Introduction

In our recent article, “6 Key Challenges in Financial Services Communications and How to Solve Them,” we examined the obstacles currently hindering effective engagement. While that overview set the stage, we now need to confront a much deeper problem. Despite the vast capital we see poured into digital upgrades, the actual quality of customer interactions is slipping. It is a strange situation where the more financial and banking organizations automate, the more disconnected customers feel.

This decline isn’t happening because technology is failing. It happens because the user experience has become fragmented across different departments. In this article, we delve into these systemic failures and demonstrate how you can begin rebuilding that essential sense of trust through more effective, unified communication.

5 Key Customer Communication Challenges in Financial Services

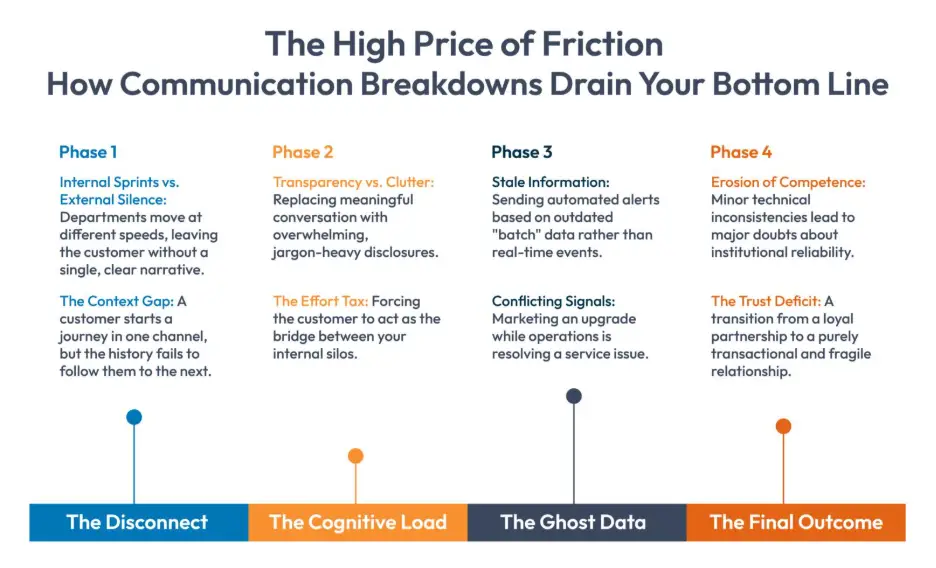

Systemic failures in customer journeys do not stem from a single technical outage. They are the result of accumulated, minor misalignments. We are witnessing a structural disconnect that transforms simple banking tasks into arduous processes. These are the primary sources of friction:

Institutional Message Fragmentation

Within most large financial organizations, the “voice” a customer encounters depends entirely on which department owns the specific channel. Marketing, risk, and collections often operate in total isolation. You may find a situation where a customer receives a promotional offer for a premium account at the same moment the risk department has flagged their activity for a routine review. This lack of a cohesive narrative makes the institution appear disorganized. When outbound messages conflict, it signals to the customer that the organization lacks a holistic view of their financial life.

Stop Funding Your Own Failure

Fragmented communication is a silent drain on your bottom line. This whitepaper provides the hard financial evidence needed to stop the capital leak, proving how modernizing your outreach directly improves claim severity, billing accuracy, and total ROI.

The Transparency Trap

Regulatory mandates demand greater transparency, but many firms have reacted with “information dumping.” Handing a customer a thirty-page, jargon-heavy PDF is a defensive maneuver. This approach creates a massive cognitive burden that quickly turns into information fatigue. When customers feel buried under a mountain of text, they simply stop engaging. This is exactly when the most critical and expensive communication breakdowns happen. It is a self-defeating cycle: in the attempt to be transparent, the institution becomes effectively invisible.

Broken Omnichannel Communication Loop

Nothing is more annoying for customers than having to explain their problem for the third time. This occurs frequently when a user initiates a query via a mobile app but must transition to a web portal or a telephone agent to reach a resolution. Because internal systems are siloed, the context of the interaction often vanishes during the transfer. This amnesia forces the customer to do the heavy lifting that your internal systems should be handling. It makes the whole customer journey feel cold and transactional.

The Latency Gap in Legacy Systems

Customer expectations have moved to real-time, yet many back-end infrastructures still crawl along on antiquated batch processing. This delay is what generates ghost communications. You see it when a customer settles an outstanding balance on a Monday morning, only to receive an automated “Late Payment” alert that same afternoon because the systems won’t synchronize until midnight.

The Personalization Dilemma

Banks often struggle to find the middle ground between being helpful and being intrusive. Customers expect a degree of familiarity; they find it frustrating when they receive generic offers that ignore their financial history. However, when a message feels too informed (referencing specific private habits without a clear reason), it triggers privacy concerns.

This friction occurs because there is no clarity on how data is used to shape communication. When the reason for a personalized message is unclear, the customer feels monitored rather than supported. Personalization should simplify a task, not just display the amount of data collected.

4 Main Causes of Financial Communication Challenges

The previous sections outlined five critical communication hurdles. The question remains: why do these challenges exist in the first place? These friction points result from specific internal choices and technical constraints.

Maintenance Costs Over Innovation

Most financial institutions spend a large portion of their budget on keeping legacy systems running. This focus leaves very little funding for the updates needed for personalized omnichannel communication. Replacing these old systems is a high-risk and expensive task. Consequently, firms continue to use disconnected tools that cannot process data in real time. This technical debt is the primary cause of the delay in the customer’s experience.

Disconnected Data Storage

The struggle with personalization and data privacy stems from how information is organized. Customer data is often stored in separate databases that do not talk to each other. Without a unified data strategy, a bank cannot see a complete history of a customer’s activity. This leads to irrelevant messages and increases privacy risks when data is used without proper context.

Competing Internal Objectives

Different departments within a bank often work toward conflicting goals. Marketing teams are judged on sales growth, while risk and compliance teams are measured on security and legal safety. These groups rarely share a common plan for customer outreach. This misalignment is why customers receive fragmented messages that seem to come from different organizations.

Prioritizing Legal Safety Over Clarity

While regulations aim to protect customers, they often lead to a defensive culture within the bank. Legal departments frequently insist on including every possible disclosure to avoid the risk of fines. This habit favors long, complex documents over simple and direct text. The result is an information dump that satisfies a rule but fails to help the customer.

Strategies to Formulate a Reliable and Relevant Communication Plan

Correcting the systemic causes of friction requires a shift from reactive messaging to a deliberate strategy. A reliable communication plan must bridge the gap between internal departments and the customer.

Consolidate Messaging Platforms

Internal departments often use separate tools to contact customers. This causes a fragmented customer journey. To fix this, firms must move all outreach into one central hub.

- Connect Marketing, Risk, and Operations tools to a single data source.

- Set rules to prevent sending conflicting messages to the same user.

- Audit all active templates to ensure a consistent tone across the bank.

Use Layered Information Structures

Transparency is not measured by the length of a document. Instead of providing large files, firms should use a tiered approach to meet regulations.

- Place critical facts like rates and fees at the top of every message.

- Use bullet points to highlight the most important actions for the customer.

- Provide digital links for those who need to read the full legal text.

Integrate Cross-Channel Context

To achieve true omnichannel communication, the bank must remember the history of a query. If a user moves from a digital app to a phone call, the context must follow them.

- Enable real-time data sharing between mobile apps and call center software.

- Train staff to use interaction logs before asking the customer to repeat information.

- Update the customer profile immediately after every contact.

Clarify Data Usage Logic

The tension between personalization and data privacy is reduced when the bank is honest about its methods. Customers need to understand why they are receiving specific alerts.

- State clearly why a specific message is being sent to the user.

- Allow customers to choose which types of data the bank can use for personalization.

- Avoid using sensitive transaction details without a direct service benefit.

Switch to Real-Time Data Triggers

Legacy systems that update once a day cause inaccurate notifications. Improving accuracy requires systems that react instantly to customer actions.

- Move from batch processing to event-driven communication triggers.

- Ensure that payment systems talk to alert systems without delay.

- Automate the cancellation of alerts as soon as a task is completed by the user.

Implementing these strategies requires more than a shift in policy. It requires a specific technology that can bridge the gap between back-end data and the customer’s screen. This is why Customer Communication Management (CCM) has become the central focus for firms trying to fix their outreach.

CCM: The Core Tool for Financial Communication

We discuss CCM because it is the only way to handle the massive volume of data a bank holds without creating more noise. Most financial institutions have the information they need, but it is stuck in different places. CCM acts as the engine that pulls this data together and turns it into something a person can actually use. It is the layer that sits between complex internal systems and the final message.

Centralize All Outbound Channels

A CCM platform allows an organization to manage every message from one place.

- Control email, SMS, and app notifications through a single interface.

- Update a disclosure once and have it change across every channel instantly.

- Remove the need for different departments to buy separate messaging tools.

Automate Compliance and Logic

Financial regulations change frequently. A CCM tool automates the inclusion of the correct legal text based on the customer’s location or account type.

- Build rules that automatically add required warnings to specific products.

- Use pre-approved templates that prevent staff from sending non-compliant text.

- Create a digital audit trail of every message sent for regulatory reviews.

Enable Real-Time Personalization

To solve the personalization and data privacy balance, CCM tools process data as it happens.

- Trigger messages based on live account activity rather than old records.

- Use data tags to insert the customer’s name or specific account details accurately.

- Manage customer preferences so they only receive messages on the channels they prefer.

Bridge the Legacy Gap

CCM software is designed to talk to old back-end systems and modern front-end apps at the same time.

- Extract data from antiquated databases without needing to replace them.

- Format data into clean, mobile-friendly designs.

- Ensure that the customer journey remains consistent even if the internal tech is old.

Way Forward

Improving how banks talk to people is now a necessity rather than a choice. The gap between internal data and the final message has become too wide to ignore. Moving forward means making communication a priority across every department, not just a task for the IT team. When a firm chooses to centralize its messaging and simplify its language, it stops being a source of frustration and starts becoming a helpful partner. This shift is what will define which institutions keep their customers’ trust in the coming years.

Schedule a demo for Cincom Eloquence to see how we can simplify your customer communication strategy.

FAQs

1. What are the main customer communication challenges in financial services?

The primary issues are message fragmentation across departments, information dumping due to regulations, and broken omnichannel loops. These are often caused by old systems and siloed data that prevent a clear customer journey.

2. How does a CCM platform improve the customer journey?

A CCM tool centralizes all messaging into one place. This ensures that a customer receives a consistent story from the bank, whether they are using a mobile app or speaking to an agent, which fixes omnichannel communication gaps.

3. Can you simplify compliance with the right technology?

Yes. Instead of long PDFs, you can use layered disclosures. This meets Regulations by providing key facts upfront while keeping the full legal text available via links, reducing information fatigue.

4. How is the tension between personalization and data privacy resolved?

Firms must be transparent about why they are using specific data. A proper communication plan uses real-time triggers to ensure messages are helpful and relevant, rather than appearing intrusive or like surveillance.