If Retention Is the Goal, Communication Is the Weak Link

If I’m serious about retaining policyholders, I need to understand two things clearly: how many of them are leaving and why.

For insurance carriers, this is often where the disconnect begins. Retention metrics are tracked, sometimes even reviewed quarterly, but rarely linked back to the actual customer experience. And when they are, the focus is usually on pricing, claims turnaround, or product fit—not on how consistently or clearly we’ve communicated across the customer journey.

The truth is that most policyholders don’t leave because of a major failure. They disengage after a series of small, preventable moments:

- A delayed claims status update.

- A confusing renewal message.

- A lack of clarity about which plan to upgrade to.

- A form they couldn’t complete on their mobile device.

The cost of losing customers is significant. Research from Harvard Business School shows that increasing customer retention by just 5% can lead to a 25%-95% improvement in profitability.

Modern customer communication tools tackle communication challenges head-on. They help insurers move beyond paper documents and generic bulk emails to deliver real-time, personalized, and context-driven messages—right when and where customers need them.

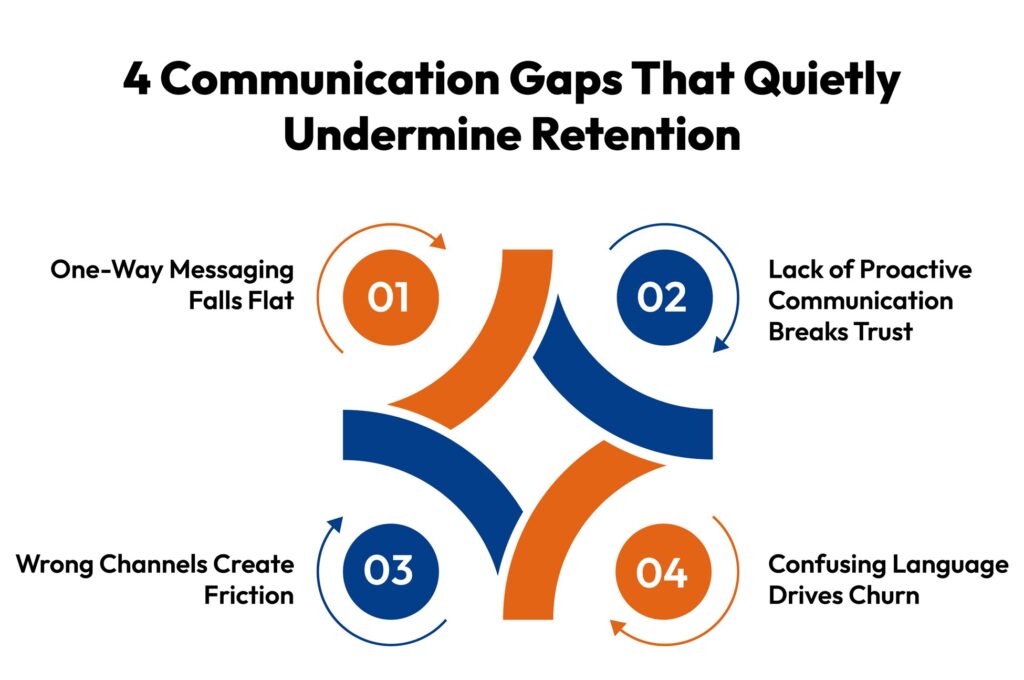

Where Retention Fails: Communication Gaps Most Carriers Overlook

Most insurers aren’t losing customers because of poor products; rather, they’re losing them because of poor communication. Policyholders expect clarity, speed, and personalization. But traditional tools for customer communication can’t deliver any of that on a scale. Before you invest more in acquisitions, look closely at where you’re unintentionally pushing existing customers away, because insurance customer retention depends more on experience than pricing.

These are most often small things, such as a policyholder who doesn’t understand their coverage, a renewal note sent at a poor time, or a claim update never sent. These moments may seem inconsequential, but they are precisely where loyalty may be lost or won.

These are four major voids in communication that are quietly draining your retention.

Guide to Choosing and Implementing the Right CCM Solution in 2025

Get the guide to find the right CCM for flexibility, confidence, and results.

Modern Customer Communication Tools: The New Engine for Insurance Retention

Today, policyholders have little tolerance for poor experiences. When they share their information with insurance carriers, they expect personalized and timely communication at every stage. They don’t want to compromise on speed, clarity, or relevance, and if they are forced to do so, they will simply leave. That’s why modern customer communication solutions are instrumental for engaging policyholders in ways that feel personal, proactive, and purposeful.

Here’s how these capabilities translate directly into stronger retention:

Hyper-Personalization Builds Long-Term Trust

Customers are quick to disengage from companies that treat them like policy numbers. They expect messages to be tailored to their personal context.

With a modern Customer Communication Management [CCM] tool, insurers can go far beyond “Dear [First Name].” These tools integrate with CRM, policy admin systems, and claim platforms to dynamically generate messages that reflect the customer’s real situation, such as:

- A new homeowner gets tailored renewal options and local weather-related risk guidance.

- A policyholder nearing retirement receives personalized life insurance upgrade suggestions.

- A customer with a recent claim gets an apology, a status update, and the next steps in plain language.

Retention impact:

When communications are personalized, policyholders feel understood, and when they feel understood, they stay.

Real-Time, Proactive Communication Reduces Anxiety and Churn

Insurance is a high-trust business, and silence during critical moments erodes that trust fast. Conventional client communication tools often rely on batch communication or manual outreach. However, modern tools support real-time, event-triggered messaging, ensuring that policyholders receive:

- Immediate confirmation after submitting a claim.

- Timely reminders for payments, renewals, and missing documentation.

- Automated nudges when something needs their attention—before it becomes a problem.

Instead of waiting for the customer to reach out, insurers can stay one step ahead by being proactive in offering reassurance, clarity, and transparency.

Retention impact:

Proactive communication prevents frustration and builds confidence, especially during claims, when loyalty is most fragile.

Omnichannel Delivery Meets Customers Where They Are

Today’s policyholders use multiple devices and channels interchangeably, and they expect a seamless experience. An email that leads to a broken link on mobile—or a paper letter referencing a missing web form—is no longer acceptable. Modern customer communication tools enable consistent messaging across channels, which include SMS, email, mobile apps, web portals, and even physical mail when needed. More importantly, they ensure that the messaging is synchronized and contextual across these channels. For example:

- A customer gets a payment reminder via SMS, and with one click, lands on a personalized payment portal.

- A claim status email links directly to their secure web dashboard with full visibility into what’s next.

- Renewal notices are sent in-app, supported by live chat for immediate questions.

Retention impact:

Friction causes drop-offs. Omnichannel communication removes that friction, keeping customers engaged and informed on their terms.

Interactive and Accessible Formats Make Every Touchpoint Effortless

Customers don’t just want information; they want clarity and control. They expect communication to work across all devices, languages, and abilities. Modern customer communication tools replace static documents with dynamic, responsive content. That includes:

- Interactive statements, forms, and letters where customers can click, complete, and sign directly

- Multilingual templates based on customer preferences.

- ADA-compliant formats, including PDF/UA, that ensure accessibility for all.

Instead of sending a PDF that requires printing and scanning, insurers can send a digital document that can be signed in two clicks.

Retention impact:

Easy, inclusive, and intuitive experiences build positive associations and reduce the risk of drop-off due to frustration or lack of access.

Built-In Compliance and Control Protect the Relationship

Many insurers hesitate to modernize communication due to regulatory risk, but ironically, outdated communication creates just as much risk, if not more. Modern client communication tools are designed with governance in mind. They offer:

- Version control for every template and message.

- Full audit trails track who sent what, when, and to whom.

- Approval workflows and legal checks to maintain compliance without slowing teams down.

This ensures that personalization and speed never come at the cost of regulatory precision.

Retention impact:

Trust is the currency of insurance. Accurate, auditable, and compliant communication builds trust at scale and prevents costly missteps that damage relationships.

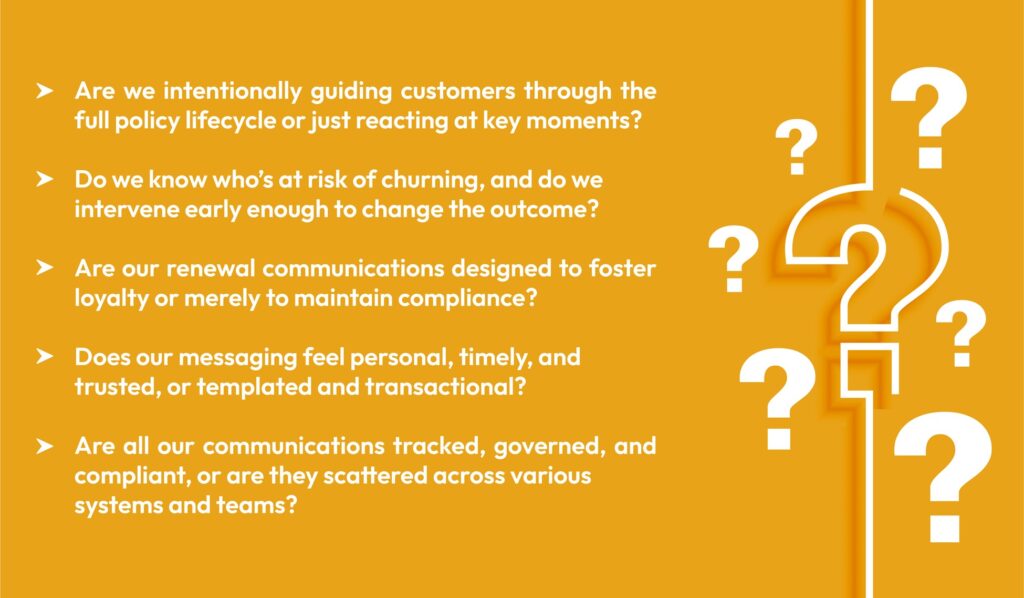

Are You Truly Using Communication to Drive Retention?

Now that we’ve explored what modern client communication software can deliver, it’s time to turn the lens inward. Before you commit to new strategies or tools, take a moment to assess where you really stand today.

If any answer is unclear, it’s time to reframe communication as a strategic retention engine.

6 Best Practices to Strengthen Retention with Modern Customer Communication Tools

In insurance, customer retention is the new growth strategy. It’s more cost-effective than acquisition and delivers stronger lifetime value. Leading carriers are now leveraging modern client communication software to engage policyholders with precision, not just to inform, but to build trust, reduce friction, and strengthen loyalty.

Here are six best practices to make communication a core driver of retention.

Redesign Onboarding to Lock in Early Value

The initial days are the most critical time for you because this is where you are shaping long-term retention. If you send a static welcome email with some dense policy packet, it will create distance, which is often difficult to fix later. Modern customer communication tools help insurers turn onboarding into a guided, responsive, and personalized experience. But timing matters. When outreach becomes excessive or irrelevant, customers quickly disengage. Advanced platforms help you avoid such incidents by pacing and personalizing communication based on real-time engagement signals.

Why it matters:

Customers who see early value are 3x more likely to renew. When onboarding is powered by intelligent communication, retention starts from day one, and so does ROI.

Shift from Reactive to Real-Time Communication

Every moment of silence during claims, billing, or renewal is a risk. Modern client communication tools allow insurers to automate real-time updates triggered by customer behavior or policy events. That means fewer inbound calls, fewer surprises, and more confidence from your customers.

Why it matters:

Real-time, proactive communication during high-stakes moments (like claims) is directly linked to trust and retention. Delays and ambiguity cost you credibility and policyholders.

Turn Every Interaction into an Opportunity to Reinforce Value

The insurance customer retention approach weakens when communication is purely transactional. Carriers must shift toward high-value engagement, such as coverage tips before renewals, lifestyle-based upsell offers or usage-based policy advice. You need to bring value to every interaction that you do.

Why it matters:

A policyholder who sees consistent value is harder to lose and easier to grow. Communicate with relevance, and you don’t just retain—you expand.

Close the Loop with Data-Driven Feedback and Action

Whenever you talk to your clients, always ask for feedback. Modern customer communication tools make it easy by adding feedback directly into your workflow. This helps you spot where customers are struggling or losing interest, so you can fix things before they leave. The best carriers don’t guess where churn is happening; they know exactly where it’s happening.

Why it matters:

Retention is often lost in patterns no one’s watching. The ability to respond to customer friction on a scale gives you an operational edge and protects your book of business.

Make Renewals Too Easy to Ignore—and Too Valuable to Decline

The renewal phase is the test of your retention strategy. It is at this point only when most of the customers leave. Modern customer communication solutions enable you to deliver personalized renewal reminders, value reinforcement messages, and loyalty-driven incentives before the policyholder’s renewal date arrives, across the preferred channel. When you communicate with your customers ahead of time, they feel seen and valued, which makes them stay.

Why it matters:

Renewals are your single biggest opportunity to prove value and prevent churn. If they’re treated like an afterthought, so is your brand.

Make Compliance Visible, Not Just Operational

Customers want confidence that they’re protected by something credible. If communications are unclear, inconsistent, and non-compliant, trust is lost by customers. Modern customer communication solutions guarantee that whatever communications you send out, from onboarding through renewal, comply with the rules of state regulations. These solutions possess functionalities like version control and audit trails that reduce unwarranted changes as communications pass between different departments. It’s not penalty evasion. It’s sending a message: “We treat your money with care. We abide by the rules. You’re in good hands.”

Why it matters:

Compliance-driven communication builds credibility, and credibility drives trust—the most valuable retention currency in insurance.

Cincom Eloquence: Enabling Retention Where It Actually Happens—In Customer Conversation

Retention is the outcome of how well you communicate, day after day, across every stage of the policyholder journey.

From the very first interaction, your customers are deciding whether you’re responsive, clear, and trustworthy or not. And as we’ve seen, it’s not a single misstep that drives churn. It’s the accumulation of small communication failures that go unchecked and unresolved.

This is where Cincom Eloquence changes the game for insurance providers. It helps teams build and manage smart, compliant, and personalized communication workflows—quickly and at scale. From onboarding and claims to renewals and everyday updates, every message is meaningful, consistent, and aligned with both business goals and what customers actually expect.

The cost of losing a customer is high; therefore, the value of getting communication right is much higher.

FAQs

1- Why is communication key to insurance customer retention?

Because insurance customer retention is built in everyday moments, not just during claims or renewals. Consistent, timely, and clear communication builds trust, reduces friction, and reassures policyholders they’re in capable hands. Poor communication, on the other hand, is one of the leading contributors to silent churn.

2- What are examples of modern customer communication tools in insurance?

Modern customer communication management software like Cincom Eloquence is a prime example of modernizing insurance communication. It supports personalized document generation, interactive onboarding, real-time policy updates, SMS and email automation, multilingual content delivery, and compliance-ready templates—all seamlessly orchestrated across channels and touchpoints.

3- How does omnichannel communication impact customer loyalty?

Policyholders expect to engage on their terms—whether via mobile, email, portal, or app. Omnichannel communication ensures consistency and continuity across all those touchpoints, reducing confusion and increasing confidence. When carriers meet customers where they are, loyalty follows.

4- Can automated messages feel personal in insurance contexts?

Absolutely. When powered by the right data and communication logic. Modern customer communication management tools enable automation that’s triggered by customer behavior, policy status, or lifecycle stage, ensuring that messages are relevant, contextual, and human in tone.

5- What KPIs should insurers track to measure communication effectiveness?

Key metrics include first-year retention rate, Net Promoter Score (NPS), response times, message engagement (open/click rates), claims-related communication satisfaction, and reduction in support tickets due to clearer messaging. These KPIs help correlate communication quality directly with customer experience and retention.