In today’s fast-paced financial world, customers expect real-time updates and accurate communication. That said, how you communicate defines your customer relationships, your brand image, and even your compliance posture.

To communicate better with customers, financial organizations need more than just emails and physical documents. They need a comprehensive financial communications solution that can help them manage conversations, meet legal requirements, and deliver great experiences across every channel.

Implementing financial communications solutions can significantly improve how financial institutions connect with their customers. But what should you look for when choosing a platform for your financial institution?

In this article, we will discuss the critical CCM features that financial organizations shouldn’t miss while choosing a tool for improving their financial services communications.

Why Financial Communication Is Now a Strategic Priority

Many financial service providers often operate with heavy paperwork and a one-size-fits-all communication approach. Not anymore. We’re in an era where expectations are shaped by technology: fast responses, personalized content, and seamless interaction across channels.

Here’s why communication has become central to every financial organization’s strategy:

- Customer trust depends on clarity: When money is involved, people want to understand every detail. Confusing language, delayed updates, or missed messages can quickly damage trust.

- Loyalty is built on personalized experiences: A generic monthly email isn’t enough. Customers expect organizations to know their preferences and speak directly to them.

- Regulators are paying close attention: From audit trails to disclosure policies, every message must follow strict compliance rules. Falling short isn’t an option.

- Digital expectations are higher than ever: People don’t want to visit branches or call for support for updates. They want answers now, through calls, chat, email, or whatever channel they prefer.

Is Your Financial Customer Communications Solution Delivering Tangible ROI and Efficiency Gains?

Boost ROI by enhancing productivity, optimizing resources, and ensuring secure, consistent communication.

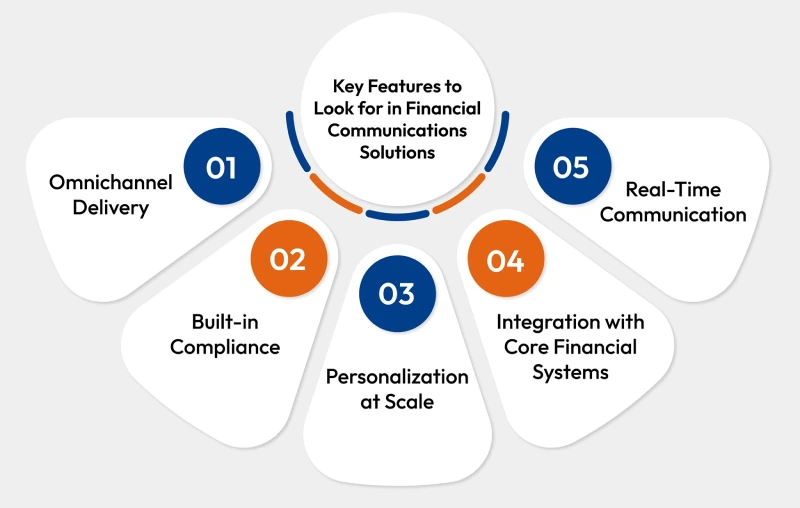

What Features to Look for in Financial Communications Solutions

Not all financial communications solutions are created equal. Every tool focuses on different aspects to provide a unique experience for customers. Here are the core features that can help financial institutions communicate better and more securely.

1. Omnichannel Delivery

Your customers are everywhere. They might check account-related information through the online portal, learn about a new service from a service rep over chat, or read monthly statements via email.

That said, financial communications solutions must provide omnichannel communications to ensure consistency across all touchpoints. Whether it’s a policy update or a payment confirmation, the message should feel seamless, no matter where it’s delivered.

Look for:

- Support for email, SMS, chat, mobile apps, and web portals

- Unified message templates for consistent branding

- Functionality to schedule recurring messages

2. Built-in Compliance

Regulatory compliance is a critical and unavoidable requirement in financial services communications. Financial communications solutions should make compliance easy for organizations, so communication is not only accurate but also compliant. This involves automating many of the manual checks and approvals in communication workflows.

Look for:

- Automatic audit trails

- Pre-approved templates that align with legal standards

- Version control and approval workflows

- Secure document storage with retention policies

3. Personalization at Scale

Customers today want relevant and personalized updates. The tool your organization chooses should be able to pull customer profiles, transaction histories, and behavioral data to deliver bespoke messages. Moreover, the entire customization should be automated, so that team members do not spend hours personalizing each message.

Look for:

- Data-driven message assembly

- Dynamic templates with smart fields

- Preference-based delivery (e.g., SMS over email if the customer chooses)

4. Integration with Core Financial Systems

Financial communications solutions should be able to integrate with other existing tools that your organization uses, such as CRM systems, to ensure data flow is smooth and there is no chance of error or silly mistakes.

Look for:

- APIs for integration with CRMs, policy systems, or core banking software

- Data syncing capabilities to avoid manual input

- Ability to trigger messages based on system events (e.g., overdue payment)

5. Real-Time Communication

Whether it’s a service-related alert or a change in interest rates, timely communication can make a huge difference. Financial communications solutions should allow teams to respond quickly and customers to receive updates instantly.

Look for:

- Event-based notifications

- Real-time message previews

- Immediate publishing and delivery features

How These Features Solve Key Challenges Financial Services in Communications

Now that your organization has the right solution in place and with the right features, many of the key communication challenges can be solved. Let’s take a closer look at how these challenges are addressed:

- Disconnected systems: A lot of banks, insurers, and other financial companies use multiple systems to operate. They may work flawlessly but might not work well together. One system might store customer data. Another might handle transactions, or a separate system handles communication documents. Financial communications solutions bring every system together. This reduces delays, avoids manual handoffs, and helps ensure accuracy from the start.

- Complex compliance requirements: Every region has its own regulations and set of rules that financial institutions need to comply with. Making sure every communication piece follows these regulations isn’t easy, especially when customization is involved.

- Security concerns: There’s no room for error when handling sensitive information like transactional data, account numbers, and personal information. Financial communications solutions bring encryption and controlled access, so the data is protected, and breaches can be avoided.

- Lack of personalized communication: Without the right tools, most messages sound generic and impersonal. Customers don’t feel special. These communication tools help customize messages and documents, so every message feels tailored without much manual effort.

- Time-consuming processes: Manually creating documents, repeated reviews, and approval to-and-fro take up time and slow down the communication process. Financial communications solutions bring automation that speeds up the process, so that your teams can communicate with customers quickly and accurately.

How Does Cincom Eloquence Help?

If your organization is looking for a smarter, more reliable way to manage financial communication, Cincom Eloquence can be a great solution. It is a Customer Communications Management solution that empowers organizations to design, deploy, deliver, and manage documents easily. Purpose-built CCM for banking, it offers the tools that you need to deliver clear, timely, and compliant communication.

With powerful financial document automation capabilities, Cincom Eloquence enables teams to generate personalized statements, disclosures, and policy documents quickly and securely. From omnichannel delivery to built-in compliance controls, it optimizes your communication processes seamlessly. With Cincom Eloquence, you get:

- Regulatory compliance and governance

- Omnichannel Personalization

- Operational efficiency and scalability

- Seamless integration

- Embedded rules logic

Conclusion

Let’s face it, communication in the financial world has outgrown the old way of doing things. What once passed as acceptable, like generic letters, delayed notices, and disconnected systems, is no longer enough in a market where customers expect speed, clarity, and relevance. Today, communication is not just a function, it is the main ingredient of the customer experience. And it’s often the difference between a loyal customer and a frustrated one.

Financial communication solutions offer the foundation. With advanced capabilities for CCM in banking and financial document automation, these solutions allow teams to manage complex communications with greater accuracy and control.

Invest in a solution that fits your needs today and prepares you for the future. Your organization can ensure that every message sent reinforces your brand, builds customer loyalty, and meets every regulatory standard.

FAQs

1- What are financial communications solutions?

These are platforms designed for financial institutions to manage customer communication across email, SMS, mobile apps, and other channels. They ensure messages are accurate, timely, secure, and personalized based on customer preferences.

2- Why is omnichannel communication important in finance?

Omnichannel communication ensures consistency across different channels. Customers can use chat, email, or the mobile app to communicate with the organization without any hiccups or hindrances.

3- How do financial communication solutions help with regulatory compliance?

Financial communications tools are built with compliance functionalities. They provide features like document version control, encryption, audit logs, and consent tracking. This helps financial organizations meet strict data protection and industry-specific regulations like GDPR, HIPAA, or DORA.

4- Can communication platforms integrate with other financial systems?

Most modern CCM platforms can integrate with financial and customer software to offer a seamless and streamlined experience.

5- How does Cincom Eloquence help in effective financial communications?

Cincom Eloquence automates and personalizes every interaction across every channel. With Cincom Eloquence, organizations can create compliant, high-impact communications at scale without burdening the IT team.