In financial services, documents are more than an operational requirement — they shape customer trust, support regulatory compliance, and influence how smoothly core processes run. A single error in a loan agreement or policy document can delay approvals, confuse customers, or lead to costly rework. According to a report by Forrester and commissioned by Adobe, 97% of organizations had minimal or no digital document processes. Yet many financial institutions still rely on legacy tools, scattered templates, and manual steps to produce these business-critical documents.

The gap between what teams need and what existing systems deliver is widening. Billing cycles are faster. Regulations shift more often. Customers expect accurate, personalized communication across every channel they use. Many online surveys show that a significant part of banks still struggle to manage document-heavy workflows efficiently, even though these workflows drive direct customer interactions and regulatory outcomes. That’s why choosing the right document generation provider has become a strategic priority instead of a routine software upgrade.

But comparing vendors is not always simple. Most claim automation, speed, and accuracy. However, the real difference lies in how well a platform handles the unique pressures of finance — high-volume output, strict compliance controls, complex logic, and data flowing in from dozens of internal systems.

This article breaks down what matters most when evaluating document generation providers for financial services, how to separate marketing promises from actual capabilities, and what a future-ready solution should look like.

Why Document Generation Matters in Financial Services

Financial services operate under pressures that general-purpose document tools cannot adequately support. Understanding these pressures helps shape your evaluation criteria.

High Volumes and Time-Sensitive Cycles

Banks and insurers release large sets of documents within fixed service windows—monthly statements, annual policy renewals, regulatory updates, and investment summaries. That said, communication cycles remain one of the top operational bottlenecks in financial institutions due to volume and accuracy demands. A small delay can affect compliance-related timelines or service-level commitments.

Complex, Data-Driven Documents

Financial documents rely on real-time data from multiple systems. A single insurance policy or mortgage contract may require:

- Rate tables

- Customer-specific risk calculations

- Region-based clauses

- Product-specific disclosures

When templates cannot handle this complexity, teams resort to manual adjustments that increase the likelihood of errors.

Regulatory and Audit Requirements

Compliance rules change frequently. Institutions must track every edit, ensure proper disclosure wording, and maintain a verifiable record of how each version of the document was created. Regulatory reviews often request evidence of:

- When a template was updated

- Who approved the content

- How data entered the document

- How the final version was delivered

A reliable document generation system reduces the risk of missing disclosures, inconsistent terms, or incomplete audit records.

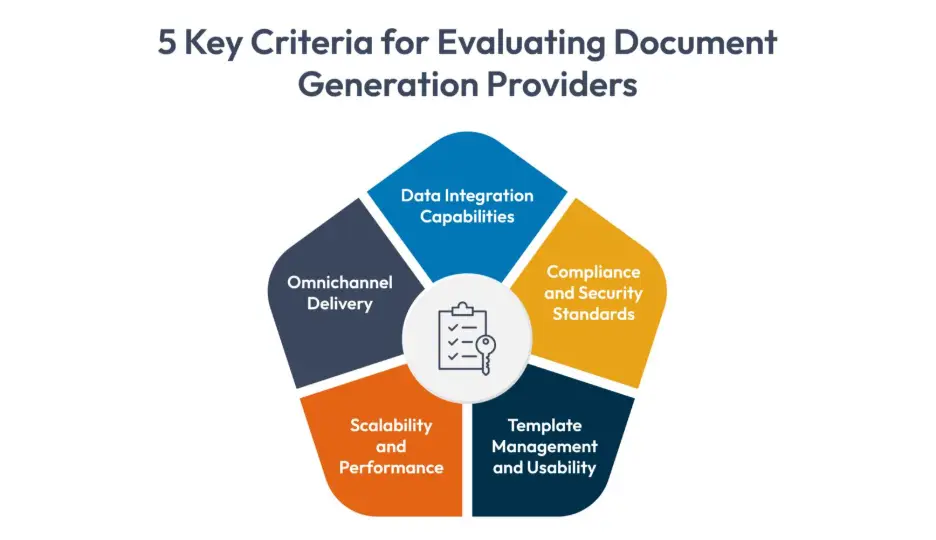

Key Criteria for Evaluating Document Generation Providers

Here are the practical elements that matter most when evaluating document generation vendors for financial services.

Data Integration Capabilities

Financial organizations work with complex data environments. Your document generation provider must connect to CRMs, core systems, underwriting engines, and legacy databases without creating extra work for IT teams.

Key considerations:

- API-first architecture that integrates with different enterprise-level systems that your organization already uses

- Support for multiple data formats, including XML, JSON, SQL, and CSV

- Stable integration even when data structures change

- Bidirectional data flow so updated information returns to your CRM or core system after document completion

Without strong integration, even the most advanced generation engine cannot deliver accurate output.

Compliance and Security Standards

Security and compliance requirements are strict across the industry. A document generation system must maintain data protection and support regulatory transparency.

Expect the vendor to offer:

- Encryption at rest and in transit

- Required certifications to meet compliance and security requirements

- Clear management procedures

- Audit logs covering access, edits, approvals, and distribution

- Role-based permissions to limit who can modify templates or generate documents

These features reduce the risk of compliance violations, especially during audits or regulatory reviews.

Template Management and Usability

Template maintenance is one of the most resource-heavy tasks in financial document teams. Regulatory updates, product changes, and branding adjustments must all be reflected in documents without delay.

Look for:

- No-code or pick-and-drop template editors that allow business and compliance teams to update content easily

- Support for conditional rules and dynamic content

- Multi-language capabilities

- Strong version control with rollback options

This reduces dependency on IT and ensures updates are implemented quickly and accurately.

Scalability and Performance

Scalability is a critical differentiator among document generation providers. A strong provider offers scalability when the demand rises. This ensures documents are generated even during periods of heavy load, without performance degradation.

Ask vendors for:

- Document volume benchmarks

- Real examples of high-volume batch generation

- Uptime records and disaster recovery plans

- Support guarantees during peak cycles

This information helps you determine whether the provider can support long-term operational demands.

Omnichannel Delivery

Customers expect access to documents across multiple channels. Your system must support print, email, SMS, portals, and mobile platforms.

Look for:

- Output formats like PDF, HTML, DOCX, and XLSX

- Mobile-responsive formats (especially HTML5)

- Integration with e-signature tools

- Automated routing based on customer preferences

These capabilities help institutions deliver consistent communication without manual steps.

Cincom Eloquence Checks All Boxes

According to report, Fortune 500 companies in total lose an average of $12 billion per year due to inefficiency caused by unstructured document management. If you are looking for a document generation provider, Cincom Eloquence proves to be a robust document generation platform built for financial service providers and insurance agencies. Here is how Cincom Eloquence stands out for enterprises:

- It brings built-in templates, real-time data integration, and automated version control for policy document generation.

- It meets PDF/UA standards, aligning with European Union (EAA) and France (RGAA) digital accessibility requirements.

- It offers cloud or on-prem deployment to keep operations smooth and disruption-free.

Is Your Financial Customer Communications Solution Delivering Tangible ROI and Efficiency Gains?

A Practical Evaluation Roadmap for Choosing Document Generation Providers

Here are 4 key steps for evaluating document generation providers for financial services.

1. Define your Use Cases

Start by identifying the processes where document automation will have the biggest impact, such as loan origination, policy generation, wealth reports, onboarding, billing statements, or regulatory communications.

2. Review Your Data Sources and Integration Needs

Create a map of where your customer and product data lives — CRMs, core banking systems, or internal databases. Now evaluate whether a vendor can integrate with these systems and create a flow of data.

3. Run a Proof of Concept with Your Templates

A POC is one of the most reliable ways to evaluate financial services communication software. Ask the provider to generate a few of your actual documents using your own rules, conditions, and data sets.

4. Assess Vendor Stability and Support Quality

Ensure the provider has a strong product roadmap and support teams to handle your operations for the long run. Customer references or case studies can provide valuable reassurance.

Conclusion: A Smarter Way to Modernize Communications

Choosing the right document generation provider is one of the most important technological decisions a financial institution can make. When you evaluate providers through real use cases, integration capabilities, and proven performance, you reduce risk and make future improvements easier.

Adopting a planned approach can ensure that the platform you select becomes a long-term asset. With the right partner, document generation becomes faster, clearer, as well as effective, giving both your teams and clients a better experience.

FAQs

1. What is document generation in financial services?

Document generation refers to the automated creation of documents such as loan agreements, policies, statements, disclosures, and onboarding forms. It pulls data from your internal systems and produces accurate, compliant documents at scale.

2. What is the Proof of Concept (POC)? Why is it necessary?

A POC is a test run, or a demo conducted to validate the feasibility and potential of an idea or technology. It shows how well the platform handles your real logic, complexity, and volume. It also confirms whether the system works in your environment—not just in a demo.

3. Can document generation systems support digital signature workflows?

Yes. Most advanced platforms integrate with e-signature tools and solutions to support digital signature workflows, making approvals quicker and stress-free.

4. What channels should a document generation platform support?

Channels that a document generation platform must support, include print, email, SMS, customer portals, and mobile platforms.