Communication Compliance Solution

Discover how to boost customer communication with a reliable compliance solution.

How Customer Journey Automation Directly Addresses Critical Policyholder Pain Points

The traditional model of insurance communication often falls short. It’s frequently reactive, responding only when a customer initiates contact. It’s heavily manual, leading to inconsistencies and delays. And often, it lacks the personal touch that builds trust and loyalty. For today’s policyholders, this translates into significant pain points:

- Frustration stemming from long wait times.

- Feeling of being just another policy number.

- Lack of proactive support.

The question then becomes: How does automation tangibly alleviate these challenges for the modern insurer? It’s not just about sending automated emails; it’s about strategically orchestrating the entire customer experience automation process with intelligent technology.

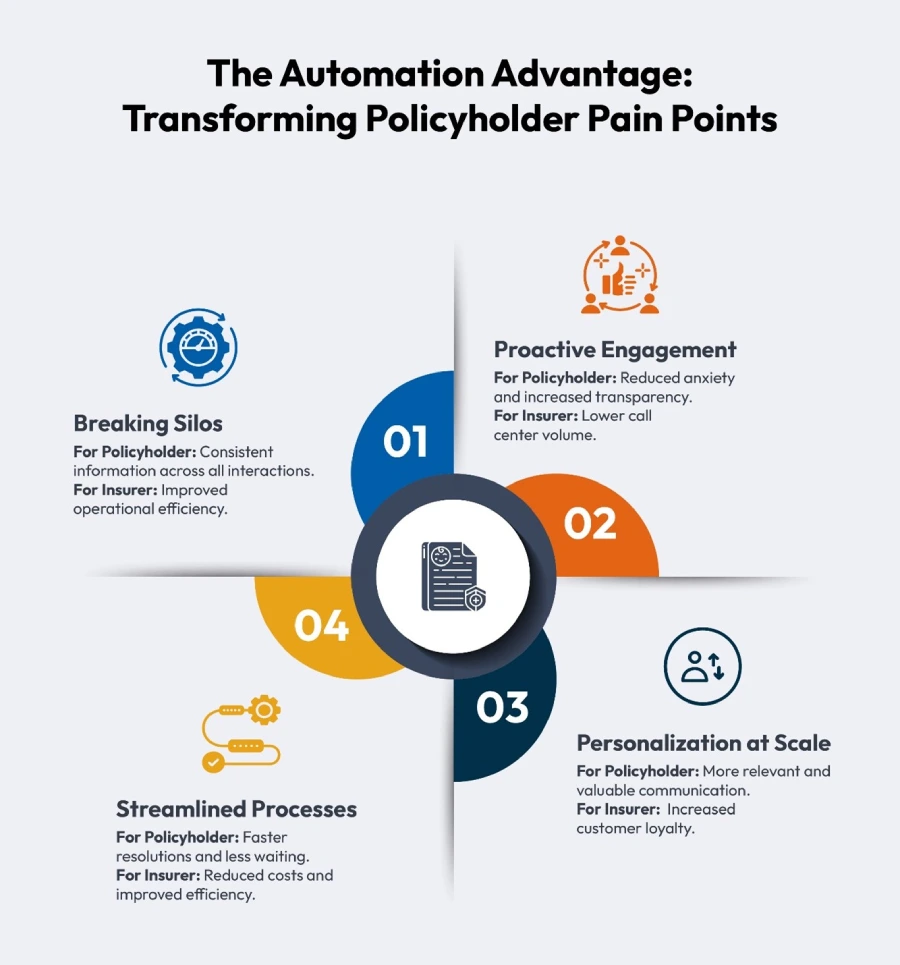

Here’s a breakdown of how automation provides concrete solutions:

Breaking Down Communication Silos:

Traditional insurance operations often involve multiple departments working independently. Automation, powered by a robust Customer Communication Management (CCM) system, integrates these silos. This means a seamless flow of information, preventing policyholders from having to repeat themselves or experience inconsistent messaging across different touchpoints.

For example, when a policyholder inquires about a specific clause, the automated system can pull relevant information from policy documents, claims history, and past interactions to provide a comprehensive and consistent answer, regardless of who they speak with.

Proactive Engagement for Reduced Anxiety:

A significant pain point is the lack of “relevant” communication, especially during critical times like a claim. Automation allows for proactive updates and notifications at each stage of the process. Imagine an automated SMS informing a claimant that their documentation has been received and is under review, or an email outlining the next steps in the claims process with estimated timelines. This proactive transparency drastically reduces anxiety and the need for policyholders to constantly chase updates.

Personalization at Scale for Enhanced Relevance:

After onboarding, communication with policyholders often becomes a one-way street—a major missed opportunity to build trust. Simply sending generic offers isn’t the solution; showing you care is. Modern automation bridges this gap by delivering timely, data-driven messages. By leveraging policyholder data, you can send proactive, relevant insights.

For example, an automated, tailored message with home preparation tips can be sent to a policyholder in a monsoon-prone area. This level of personalization provides tangible value, transforming the insurer from a distant provider into a trusted, proactive partner. Remember, by designing a personalized customer journey, insurers create meaningful engagement at every stage.

Streamlining Processes for Faster Turnaround Times:

Manual processes are inherently time-consuming and prone to errors. Automation streamlines critical workflows, such as document generation, information dissemination, and even initial claim assessments. By automating the routing of claims to the appropriate adjusters and automatically triggering follow-up communications based on predefined rules, insurers can significantly reduce turnaround times, leading to higher customer satisfaction. This is where customer lifecycle automation ensures that policyholders receive consistent support from onboarding to renewal, making every stage of their journey more seamless.

Where Does Customer Journey Automation Have the Biggest Impact in Real-World Scenarios?

While the concept of customer journey automation may seem abstract, its true power lies in its tangible impact at every stage of the policyholder journey. This is where a strategic approach to automation provides a definitive competitive advantage. It’s about moving from theory to tangible, real-world results.

Onboarding: Reducing Friction and Building Trust

First impressions matter. A fragmented, manual onboarding process can create unnecessary friction and lead to early churn. Customer lifecycle automation streamlines this critical stage by:

Automating the Welcome Series

Immediately after a policy is purchased, an automated welcome series delivers essential documents, provides next steps, and offers a warm introduction. This ensures the new policyholder feels supported from day one.

Personalized Follow-Ups

Automated emails or texts can follow up to answer common questions and provide a clear contact point, eliminating the need for a call to the service center.

Routine Policy Management: Providing Continuous Value

In the absence of a claim, a policyholder’s relationship with their insurer can feel passive. Customer journey automation changes this dynamic by providing continuous value and keeping your brand top-of-mind.

Proactive Reminders

Automated reminders can be sent for policy reviews or updates, ensuring policyholders are always well-informed.

Educational Content

By leveraging data on a policyholder’s policy type and location, you can proactively share relevant, educational content—like home safety tips for homeowners—that builds trust and shows you care.

The Claims Process: Building Transparency and Confidence

For a policyholder, a claim is a moment of truth. Automation can transform a traditionally stressful experience into a transparent, reassuring one.

Real-Time Status Updates

Provide real-time, automated status updates via SMS or email, keeping the policyholder informed at every step without them having to call for an update.

Automated Document Requests

Automatically request necessary documents and clearly explain what’s needed and why. This sets clear expectations and accelerates the process.

Renewals & Retention: Simplifying the Final Step

The renewal process is a final opportunity to reaffirm your brand’s value. Automation can make it effortless for the policyholder.

Clear Renewal Notifications

Send automated, clear renewal notifications well in advance, giving the policyholder ample time to review their options.

One-Click Renewals

Offer a seamless, one-click renewal option for eligible policies, eliminating the need for manual paperwork and improving convenience.

Ensuring Compliance and Reducing Risk

In a highly regulated industry like insurance, consistency in communication is non-negotiable. Journey automation provides an essential layer of protection by:

Automating Meticulous Documentation

Automation ensures that every piece of correspondence, from mandatory disclosures to policy changes, is delivered accurately and documented meticulously. This drastically reduces the risk of human error and provides an irrefutable audit trail.

Guaranteeing Consistency

Automated rules ensure every message, disclaimer, and required piece of information is consistently included and sent at the correct time, protecting the company from non-compliance and potential penalties.

Supporting Scalability and Business Growth

As your business grows, so does the complexity of your communication needs. Journey automation provides a scalable and flexible foundation that allows you to expand without compromising quality by:

Managing High-Volume Interactions

It allows you to onboard thousands of new policyholders and manage millions of customer interactions without a linear increase in operational costs or staff.

Accelerating New Product Launches

You can rapidly build and deploy new communication journeys for new products or services, ensuring you can grow at pace and respond to market demands without being bottlenecked by manual processes.

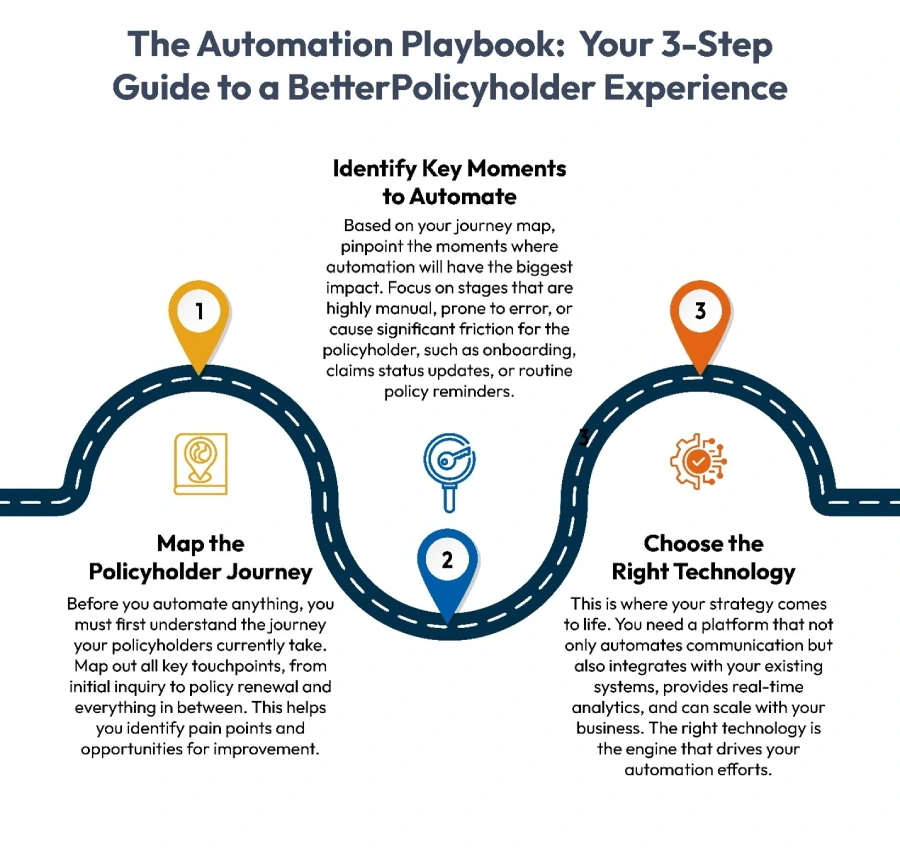

How to Start Automating Your Customer Journey

So, you’re convinced of the immense value of automating your policyholder journey. The question is, where do you begin? It may seem like a daunting task, but it can be broken down into a strategic, three-step process. This approach helps ensure your efforts are focused, efficient, and aligned with your business goals.

Is CCM the Right Fit for Customer Journey Automation?

We’ve explored the distinct nature of the customer journey in insurance, the critical pain points automation solves, and its tangible impact across the business. Now that you have a three-step guide for getting started, the most important decision is choosing the right technology.

While many organizations might consider separate Customer Journey Management Software, a more strategic and efficient approach is to leverage modern Customer Communication Management (CCM) software as your primary CX Automation Tool.

While a CCM is traditionally seen as a platform for delivery, its advanced capabilities extend far beyond that. The most powerful CCM solutions are built with a suite of features that make them uniquely suited to orchestrate and automate the entire policyholder journey.

- Powerful Integration: A robust CCM seamlessly integrates with CRM, ERP, and your core policy and claims systems, allowing for a unified flow of customer data that drives relevant communication.

- Advanced Automation and Tracking: It provides the rules-based automation needed to trigger the right message at the right time, while also offering the analytics to prove its impact.

- Content as a Central Repository: By acting as a central hub for all content—including policy documents, regulatory notices, and marketing materials—a CCM ensures brand consistency and efficiency across every communication channel.

- Scalability and Flexibility: A modern CCM platform can handle millions of interactions at scale, giving you the flexibility to adapt and launch new journeys as your business grows.

- User-Friendly Interface: With an intuitive user interface, your teams can easily create and manage complex communication journeys without extensive technical support.

- Built-in Compliance: The best CCMs are designed with built-in compliance features, ensuring all communications adhere to state regulations and provide a secure, auditable trail.

By leveraging a CCM, you don’t just streamline your communication; you gain a powerful, all-in-one platform for customer journey automation that can drive significant business growth and customer loyalty. This is precisely the philosophy behind Cincom Eloquence, a solution built to empower insurance leaders to deliver exceptional experiences, optimize operations, and achieve unprecedented growth.

FAQs

1- What is customer experience automation in the insurance industry?

Customer experience automation is the strategic use of technology to automate communication and workflows throughout the policyholder lifecycle. It leverages CX automation tools to proactively engage customers with personalized messages, ensuring they feel supported and informed at every stage, from onboarding to claims and renewals.

2- How does automation create a more personalized customer journey?

Automation enables a personalized customer journey by using data to deliver timely and relevant communication. Instead of sending generic messages, automation platforms can trigger tailored content based on a policyholder’s specific policy type, location, or recent activity (e.g., a claims filing), making every interaction feel unique and valuable.

3- Do I need separate customer journey management software?

Not necessarily. While the dedicated customer journey management software exists, a modern Customer Communication Management (CCM) platform can be a more strategic choice. A robust CCM offers a full suite of features, including integration, analytics, and compliance, that enable it to effectively orchestrate and automate the entire customer journey.

4- What is the difference between customer automation and customer lifecycle automation?

Customer automation is a general term for automating customer interactions. Customer lifecycle automation refers specifically to automating communications across the entire end-to-end policyholder journey, including onboarding, routine policy management, claims, and renewals. This ensures consistent and proactive engagement throughout the customer’s entire relationship with your brand.

5- How does this type of automation benefit our company?

Automating the customer journey offers significant benefits, including increased policyholder retention, higher satisfaction scores, and reduced operational costs. By proactively solving customer pain points and providing a seamless experience, you build trust and loyalty that directly contribute to long-term business growth.