Introduction

Choosing the best customer communication software for an insurance company isn’t about comparing long lists of features; it’s about finding the one solution that can stand up to the real demands of insurance. Claims need to move faster. Compliance needs to be watertight. Communication costs need to come down. That’s the baseline.

The problem? Most vendors sound the same. They promise omnichannel delivery, automation, and personalization. But only a few can actually handle the complexity of insurance operations—the regulations, the integrations, and the high-pressure moments when communication simply cannot fail.

This guide provides a clear, no-fluff roadmap to help you make the right choice. We’ll show you what to prioritize, the exact steps to follow, and how to set your business up for success long after the software is selected.

The Foundation for Selecting the Best Customer Communication Management Software in Insurance

Before evaluating vendors or running demos, it’s essential to establish the foundation for your selection. Defining the criteria that matter most ensures you focus on customer communication solutions that truly fit your insurance business, rather than being distracted by flashy features or marketing claims.

Compliance & Security

In insurance, compliance is not optional. The software must help you stay aligned with industry regulations (HIPAA, GDPR, state-specific mandates, etc.) and protect sensitive customer data without adding extra complexity.

Insurance Expertise

A general-purpose customer communication tool often misses the nuances of insurance. Prioritize vendors with proven experience in the industry, those that understand claims communication, renewal notices, and regulatory audits. A strong track record with other insurers is a positive indicator of stability, reliability, and market-tested use cases you can trust.

Integration Capabilities

A digital communication platform should not sit in isolation. It needs to connect seamlessly with your core systems, such as policy administration, claims, billing, and CRM, so customer interactions are always accurate and up-to-date.

Omnichannel Support

Customers expect flexibility in how they receive updates. Whether it is email, SMS, print, portals, or agent communications, the software should give you one place to manage every channel consistently.

Guide to Choosing and Implementing the Right CCM Solution for Insurance

Download the guide to discover what makes a modern CCM stand out—and how to choose one that delivers confidence, flexibility, and real results.

Scalability & Automation

Insurance is not steady year-round. Renewal seasons, catastrophic events, or sudden claim spikes can multiply your communication volume overnight. The right platform should scale instantly and automate routine touchpoints to keep service levels high.

Personalization & Customer Experience

Sending messages is not enough; they need to be relevant. Look for tools that allow dynamic templates, data-driven personalization, and the ability to adjust tone or content based on customer type or policy stage.

User-Friendliness & Governance

Your teams should not depend on IT for every edit. At the same time, governance is crucial to avoid unauthorized changes. The right solution strikes a balance, empowering business users with guardrails for compliance.

Cost & ROI Considerations

Beyond licensing fees, consider implementation, training, support, and long-term maintenance. The strongest platforms deliver ROI through reduced paper costs, fewer errors, and faster cycle times, not just a lower upfront price.

Sustainability & Vendor Support

The right customer communication tool is not just about today’s needs but also tomorrow’s. Look for vendors who provide continuous upgrades, strong customer support, and a roadmap for sustainable growth so your investment keeps delivering value over time.

These nine criteria form the foundation of your decision. With them established, you can confidently move into the step-by-step process of selecting the best customer communication software for your insurance business.

A Step-by-Step Guide to Choosing the Right Customer Communication Software for Insurance

From clarifying priorities to running pilots and finalizing contracts, this section walks you through the exact steps to ensure your next customer communication software drives measurable impact.

Step 1: Define the Business Outcomes You Want

Every technology decision should begin with absolute clarity of purpose. Before looking at platforms or sitting through demos, define what you expect a customer communication tool to achieve for your insurance business.

Start by identifying the communication challenges that create the most friction today. These may include:

- Speeding up claims’ notifications,

- Reducing errors in renewal notices,

- Improving onboarding journeys, or

- Driving adoption of digital channels.

Documenting these outcomes ensures you evaluate every vendor against the same benchmarks, rather than being swayed by flashy features that don’t move the needle for your business.

Step 2: Audit Your Existing Systems

Once priorities are clear, review your current communication environment.

- List all active channels (print, email, SMS, portals, agent communications).

- Map the systems connected to these channels, such as policy administration, claims, billing, and CRM.

- Identify gaps where systems don’t share data or where communication is inconsistent.

This audit sets the stage for integration requirements and highlights weaknesses a new tool must address.

Step 3: Engage Key Stakeholders

Before reaching out to vendors, bring together a cross-functional team. This should include IT (for integration and security), compliance (for regulatory needs), operations (for daily communication tasks), and customer experience (for tone and personalization).

Hold a working session to capture each team’s must-haves. For example:

- Compliance may insist on audit trails.

- Operations may require automation of high-volume renewals.

- CX may want flexibility in message design.

Document these needs to ensure the final selection works for everyone.

Step 4: Create a Vendor Shortlist

Now, turn your business goals and system audit into a clear evaluation framework to filter the vendor landscape.

- Use the foundational criteria we outlined earlier (compliance, integration, scalability, personalization, governance, cost, vendor stability).

- Eliminate tools that lack proven insurance expertise.

- Narrow down to 3–5 vendors that meet your essential requirements.

A focused shortlist prevents wasted time and allows for deeper evaluation.

Step 5: Run Demos and Pilot Programs

Invite shortlisted vendors to demonstrate how their tool performs in your real-world scenarios. Observe:

- How easily your team can build and approve templates,

- How well data-driven personalization works,

- How smoothly the platform scales under volume.

Include end users in the testing so feedback reflects daily operations, not just leadership expectations.

Step 6: Assess Support and Vendor Reliability

After the demo, evaluate the vendor’s ability to support your business long-term. Review:

- Implementation support and training,

- Ongoing customer service and response times,

- Product roadmap and upgrade process,

- References from existing insurance clients.

This step ensures you don’t just buy a digital communication platform but also gain a reliable partner.

Step 7: Make the Final Selection and Secure the Contract

Compare vendor performance against your weighted criteria and pilot results. Choose the tool that not only meets functional needs but also offers the highest adoption potential across teams. In contracting, secure service levels (uptime, delivery speed), compliance guarantees, clear data ownership, and exit clauses. This ensures the tool delivers value and reduces long-term risk.

By following these steps, you’ll be well-positioned to select the best customer communication management software for your insurance business—one that not only meets your requirements but also drives adoption, efficiency, and long-term value.

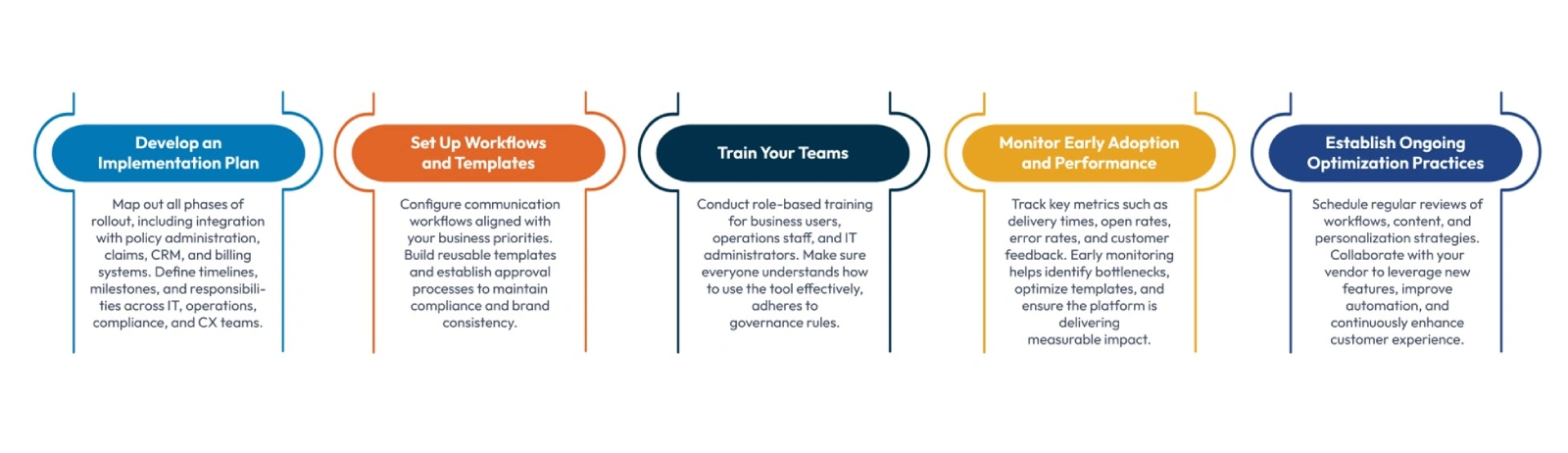

Getting Started After Selecting Your CCM Software

Choosing the right platform is only the beginning. To realize its full value, you need a structured approach to implementation, team adoption, and continuous optimization. Once you’ve selected the best CCM software for your insurance business, the focus shifts from evaluation to execution. A structured approach ensures the tool delivers on its promise:

With your CCM software implemented, teams trained, and workflows optimized, you’re ready to leverage the platform to its full potential—setting the stage for improved efficiency, compliance, and superior customer experience across your insurance business.

Final Thoughts

The future of insurance lies in how effectively companies communicate with their customers. Selecting the right customer communication software is a strategic move that impacts operational efficiency, compliance, and customer experience. By establishing clear criteria, evaluating vendors rigorously, and executing a structured implementation, insurers can ensure their communications are timely, personalized, and consistently accurate.

Cincom Eloquence meets these demands comprehensively. It integrates seamlessly with core systems, scales to handle peaks in claims and renewals, and enables precise, data-driven personalization. With it, insurers are not just automating communications; they are creating a foundation for long-term growth, resilience, and competitive differentiation in an increasingly digital market.

Remember, when executed thoughtfully, customer communication becomes more than a process; it becomes a strategic lever that drives growth, strengthens trust, and positions insurers for the future.

FAQs

1- Why do insurance companies need customer communication management software?

Insurance companies need customer communication solutions to improve operational efficiency, maintain regulatory compliance, enhance customer experience, and reduce errors in claims, renewals, and onboarding communications.

2- How long does it take to implement a customer communication solution in insurance?

Implementation timelines vary depending on system complexity, integrations, and the scope of workflows. A structured approach with planning, configuration, stakeholder training, and pilot testing typically takes 6 to 8 weeks, but proper preparation ensures faster adoption and minimal disruption.

3- Can customer communication solutions improve claims and renewal processes in insurance?

Yes. Customer communication solutions streamline claims updates, reduce errors in renewal notices, automate repetitive communications, and enable personalized messaging. This leads to faster response times, higher customer satisfaction, and improved operational efficiency.

4- How do I ensure adoption of customer communication software across my insurance teams?

Successful adoption requires role-based training, clear governance processes, and involving stakeholders from IT, compliance, operations, and customer experience early in the selection process. Ongoing monitoring and optimization help reinforce usage and maximize ROI.

5- How can I measure the ROI of customer communication software in insurance?

ROI can be measured through faster communication cycles, reduced errors, lower operational costs, higher customer engagement, and improved compliance. Tracking metrics such as delivery times, customer response rates, and process efficiency helps quantify the software’s impact.

6- What role does vendor expertise play in selecting the best CCM software for insurance?

Vendors with proven experience in insurance understand regulatory requirements, claims processes, renewal workflows, and customer expectations. This expertise ensures the platform is not only technically capable but also aligned with the industry’s best practices.