Organizations need to understand their customers to increase engagement and retention. This is what builds lasting relationships between them. In the insurance industry, business relationships are everything. They help organizations create loyal customers who become the most valuable assets an insurance organization can have.

However, these relationships cannot happen overnight. They are shaped by how well insurers communicate with their policyholders. Thus, effective communication plays a significant role in this. It helps people understand what is happening and what to expect. That is why insurers must focus on making communication clear and consistent across the entire policy lifecycle.

Using customer journey mapping tools can help insurers understand the customer’s experience from the first interaction to policy renewal or claim resolution. When insurers have this level of insight, they can align their communication, services, and support accordingly.

Let’s dive deeper into the concept of customer experience mapping and how customer journey mapping tools can help your organization achieve that.

What Is a Customer Journey Map?

A customer journey map is a visual overview of how a customer interacts with your business. It shows the full path from learning about your services to purchasing a policy and beyond.

Customer journey mapping often includes the steps and motivations behind customer interactions. It helps you visualize the entire customer journey and see what your customers might be thinking or feeling at each stage. It also enables clear, timely, and helpful communication at every step.

Customer journey mapping tools help organizations create these maps more efficiently. These tools make it easier to track interactions and generate insights in communication across the policy lifecycle. As a result, organizations get help in improving conversion rates, optimizing onboarding, and enhancing customer retention.

Why Is Customer Journey Mapping Important in Insurance?

Customers might have tons of questions related to policy terms and claims for which they want quick and accurate answers. Thus, timing and clarity becomes extremely important for organizations in the insurance industry.

When communication is inconsistent and unclear, customer trust starts to fade away. That is why journey mapping and customer journey mapping tools are useful. Here are a few reasons why journey mapping is worth the effort.

1- Better Understanding of Customer Needs

When organizations use a journey map, they start to understand what matters the most to their customers. They learn where they get stuck or confused. This allows them to make communication more helpful and focused.

2- More Relevant Communication

Different stages of the policy lifecycle require different kinds of messages. A new customer needs help with onboarding. Someone filing a claim wants updates and support. Journey maps help organizations know what to say and when.

3- Consistent Experience Across All Channels

Customers might talk to your team by phone, email, chatbot, or through your website. They expect the same messaging and tone everywhere. Using customer journey mapping tools makes this easier by giving your teams a clear picture to work from.

4- Higher Customer Retention

When communication is helpful and reliable, customers are more likely to stay connected to the business. They feel like they matter. That leads to stronger loyalty and more renewals.

5- Better Team Coordination

Journey maps also help your internal teams as well. Everyone from sales to claims can use the same information provided by customer journey mapping tools. This helps reduce confusion and keeps everyone focused on customer needs.

Are Your Customer Communications Creating the Insurance Experience Your Customers Deserve?

See how your communication stacks up—download the asset and spot areas for growth.

How to Create a Customer Journey Map for Insurance

Creating a good journey map requires planning. Organizations need to gather real feedback, look at data, and think carefully about what customers are going through.

Here is a simple step-by-step approach to follow.

Step 1: Build Your Customer Personas

Creating a customer persona is the first step of the customer journey mapping process. Think about your ideal customers. What are their needs and concerns? What channels do they use most often? What work do they do? Answer these questions to create a detailed profile and initiate customer experience mapping or buyer persona mapping.

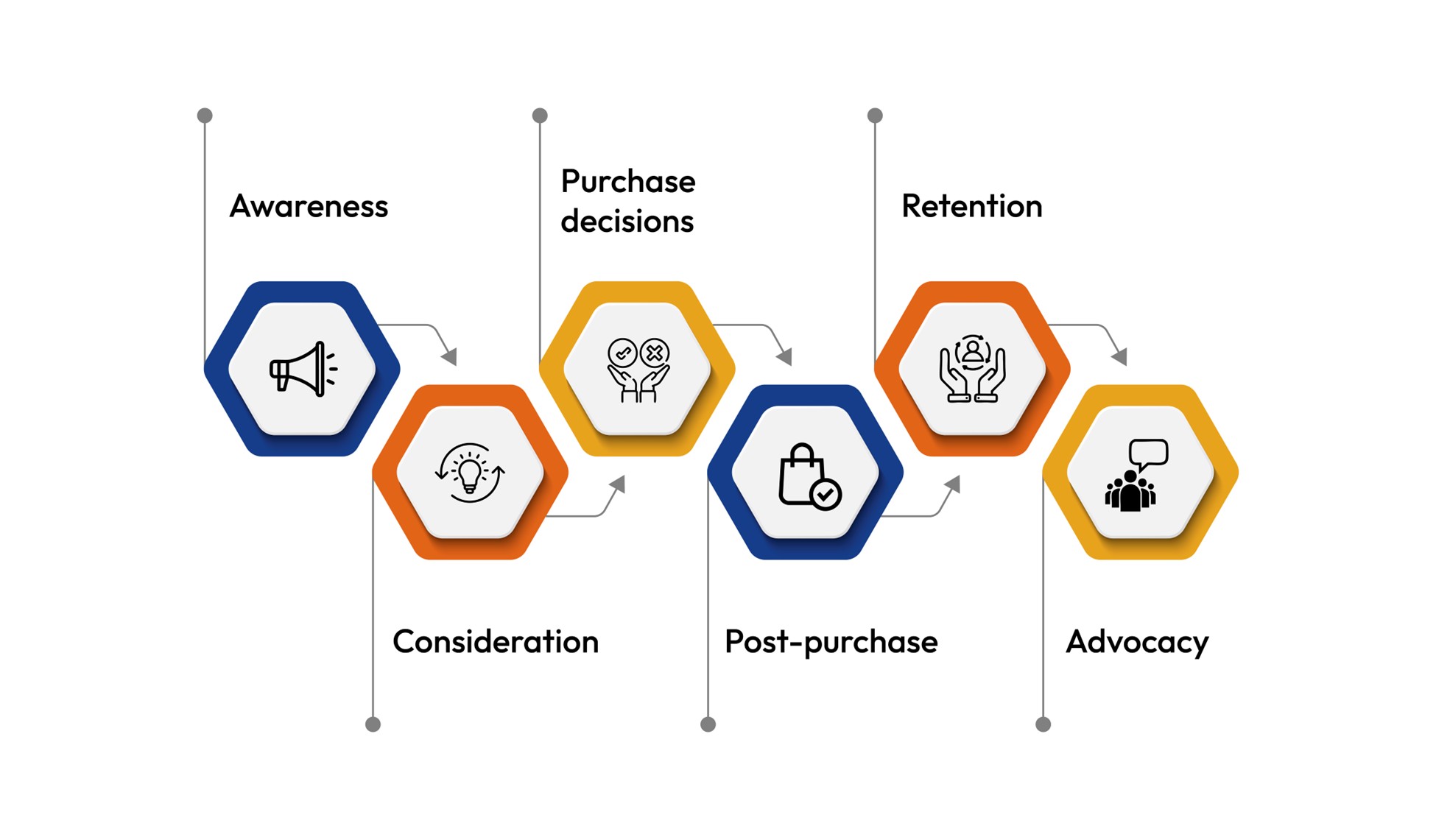

Step 2: Set customer journey stages

Stages are the steps that customers take when interacting with your products and services. Though the number of stages may vary from business to business, common stages that most businesses define are:

- Awareness

- Consideration

- Purchase decisions

- Post-purchase

- Retention

- Advocacy

These stages can define the customer’s journey right from when they interact with your insurance service to making the final purchase and filing the claim.

Step 3: Identify Customer Touchpoints

List out every point of contact your customer has with your business. This might include visiting your website, speaking to an agent, receiving policy documents, filing a claim, or getting reminders for renewal. These are the touchpoints that you need to improve to enhance communication across the policy lifecycle.

Step 4: Spot the Problem Areas

Use customer feedback, support data, and surveys to identify where people are having trouble. Are they unsure about claim steps? Are emails being missed? These issues give you clear areas to fix.

Step 5: Set Metrics to Measure Progress

Decide how you will track improvements. Look at customer satisfaction scores, response times, or complaint numbers by using customer journey mapping tools. This will help you understand if your new communication plans are working.

Also, Read: What is CCM?

How to Make Journey Mapping More Effective

Once you have a map in place, there are a few things you can do to make it more useful over time in order to enhance communication with customers.

Cross-team collaboration

Involve people from different departments, including sales, customer support, claims, and marketing. The people working in these teams can bring different insights relevant to their operations and KPIs. When these teams work together, the map becomes more accurate and useful.

Keep the Map Updated

Customer behavior can change from time to time. Thus, it becomes important to match stages with changing customer behavior. You must review your map regularly and update it based on user feedback and new data.

Use Technology to Support Communication

Using customer journey mapping tools to help you send messages at the right time can enhance your communication significantly. For example, when a policyholder submits a claim, the system can automatically generate a personalized response with clear next steps.

Tools like Cincom Eloquence help insurers manage communication with speed, accuracy, and consistency. With Cincom Eloquence in place, your teams can automate the creation and delivery of policy documents, billing notices, claim acknowledgments, and renewal letters—without relying on manual effort. It can also help you respond quickly without needing manual follow-up every time.

Move beyond mapping to execution. Learn how customer journey automation is redefining the policyholder experience with personalized, real-time communications.

Start Improving Your Communication Today

Clear and consistent communication is key to building strong customer relationships in the insurance industry. If you are looking to improve how, when, and what you communicate with policyholders, implementing customer journey mapping tools is an effective way to begin. If you are looking for a customer journey tool, Cincom Eloquence can be a great solution for your organization. It equips insurers with the tools to deliver accurate, compliant, and personalized communications at scale. Contact us to learn how Cincom Eloquence can help you deliver a more consistent and confident experience to every policyholder.

FAQ

1- Why is communication so important across the policy lifecycle?

Clear and timely communication builds trust, reduces confusion, and helps customers feel supported, especially during claims or renewal stages. It also improves customer satisfaction and retention.

2- How do customer journey mapping tools help insurers?

Customer experience mapping involves outlining every step a customer takes while interacting with your company. Customer journey mapping tools make it easier to identify gaps, monitor customer behavior, and create communication strategies throughout the journey.

3- What are common communication challenges insurers face today?

Insurers struggle with challenges like delayed responses, inconsistent messaging, unclear policy documents, and lack of personalization. Using customer journey mapping tools can help insurers fill these gaps and lead to effective communication.

4- Are customer journey mapping tools difficult to integrate with existing systems?

Many modern customer journey tools are designed to be user-friendly and flexible. They can integrate with existing CRM and policy management systems.

5- How can Cincom Eloquence help with customer communication?

Organizations looking to implement customer journey mapping tools can choose Cincom Eloquence to create, manage, and deliver accurate, compliant, and personalized communications. It automates document generation and supports multichannel delivery, improving efficiency and consistency across all customer touchpoints.