In insurance and financial services, a customer email isn’t just a message; it’s a legal record. A policy statement isn’t just a document; it’s a promise backed by regulations. The stakes are uniquely high, and every interaction must reinforce compliance, protect against regulatory exposure, and strengthen customer trust. When mismanaged, communication becomes a source of risk, regulatory scrutiny, and revenue leakage.

This is why Customer Communication Management (CCM) has become a critical capability across the industry. But evaluating solutions goes far beyond feature grids and vendor claims. Decision-makers are less interested in polished brochures and more focused on whether a platform can address their day-to-day realities: fragmented systems, evolving regulations, and customers who now expect personalized, seamless communication.

This article takes a closer look at what financial and insurance organizations truly expect from CCM solutions and how those expectations are reshaping technology investments and strategic priorities.

What Financial and Insurance Organizations Really Want in CCM Solutions

When decision-makers in financial services and insurance look at the CCM platform, the evaluation rarely begins with features. It starts with a simple question: If we invest heavily in this solution, what will we get in return?

In this industry, return on investment is not just about cost savings. It is about reducing regulatory exposure, improving customer retention, and creating operational resilience. Organizations judge CCM software based on its capacity to safeguard against compliance failures and facilitate intelligent, personalized communication on a large scale. The mindset is pragmatic: “Show me how this solution lowers my risk, increases efficiency, and strengthens customer relationships; then I’ll consider the investment worthwhile.”

From that perspective, here is what organizations consistently look for:

Compliance-First Assurance

Compliance is not negotiable. Every communication must stand up to regulatory scrutiny, and the penalties for failure are severe. That is why decision-makers prioritize CCM solutions that offer robust audit trails, version control, and standardized templates that are already aligned with industry regulations.

The questions in their mind:

- Does this platform comply with regulatory requirements as per my geographical location?

- Can this system prove, instantly, who approved communication and when?

- Will regulators accept these records as defensible evidence?

- How easily can we update disclosures or policy language across all templates when regulations change?

- Can I trust this platform to keep us out of headlines and away from fines?

What they want is visibility and confidence. If a regulator asks who approved a policy letter or when a disclosure was last updated, the CCM platform should provide that answer in seconds. Without this assurance, the risk of fines, reputational damage, or litigation outweighs any operational gain.

Guide to Choosing and Implementing the Right CCM Solution

Get the guide to find a CCM that offers peace of mind, flexibility, and real results.

Integration and Flexibility

A CCM solution that operates in isolation is of little value. Financial institutions and insurers run on complex ecosystems—policy administration systems, claims management platforms, CRM tools, and core banking systems. Leaders expect client communication software to integrate seamlessly with these systems, not force additional silos.

Flexibility is just as critical. Regulations shift, product lines evolve, and customer preferences change. Organizations want CCM software that adapts quickly to these changes without months of custom development.

The questions in their mind:

- Will this solution plug into our existing policy admin and claims systems without months of customization?

- If we acquire another company, can the platform adapt without a full rebuild?

- How easy will it be to add new channels or products in the future?

- Are we locking ourselves into a rigid system that will become a bottleneck?

In other words, they want a platform that works with their existing landscape today and can pivot with them tomorrow.

Customer Experience Enhancement

Customers now expect communication that is clear, personalized, and delivered in the channel they prefer. For insurers and financial firms, this is no longer a “nice-to-have”; it is a differentiator.

Decision-makers want CCM solutions that can personalize content at scale, ensuring communications reflect customer data accurately, whether it is a billing reminder, claims update, or policy renewal. They also want true omnichannel delivery, so the same message is consistent across email, mobile, print, and self-service portals.

The questions in their mind:

- Can this solution help us move beyond generic templates to real personalization?

- Will the customer notice that we actually know their history, their preferences, and their policies?

- Can it ensure a consistent experience across channels without duplication or errors?

- If communication feels impersonal, are we risking trust and retention?

The “why” is straightforward: better communication drives trust, and trust drives retention.

Operational Efficiency

Manual intervention is costly and prone to error. Leaders want CCM platforms that automate repetitive processes such as document generation and approvals, while offering centralized template management to reduce duplication across departments.

The questions in their mind:

- How much time will automation really save my compliance and operations teams?

- Can this platform reduce errors that expose us to compliance risk?

- Will it cut down on duplicate work across departments?

- Does it allow us to get new communications out faster, without waiting weeks for IT?

The goal is not only cost reduction but also freeing skilled staff from administrative work so they can focus on higher-value activities like compliance strategy or customer engagement. Efficiency in communications directly translates into faster time-to-market, fewer errors, and lower operating costs.

Scalability and Future Readiness

Organizations in this sector know that today’s solution must be ready for tomorrow’s challenges. That is why scalability and adaptability are non-negotiable. Decision-makers increasingly look for cloud-native platforms that can scale with demand, whether it is a sudden surge in policy communications or the rollout of a new product. Equally important is the ability to adapt to new regulatory requirements without major system overhauls.

The questions in their mind:

- Can this platform handle peak volumes without disruption?

- How quickly can we scale if we launch new products or expand into new markets?

- Will we be forced into expensive rework when regulations change again?

- Is this technology future-proof, or will we outgrow it in two years?

A future-ready CCM solution protects the organization from becoming obsolete or locked into expensive rework when the regulatory landscape shifts.

The Review Lens: How Leaders Evaluate CCM Solutions Today

No two stakeholders view CCM platforms in exactly the same way. Compliance officers, CX leaders, operations managers, and IT leaders all come to the table with different priorities. The best organizations recognize this and evaluate solutions through multiple lenses.

What compliance officers look for

Compliance officers focus on risk reduction and defensibility. They want a CCM platform that makes regulatory audits straightforward and ensures that every piece of customer communication can be traced back to an approved template. Their lens is shaped by questions like:

- Does this system provide a clear audit trail?

- Can I demonstrate compliance instantly to regulators?

- How quickly can we update communications when regulations change?

What CX leaders prioritize

Customer experience leaders view client communication software as a relationship-building tool. Their interest lies in how communications reflect the brand, engage customers, and build trust. They evaluate solutions by asking:

- Can this platform personalize communication without sacrificing compliance?

- Does it deliver a consistent experience across all channels?

- Will better communication help us retain and grow customer relationships?

What operations managers value

Operations managers are driven by efficiency and cost control. They are interested in how a CCM solution can streamline processes, reduce manual work, and eliminate duplication. Their questions sound like:

- How much time and cost will automation actually save us?

- Can we reduce the number of templates in circulation?

- Will this system allow faster turnaround for new communications?

What IT managers need

IT managers bring a technical and security-first perspective. Their priority is ensuring the solution integrates with existing infrastructure, scales reliably, and meets security requirements. They ask:

- Will this platform integrate easily with our core systems and data sources?

- Is it cloud-native and built to scale with business growth?

- Does it align with our security standards and data protection policies?

While each role has unique priorities, successful organizations evaluate CCM platforms through all of these lenses at once. The strongest CCM investments are those that deliver on compliance, customer experience, operational efficiency, and IT scalability simultaneously. When organizations adopt this multi-lens approach, they end up with a platform that not only meets today’s needs but also positions them for long-term success.

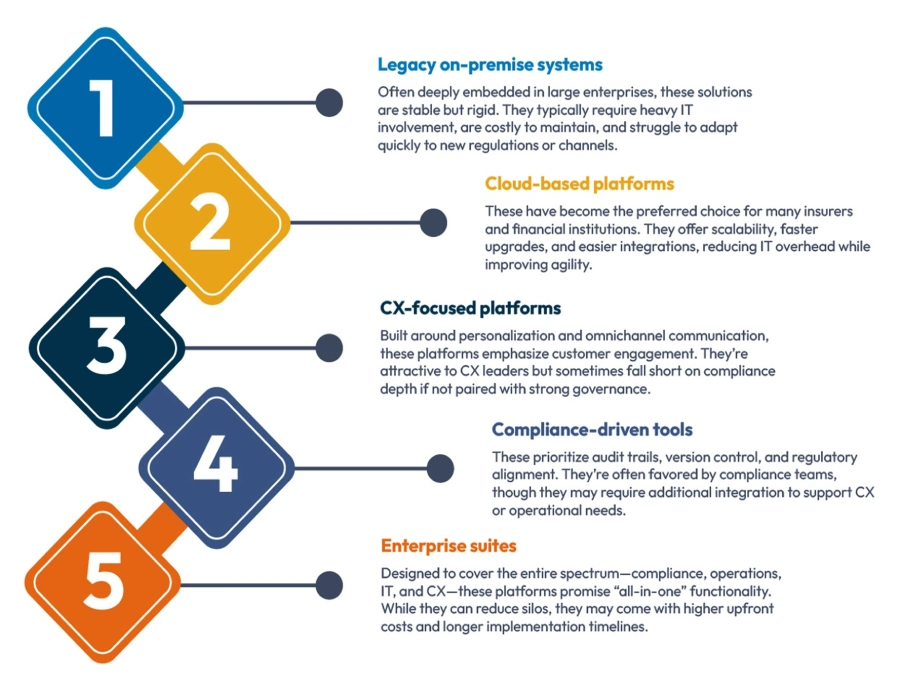

Types of CCM Solutions Available in the Market

When organizations begin their search for a CCM platform, they quickly realize the market is diverse, and no two solutions are built the same. Each category has its own strengths and trade-offs. Understanding these types is critical to aligning your priorities with the right kind of technology.

The key to a successful CCM investment is not simply picking the most feature-rich platform, but selecting the solution that delivers measurable compliance, operational efficiency, and customer impact, while positioning your organization for future growth.

Wrapping Up

For financial and insurance organizations, customer communication management is a strategic capability that touches compliance, operations, IT, and customer experience. The right CCM platform reduces regulatory risk, streamlines operations, and creates meaningful, personalized interactions that build trust and loyalty.

When evaluating solutions, leaders focus on long-term value rather than short-term features. By aligning technology choices with organizational priorities and adopting a multi-lens approach, CCM becomes a foundation for sustainable growth, stronger customer relationships, and regulatory confidence. Ultimately, the right solution is one that delivers on all of these fronts simultaneously.

That’s precisely why many leaders are turning to Cincom Eloquence. As an enterprise-grade CCM platform, Cincom Eloquence is designed to deliver measurable compliance, operational efficiency, and customer impact, positioning your organization for long-term growth and success.

FAQs

1- What is a CCM solution, and how does it help financial and insurance companies with compliance?

A Customer Communications Management (CCM) solution helps financial and insurance firms create, manage, and deliver critical customer communications like policy documents, statements, and bills. It ensures compliance by providing robust audit trails, version control, and centralized templates to meet regulatory requirements and pass audits with confidence.

2- What are the key features to look for in a CCM platform for risk management?

For risk management, look for a platform with secure content locking, automated approval workflows, and built-in accessibility (ADA/WCAG) standards. These features are essential for mitigating legal exposure and ensuring every communication is compliant before it reaches the customer.

3- How can a CCM solution improve our customer experience and retention?

A CCM solution improves customer experience by enabling true omnichannel personalization. It allows you to deliver consistent messages across all channels (email, print, and mobile) and use customer data to create relevant and engaging communications, which ultimately builds trust and drives retention.

4- Can this CCM software integrate with our existing core banking and policy administration systems?

Yes, top-tier CCM platforms, such as Cincom Eloquence, are designed to integrate seamlessly with your existing core banking, CRM, and policy administration systems. This ensures a smooth flow of data, eliminates silos, and allows for the automation of communication processes without disrupting your current infrastructure.

5- What makes Cincom Eloquence the preferred CCM solution for financial and insurance leaders?

While many platforms exist, Cincom Eloquence is a top choice because it’s built to address the most critical needs. It provides the audit-ready compliance that legal teams require, the personalization capabilities that CX leaders demand, the operational efficiency that keeps costs in check, and the scalability and integration that IT departments need. The platform’s ability to handle high-stakes communications with confidence and scale to meet complex business demands is why it stands out in a crowded market.