Introduction

Life insurers are facing some of the strictest life insurance regulatory requirements seen in the industry, with state and federal rules changing faster than most legacy systems can keep up. Regulators now expect insurers not only to send compliant communications but also to prove how each policy document was created, updated, and approved.

This has exposed a major gap in older communication processes. Most legacy systems cannot provide reliable version tracking, jurisdiction-based rules, or audit visibility. As a result, insurers are accelerating modernization efforts, with many reporting an average 43% efficiency gain when moving policy and communication data from legacy systems to modern platforms. That gain is not just operational. It directly improves regulatory readiness by reducing manual edits, limiting user-dependent processes, and improving the accuracy of disclosures and notices.

With increasing regulatory pressure and limited tolerance for errors, many insurers are now turning to Customer Communication Management (CCM) software as a core compliance system rather than a document-generation tool. The following sections explain why.

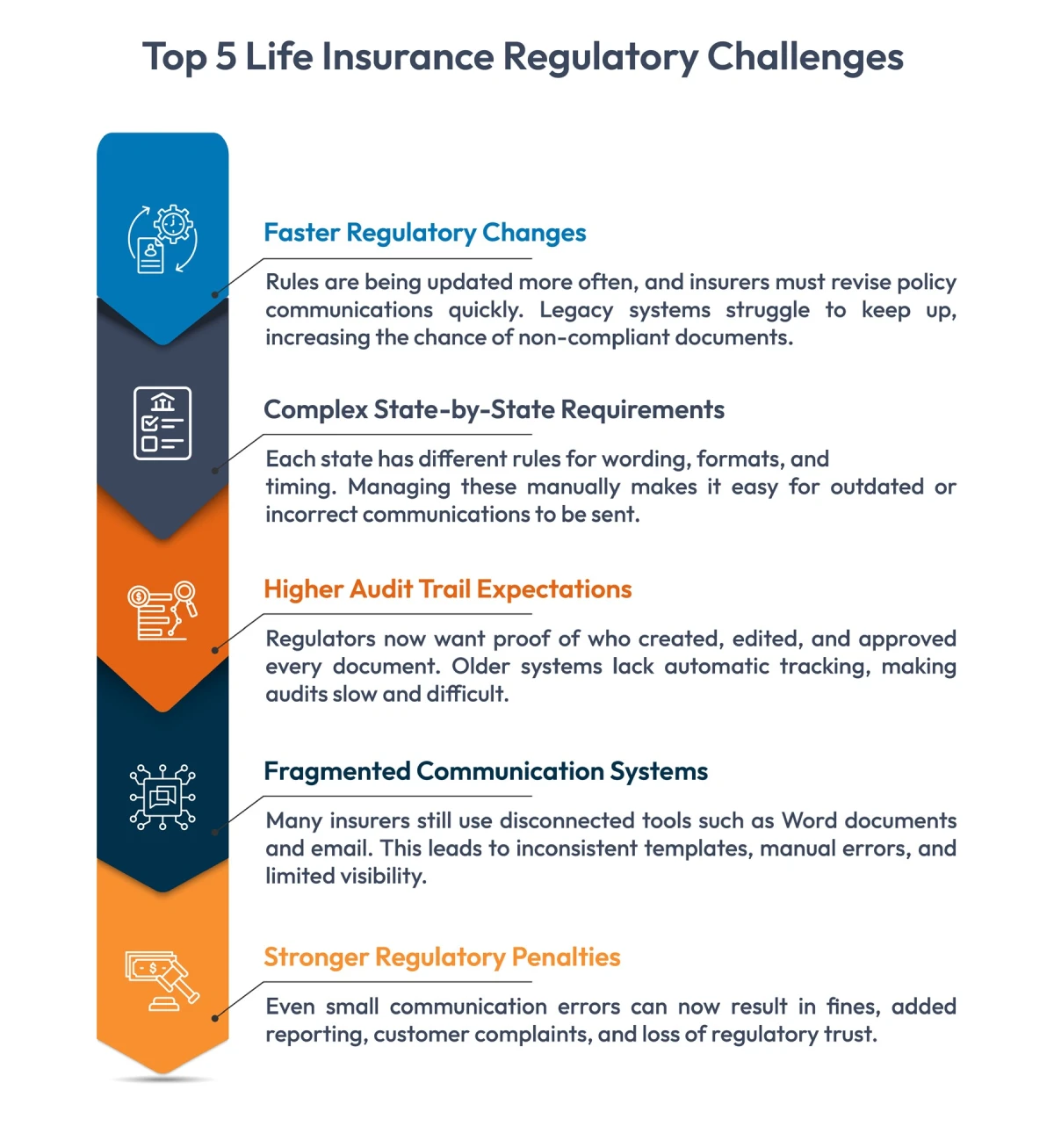

Top 5 Life Insurance Regulatory Challenges

Life insurers are managing a higher volume of regulatory expectations than ever before. Requirements now vary across states, product types, communication formats, and evolving industry guidelines. Below are the five major regulatory challenges insurers are struggling with:

These pressures show that carriers need systems that support life insurance regulatory requirements without depending on manual review. As a result, there is a strong shift toward CCM software for insurance compliance, which can automatically apply state rules, centralize all communication content, and generate complete audit logs without extra effort.

Get the CCM Buyer’s Guide

Make smarter CCM decisions for your life insurance communications. Streamline audits, maintain compliance, and choose the platform that fits your needs.

What Is the Financial Risk of Non-Compliant Insurance Communications

When communication errors slip through, the financial consequences can be immediate and long-lasting. Regulators now expect insurers to prove accuracy and maintain complete audit trails for insurance communications, and the cost of failing to do so is rising.

- Regulatory fines for non-compliant documents can be issued for incorrect, missing, or outdated disclosures.

- Operational rework (correcting, re-approving, and reissuing documents) can exceed the cost of the fine.

- Longer and more intense regulatory examinations when audit records cannot be produced quickly.

- Customer disputes may require claim payouts, compensation, or legal involvement.

- Loss of trust from regulators and policyholders, which affects brand and future oversight.

Legacy Systems vs. Modern CCM Platforms

Life insurers are now realizing that older communication tools can’t keep up with rising regulatory expectations and digital customer needs. Modern platforms offer faster updates, clearer audit control, and better digital policy delivery compliance.

| Category | Legacy CCM Systems | Modern CCM Platforms |

| Regulatory Updates | Manual edits across multiple templates; easy to miss changes | Rules-based updates are applied once and published everywhere |

| Compliance Tracking | Limited or no automatic audit logs | Full audit trails, timestamped approvals, and version tracking |

| Content Storage | Files are spread across folders, drives, or email | Centralized content library with controlled access |

| Policy Delivery | Heavily print-dependent; slow and costly | Full digital delivery with channel flexibility and compliance control |

| Personalization | Very limited, often static templates | Dynamic content based on customer, product, and jurisdiction |

| IT Dependency | Frequent technical involvement for updates | Business users can make updates with low IT support |

| Speed of Change | Slow and paperwork-driven | Rapid configuration and automated deployment |

| Customer Experience | Generic and often unclear communications | Clear, personalized, and consistent communications across all channels |

Modern CCM platforms provide the reliability and automation insurers need to strengthen compliance and deliver policies digitally with confidence. Replacing the legacy system is a requirement for staying competitive and audit-ready.

How Modern CCM Helps Life Insurers Stay NAIC Compliant

Meeting NAIC standards and other regulatory requirements is critical for life insurers. Modern customer communication management platforms help automate compliance, reduce errors, and provide full visibility into communications, supporting life insurance regulatory requirements.

Automated Regulatory Rule Application

Modern CCM applies NAIC and state-specific rules automatically across all communications. This ensures consistent, compliant messaging without relying on manual edits.

Key benefits:

- Templates automatically update with new regulatory language.

- Different products and states receive the correct disclosures.

- Reduces human errors and speeds up communication updates.

NAIC Compliance Communication Across Channels

CCM ensures that all communications, whether print, email, SMS, or digital portals, meet regulatory expectations consistently.

Key benefits:

- Automatically insert the correct clauses and deadlines.

- Maintain consistent content across multiple product lines.

- Standardize formatting and language for all customer communications.

Complete Audit Trails for Insurance Communications

Every change, approval, and delivery is tracked in real time. This allows insurers to respond quickly during audits and maintain full compliance records.

Key benefits:

- Track who made changes and when.

- Maintain a complete version history for every document.

- Provide instant proof during regulatory reviews.

Reduce Risk of Regulatory Fines for Non-Compliant Documents

By centralizing and controlling content, insurers can significantly reduce errors that could lead to fines or reissued communications.

Key benefits:

- Avoid penalties for missing or incorrect disclosures.

- Reduce costly document rework.

- Minimize customer disputes and complaints.

Digital Policy Delivery Compliance

Modern CCM platforms ensure that updates are applied across all delivery channels simultaneously, keeping communications accurate and compliant.

Key benefits:

- Supports portals, email, SMS, mobile apps, and print.

- Reduces manual intervention for content updates.

- Ensures consistent and timely communication for every policyholder.

Modern CCM helps life insurers meet life insurance regulatory requirements, maintain audit trails for insurance communications, ensure digital policy delivery compliance, and reduce exposure to regulatory fines for non-compliant documents.

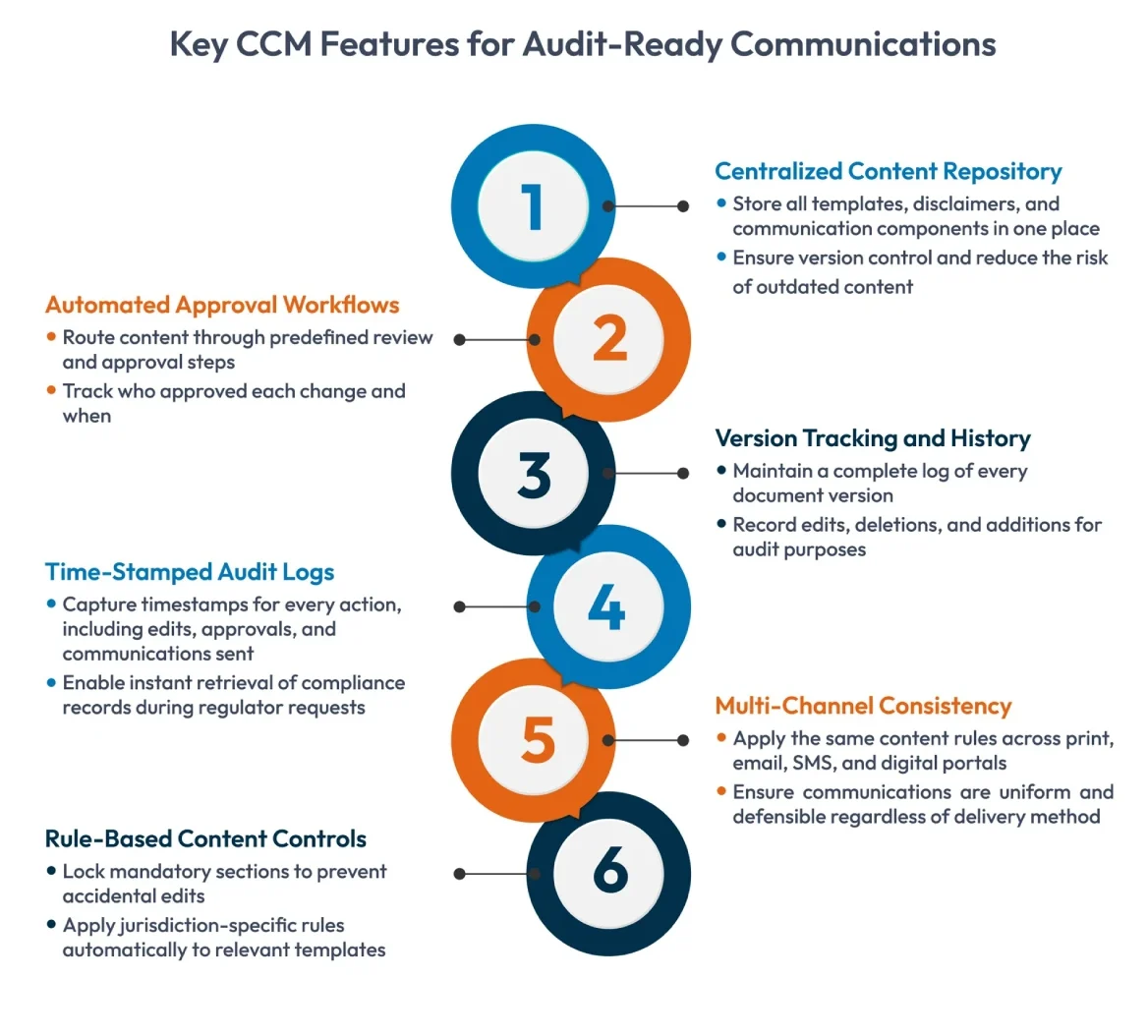

Which Specific CCM Features Are Critical for Life Insurer Audit Trails

For life insurers, maintaining audit-ready communications is essential. Modern CCM platforms include features that make regulatory reviews faster, easier, and fully defensible.

These CCM capabilities make life insurers’ communications fully traceable, consistent, and defensible, enabling faster regulatory reviews and reducing the risk of errors during audits.

Future-Proof Your Life Insurance Communications

Life insurers using outdated systems risk errors, regulatory fines, and inefficient processes. Modern CCM platforms provide a centralized system for content, automate updates, and maintain full audit trails to ensure communications are accurate, timely, and compliant.

Investing in a legacy CCM system replacement for life insurers helps reduce compliance risk, improve operational efficiency, and strengthen trust with policyholders and regulators.

Discover how Cincom Eloquence can streamline your life insurance communications, ensure compliance, and simplify audits.

FAQs

1. What is the difference between CCM and traditional document management systems?

CCM is designed for regulated communications with automation, audit trails, and multi-channel delivery, while traditional document systems focus only on storage and basic editing.

2. Can CCM integrate with existing insurance policy administration systems?

Yes, modern CCM platforms are built to integrate with core insurance systems to pull data, automate content, and ensure consistent communication across all channels.

3. How does CCM help improve customer engagement?

By enabling personalized, accurate, and timely communications, CCM platforms enhance the policyholder experience and build stronger trust with customers.

4. Is implementing a CCM system disruptive to daily operations?

With proper planning and phased deployment, CCM implementation can be smooth and often results in efficiency gains while reducing manual errors.

5. How scalable is CCM for growing life insurance companies?

Modern CCM solutions are highly scalable, supporting increasing policy volumes, multi-channel communication, and evolving regulatory requirements without additional complexity.