Introduction

Decision-makers in insurance usually don’t worry about individual emails or letters. They worry about what those messages represent: a commitment, a deadline, a risk, a promise that can’t be broken.

Yet, the way most insurers handle everyday correspondence hasn’t changed in years. Messages move through the organization like loose papers in the wind—some land where they should, some don’t, and no one can really prove what happened in between.

This isn’t a “workflow problem.” It’s an exposure problem.

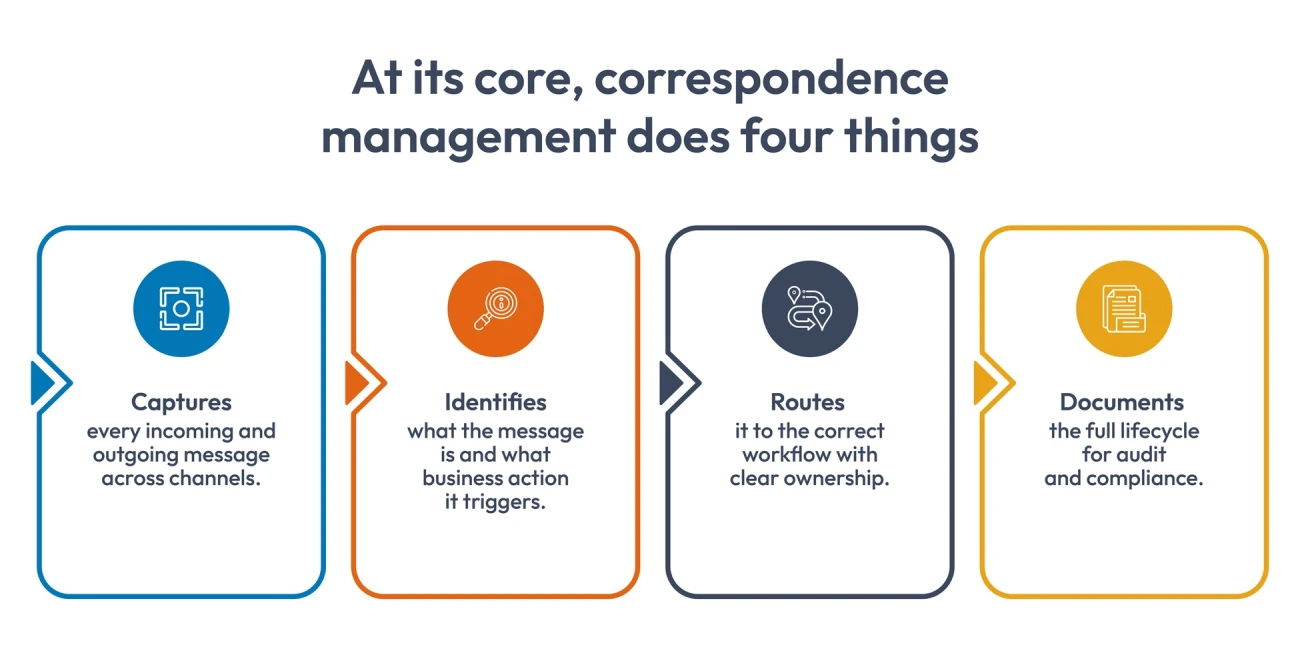

This is where correspondence management earns its keep. Not by “organizing messages,” but by giving insurers real visibility into the day-to-day exchanges that shape the entire business.

What Correspondence Management Actually Is (and Isn’t)

In insurance, correspondence management isn’t just “handling messages.” It’s the operational backbone that connects communication to processes. Every inquiry, document, or notice enters the organization with an implied obligation, and this function ensures that obligation is met.

Why insurers use it

- To eliminate ambiguity about who saw what and when.

- To reduce risk tied to misrouted or untracked communication.

- To support consistent response times across teams.

- To maintain a defensible record of interactions for regulators and auditors.

The goal isn’t tidiness. It’s control, predictability, and transparency at scale.

How Strong is Your Insurance Customer Communications Strategy? Evaluate Now

Types of Correspondence in Insurance

Communication inside an insurance company isn’t one big category. It splinters into dozens of streams, each carrying its own expectations, deadlines, and risks. Some require immediate action. Others demand documentation. Some simply need a clear “yes” or “no.”

When these streams mix together without structure, that’s when things slip, not because people aren’t doing their jobs, but because the system around them isn’t telling the full story.

Here’s a clearer view of what “correspondence” actually looks like inside an insurance company.

| Type of Correspondence | What It Usually Includes | Why It Matters |

| Claims-Related Communication | FNOL notices, medical reports, repair estimates, claimant questions, adjuster notes | Drives claim decisions; delays here often slow the entire claim cycle |

| Policy Servicing Requests | Address changes, endorsements, coverage updates, and billing questions | Affects active policies and customer experience; errors create downstream corrections |

| Underwriting Communication | Application clarifications, risk documents, inspection notes, broker inquiries | Supports risk assessment and pricing; missing info leads to underwriting leakage |

| Regulatory Notices | Compliance letters, filing updates, supervisory requests | Carries strict deadlines; mishandling exposes insurers to audits and penalties |

| Agent/Broker Communication | New business submissions, quote requests, status checks, document follow-ups | Impact distribution relationships; inconsistent responses harm trust |

| Provider/Partner Correspondence | Hospitals, repair shops, TPAs, and legal partners sending documents or requests | Influences claim accuracy and turnaround time; must be tracked cleanly |

| Customer Complaints & Escalations | Complaint letters, dispute emails, grievance forms | High-sensitivity items that require documented handling and timely closure |

| Payment & Billing Correspondence | Refund queries, missed payment notices, and invoice clarifications | Impacts revenue flow; errors create reconciliation issues |

| Legal Correspondence | Subpoenas, demand letters, and attorney communication | Requires strict documentation; misrouting increases legal exposure |

| Internal Operational Messages | Hand-offs, clarifications, approvals, exception requests | Invisible to customers but critical for accountability and audit trails |

These areas carry most of the risk in day-to-day operations, especially when insurance document creation and regulated insurance communications need to be handled without errors.

Why Correspondence Management Matters for Insurers

Correspondence management benefits go far beyond “organizing messages.” For insurers, it’s the layer that reduces exposure, tightens operations, and turns everyday communication into something the business can actually rely on.

1. Reduces Operational Exposure You Don’t See Until It’s Too Late

Most insurers don’t lose ground because of a single big mistake. They lose it through a slow drip of small communication failures, such as an email that wasn’t forwarded, a document that sat in someone’s inbox, or a request that never reached the right desk. One gap doesn’t hurt you. A pattern does.

Correspondence management addresses those blind spots directly, not by adding more oversight, but by giving teams a clear record of what entered the organization, where it went, and what still needs attention. It turns invisible risks into visible ones long before they surface as complaints, penalties, or escalations.

What this helps insurers prevent:

- Missed deadlines that trigger financial penalties or strained relationships.

- Claims or policy updates stalled because no one realized a key document was waiting.

- Disputes where neither party can prove who said what, or when.

- Sensitive items (like cancellations or disclosures) falling through the cracks.

- Quiet accumulation of unresolved messages that later snowball into backlogs.

2. Gives Teams a Single Source of Truth (When Everything Else Is Fragmented)

These days, insurers already have plenty of systems. The problem isn’t the lack of tools. It’s that none of them reliably show the whole story of a conversation. Everyone sees their slice, and no one sees the thread.

That’s where correspondence management earns its value. It pulls scattered messages, documents, and updates into one place so people stop guessing which version is real. When teams operate from a shared view (even a simple one), errors drop, decisions move faster, and no one wastes half a morning hunting for the “latest file.”

How this clarity helps insurers stay in control:

- Teams stop duplicating work because the current status is visible to everyone.

- Policy changes, requests, and clarifications stop bouncing between systems.

- Hand-offs become smoother because each person sees the full conversation context.

- Brokers and internal teams get consistent information, not conflicting answers.

- Managers can spot bottlenecks immediately instead of hearing about them after the fact.

3. Stabilizes Response Times in an Environment Where Delays Cost Money

In insurance, a slow response can influence claim outcomes, trigger compliance issues, stall policy changes, or frustrate a customer who’s already anxious.

A strong correspondence management setup keeps that from happening. It makes sure every inquiry, notice, attachment, and form shows up where it should, with the right context, so teams can act instead of searching. When insurance document creation is part of the workflow, the process stops depending on manual drafting, copy-pasting, or “who has the right template.”

Where insurers see the biggest gains:

- Less time wasted tracking down missing forms, signatures, or earlier messages.

- Faster turnaround on policy changes, endorsements, and confirmations.

- Clearer routing rules that ensure the right person responds the first time.

- Fewer back-and-forth cycles because communication arrives complete, not piecemeal.

- Reduced customer callbacks and follow-ups because the first answer is accurate.

4. Turns Daily Messages into Auditable, Defensible Records

In insurance, the conversation is part of the contract. A missing note, an outdated form, or an undocumented promise can come back months or years later with real consequences.

This is where the deeper correspondence management benefits show up. When every interaction is captured and tied to the correct file, insurers gain a clean, traceable record that stands up to scrutiny. Whether it’s regulated insurance communications or everyday service updates, nothing relies on memory or scattered attachments. Add insurance document creation into the mix, and teams can generate correspondence that’s always current, compliant, and automatically logged.

Why does this matter when regulators, auditors, or customers ask tough questions:

- Communication timelines become easy to prove.

- Required notices and disclosures are tracked, not assumed.

- Outdated templates stop slipping into circulation.

- Sensitive conversations (cancellations, claims decisions, corrections) gain clear audit trails.

- Legal and compliance teams can review communication history without chasing multiple departments.

5. Improves Cross-Functional Coordination Without Adding More Tools

Insurance work is rarely contained within one team. A single customer request can touch underwriting, claims, billing, legal, and even external partners like brokers or TPAs.

Correspondence management doesn’t force teams to adopt yet another platform. Instead, it becomes the connective tissue, a kind of shared layer where the conversation lives, no matter where the work is happening. Everyone sees the same context, the same documents, and the same decisions, meaning no rewrites, no duplicated efforts, and no “who handled this last?”

How this coordination shows up in real operations:

- Underwriting and claims stop re-asking customers for documents that someone has already collected.

- Brokers get clearer updates because internal teams are working from the same thread.

- Legal can flag issues early because they see communication patterns as they form.

- Service teams avoid sending mixed messages when multiple cases overlap.

- Leaders gain visibility into cross-team bottlenecks without adding reporting burden.

6. Helps Teams Spot Patterns Before They Become Problems

Insurance problems build up slowly, such as recurring complaints about a product clause, repeated confusion over a form, and delays tied to the same type of request. The signals are always there; they’re just buried inside scattered emails, handwritten notes, and siloed systems.

A mature correspondence management function brings those signals to the surface. When communication flows through a single layer instead of ten disconnected channels, patterns start to emerge. And trends give decision-makers something far more valuable than hindsight: early warning.

What insurers can detect sooner (and act on faster):

- A rising volume of requests is tied to a confusing product rule.

- Bottlenecks caused by the same missing document or unclear requirement.

- Repeated service issues point to training gaps or broken processes.

- Emerging risk indicators hidden inside customer complaints or broker feedback.

- Breakdowns in regulated communication steps before they escalate into findings.

- When communication becomes analyzable, insurers stop fighting fires and start preventing them.

What Strong Correspondence Management Looks Like in Practice

When insurers talk about real correspondence management benefits, they’re usually talking about control, consistency, and communication that doesn’t fall apart under pressure. A mature setup blends insurance document creation, regulated insurance communications, and everyday messaging into one clean and traceable flow.

When insurers build this level of coherence into their communication layer, they don’t just move faster; they operate with far fewer risks hiding in the margins.

Final Thoughts

Correspondence management isn’t about tidying up communication. It’s about tightening the parts of the business that quietly determine loss ratios, service quality, audit outcomes, and ultimately trust.

When an insurer can track every notice, generate documents without errors, route regulated communications correctly, and surface issues before they escalate, that control shows up in very real numbers: fewer complaints, fewer escalations, fewer regulatory findings, cleaner hand-offs, faster cycle times, and a noticeable drop in rework that normally gets written off as “the cost of doing business.”

The value is simple: insurers who manage communication with precision run leaner operations and make fewer avoidable mistakes. And in a business where outcomes depend on timing, clarity, and proof, the insurer with the cleanest communication layer usually wins—quietly, consistently, and over the long haul.

Cincom Eloquence was built for insurers who are done patching old systems and want communication they can finally trust.

Curious how this works in real life? Book a short demo and judge for yourself.

FAQs

1. How does Insurance CCM software support and enhance correspondence management?

Insurance CCM software acts as the central engine that powers accurate, consistent, and trackable communications. CCM technology ensures every document produced is compliant, personalized, and aligned, making the entire correspondence process stronger and more efficient.

2. Is deploying correspondence management difficult for insurers?

Usually not. Modern platforms integrate with core systems without heavy rebuilds, and most insurers start with a phased rollout.

3. Do we need a big tech infrastructure to support correspondence management?

No. Cloud-ready tools and insurance CCM software handle heavy lifting, so you don’t need new servers or major architecture changes.

4. Will correspondence management slow down existing insurance document creation workflows?

It’s the opposite. It streamlines routing, approvals, and version control so documents move faster and with fewer errors.

5. Can correspondence management scale as our communication volume grows?

Yes. Most systems are built for fluctuating demand, so growth in claims, inquiries, or policy changes won’t break your processes.