The New Insurance Landscape: A Digital Imperative

Policies still anchor the business of insurance. What’s changed is everything around them—how they’re issued, communicated, managed, and experienced by the customer.

Customers now look for coverage that adapts to their lives. They expect clarity, control, and real-time access, without jumping through hoops. On the other side, regulatory pressure is tightening. Communications must be immediate, precise, and fully traceable—no matter the channel or context.

This puts legacy systems under strain. Many were built for policy management, not for real-time, two-way engagement.

That’s where modern insurance industry software solutions come in—systems that support:

- Product flexibility

- Real-time personalization

- Integrated compliance

- And consistent, contextual communication

Customer Communication Management (CCM) is a part of the core tech stack needed to compete and drive digital transformation in insurance. Without it, insurers can’t deliver the kind of experience today’s policyholders expect and meet the demands regulators require.

Why Customer Communication Management Is More Than a Messaging Tool

Modern CCM goes beyond sending out documents. It gives insurers command over large-scale communication, balancing legal precision, customer relevance, and brand consistency across geographies and formats. These platforms plug directly into core systems through APIs and operate in the cloud, allowing quick shifts without losing control over timing or accuracy.

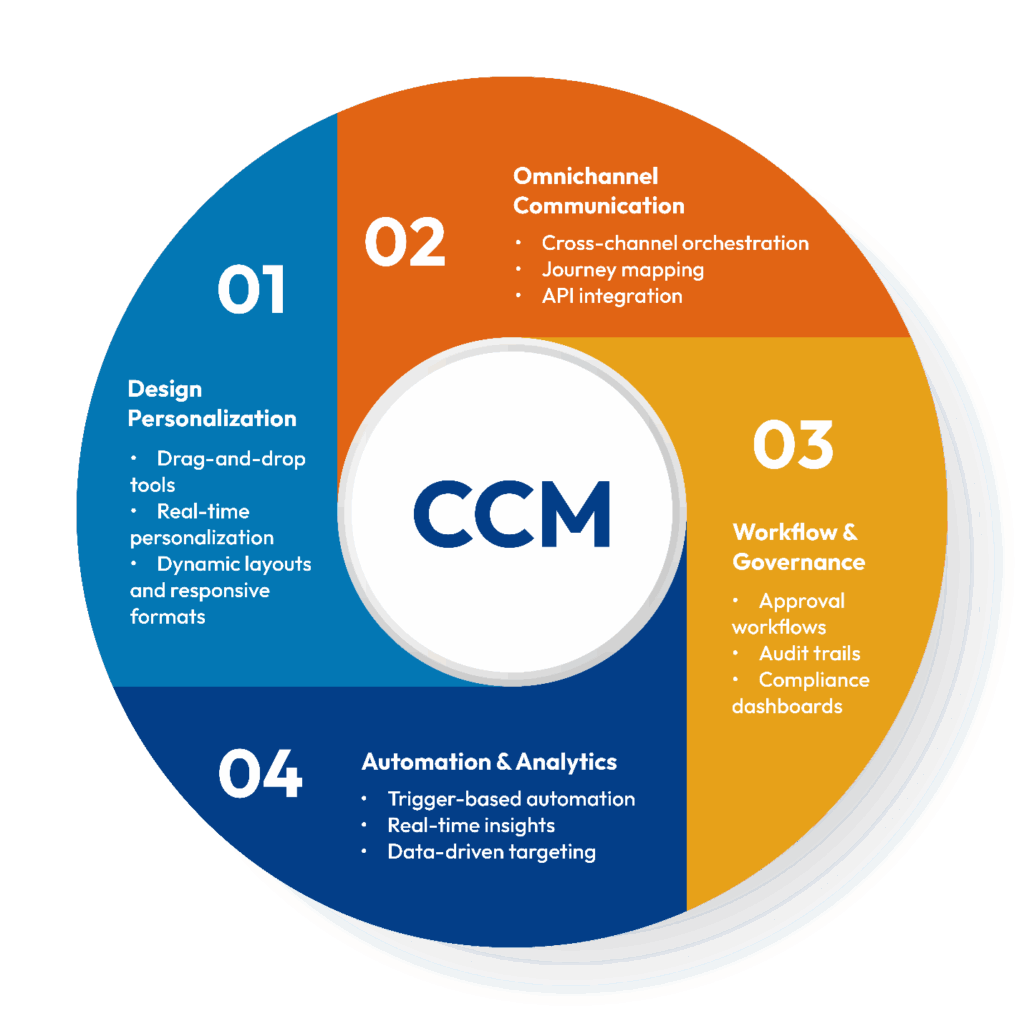

Its capabilities are best understood through four core pillars:

Design and Personalization

Business teams work directly in the platform, building content through guided templates and drag-and-drop tools. They can adjust layouts, add dynamic fields, and tailor formats for any channel without waiting on IT. The system pulls in live policy data, actions, and preferences to shape content as it’s sent. Interactive formats like video summaries, smart forms, and guided chat keep customers involved and reduce service calls.

Omnichannel Communication

Once created, messages are routed automatically across email, print, SMS, apps, and portals. Each message pulls from the same approved source to maintain consistency, even as delivery changes based on behavior or timing. Built-in logic tracks the customer journey and triggers the next message based on what just happened. External systems stay in sync through API connections, keeping every handoff clean and on point.

Workflow and Governance

No message leaves the system without following a defined path. Templates move through structured approval routes, tracked by role, timestamped at each step, and restricted by defined access rights. The system logs a full change history—who made edits, when they did it, and why. Through this established insurance automation, compliance and business leads can track message activity in real time, spot delays, and address risks early, without chasing down emails or disconnected documents.

Automation and Analytics

Insurance automation replaces manual steps with rules. Claim filings, renewals, or policy lapses trigger the right message instantly. No handoffs. Dashboards stay live, tied to your KPIs, showing what’s gaining traction, where things stall, and what’s slipping through. Teams act on what they see, adjust quickly, and keep output tight.

Build or Buy? Simplify Insurance Communications the Smart Way

Learn how to reduce costs, speed up delivery, and improve customer experiences.

CCM at the Core of Regulatory-Ready Digital Transformation in Insurance

Why Regulation Matters in Insurance

Insurance deals in private contracts, but the outcomes often carry public weight. A policy affects health decisions, financial stability, and long-term planning. That’s why it sits under close watch. Regulations like HIPAA, GDPR, and PDF/UA set guardrails around privacy, fairness, and accessibility. At the core is a mandate: communicate clearly, stay consistent, and be able to prove what you communicated.

How CCM Supports Compliance at Every Step

The modern insurance communication platform, especially CCM, helps insurers meet compliance standards by embedding control, traceability, and governance into every message. Here’s how:

-

Consistent, Controlled Output

CCM ensures only approved templates and language are used in regulated communications, such as health insurance documents, claim letters, and policyholder notices.

-

Audit-Ready Processes

Every communication you create is version-controlled and time-stamped, and audit trails clearly show exactly who authored, reviewed, and approved the content.

-

Regulatory Workflows

CCM systems route sensitive documents through preset compliance checks. Controls stay tight without slowing the process.

The Consequences of Non-Compliance in Insurance Communication

Regulatory failure doesn’t just lead to fines. It undermines trust and exposes insurers to legal and reputational risk. Non-compliance may result in:

-

Hefty Penalties

Regulatory bodies can impose millions in fines for missed deadlines, non-accessible health insurance documents, or misleading language in customer-facing policies.

-

Legal Liability

Companies risk lawsuits, settlement costs, and even license suspension for repeated or systemic violations of laws like HIPAA, GDPR, or state-level insurance mandates.

-

Operational Impact

Regulatory investigations consume internal resources, slow down service delivery, and delay critical initiatives, disrupting digital transformation in insurance.

-

Customer Churn

Inconsistent, inaccessible, or unclear communication erodes policyholder trust. Once confidence is lost, retention drops, especially in competitive health or life insurance segments.

-

Reputational Damage

Compliance failures make headlines. Rebuilding brand trust takes years and directly impacts customer acquisition and renewal rates.

Compliance can’t be based on assumptions. In an industry managing private medical and financial data, the risk is too high. Enterprise-grade software solutions for insurance industry give insurers control through advanced communication systems. Messages are tied to data, timestamped, and traceable. It replaces guesswork with proof.

Seamless Integration of CCM with Core Insurance Systems

Communication has to move with the operation, not lag behind it. That means CCM must work as part of the core system, not outside it. When it’s tied directly to Policy Admin, Claims, CRM, and Billing, communication becomes part of the workflow. That connection eliminates rework, cuts delays, and keeps messages aligned with the current state of business while accelerating digital transformation in insurance.

Why Integration Powers Insurance Automation

Disconnected systems slow everything down. Teams waste time on swivel-chair operations, jumping between platforms, copying data, and fixing errors. Integration through modern insurance industry software solutions puts an end to that. It’s the engine behind true insurance automation, allowing communications to be triggered by real-time events and supported by live customer data.

What Integrated CCM Delivers

-

Real-Time Data Sync

When CCM draws directly from real-time system data, it removes the gap between what’s happening and what’s being sent. Every message reflects live account status, activity history, and preferences. There’s no need to patch in updates or chase missing context—what the customer receives matches their actual position.

-

Contextual, Journey-Aware Messaging

Every message adapts to the customer’s place in the journey. Whether it’s a policy quote, a claim update, or a payment reminder, the system pulls real-time data and moves the message forward. No extra coordination. No lag. Just accurate communication, tied to action.

-

Intelligent, Streamlined Operations

By embedding CCM across your insurance industry software solutions, you remove the need for manual processes and patchwork tools. Communications are automated, governed, and fully auditable. This not only reduces human error and operational friction but also unlocks end-to-end insurance automation, allowing teams to scale output without scaling cost or complexity.

To enable digital transformation in insurance, CCM can’t sit on the sidelines. It must be wired into the core—driving smarter workflows, faster communication, and complete control.

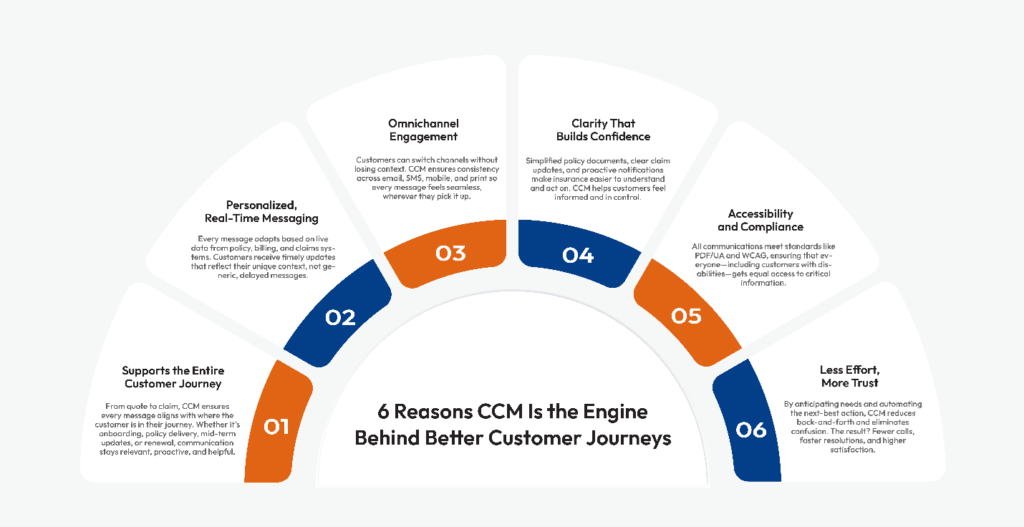

The Strategic Role of CCM in Customer Experience

We’ve seen how CCM transforms internal operations, drives automation, and integrates across insurance industry software solutions. But what does it actually do for your customers?

A lot.

Here’s how modern Customer Communication Management (CCM) systems elevate customer experience:

The Real ROI of CCM: Strategic Gains That Go Beyond Cost Savings

CCM delivers ROI that extends far beyond trimming expenses. In insurance, it serves as a key operational lever, which turns routine communication into something that actively supports growth, retention, and compliance. The return may not always register in immediate monetary terms, but over a period of time, the gains in consistency, speed, and trust build a measurable and lasting advantage.

Lower Operational Costs

- Cuts printing, postage, and manual effort by digitizing high-volume communications.

- Reduces IT dependency with low-code tools for content updates and campaign rollouts.

- Consolidates multiple tools into one seamless insurance industry software solution.

Faster Time to Market

- Automates content approvals, testing, and delivery workflows.

- Adapts instantly to regulatory changes and product updates.

- Speeds up campaign execution and customer onboarding.

Improved Compliance Posture

- The system maintains full traceability with audit trails, version control, and approval logs.

- Embeds compliance into every step with rule-based workflows to uphold the integrity of communication.

- Supports HIPAA, GDPR, PDF/UA, and EAA requirements natively while elevating insurance automation.

Better Customer Retention

- Sends timely, personalized updates across preferred channels.

- Keeps messages aligned with policy, claims, and billing data in real time.

- Fosters confidence and trust through transparent, meaningful, and consistent interactions.

Increased Revenue Opportunities

- Enables cross-sell and upsell with contextual targeting.

- Improves engagement through behavior-triggered messaging.

- Turns everyday documents into sales and retention touchpoints.

Actionable Insights for Continuous Optimization

- Tracks communication performance with built-in analytics.

- Identifies what drives engagement, churn, or service requests.

- Allows insurers to adapt strategies using real-time data.

When CCM is built into your insurance systems, everything moves smoothly. Friction drops. Delays shrink. Risk stays visible. With a reliable insurance communication platform, customers get what they need, when they need it. The result is a business that’s faster, safer, and better equipped to scale—without sacrificing control.

Conclusion: Where CCM Fits in the Modern Insurance Enterprise

Throughout this discussion, it’s clear that modern Customer Communication has moved from a back-office function to a core driver of compliance-ready, customer-led digital transformation in insurance. It doesn’t just support interactions—it reinforces the systems insurers rely on, from policy issuance to claims processing and billing.

The value isn’t limited to personalization. CCM brings clarity, oversight, and structured control across every channel and stage. As part of comprehensive insurance industry software solutions, it embeds automation, real-time intelligence, and coordinated delivery across journeys, becoming the operational link between regulatory compliance and customer experience.

In a market where timing, accuracy, and trust decide outcomes, CCM isn’t a plugin. It’s the layer that keeps the business alert, responsive, and on track. That’s where it earns its place.

Our comprehensive platform, Cincom Eloquence, delivers on that promise, giving insurers the power to create, manage, and deliver communications that meet today’s demands and tomorrow’s expectations.

FAQs

1- What is CCM in the context of insurance?

Customer Communication Management (CCM) in insurance refers to a specialized insurance communication platform that helps create, manage, and deliver personalized, compliant communications across channels—print, email, SMS, portals, and more. It plays a key role in streamlining customer interactions within modern software solutions for the insurance industry.

2- Why is CCM important for insurance providers?

CCM enables insurers to deliver consistent, real-time communication at scale while ensuring compliance. It supports efficiency, reduces manual work, and enhances service quality, making it a foundational part of insurance industry software solutions designed to meet rising customer expectations.

3- How does CCM improve policyholder communication?

CCM delivers clear, contextual messages throughout the policyholder journey. From onboarding to claims, it ensures timely updates and personalized touchpoints, even in complex processes like managing health insurance documents, ultimately building trust and improving satisfaction.

4- Can CCM be integrated with existing insurance software systems?

Yes. Modern CCM platforms are built for seamless integration with core systems like policy admin, claims, billing, and CRM. This allows insurers to unify data and workflows across their software solutions for the insurance industry, eliminating silos and boosting operational agility.

5- What compliance benefits does CCM offer in the insurance industry?

CCM enforces strict governance using controlled templates, audit trails, and approval workflows. It helps insurers meet regulations such as HIPAA, GDPR, and PDF/UA by ensuring accuracy, accessibility, and traceability across all communications.