For any insurer, securing long-term customer loyalty is essential for business stability and growth. But what if insurers had a clear road map to navigate this challenge? A recent academic study provides just that, offering a fresh perspective on what truly drives customer loyalty in the insurance industry. The findings can help inform your strategy and identify the tools needed to execute it.

Unlocking the Customer Loyalty Code: It’s All About Behavior

The research, led by Martin Mende, Ruth N. Bolton, and Mary Jo Bitner, developed a matrix that connects customer preferences for communication to their overall loyalty. They analyzed survey data from 1,199 insurance customers and followed up with purchase records from 975 of them. The results reveal four distinct customer segments, showing that a one-size-fits-all approach to customer behavior and loyalty in insurance is not effective anymore.

The Highly Loyal & Close-Relationship Seekers

These customers are your most satisfied and loyal. They are comfortable and happy receiving consistent contact across multiple touchpoints. The key here is to maintain this consistent, multi-channel communication to reinforce their positive experience.

The Low-Loyalty & Close-Relationship Seekers

This group, representing the largest segment at nearly 40% of all respondents, has a strong desire for a close relationship with their insurer but shows a lower level of loyalty. The researchers identified this as a high-potential group for targeted communication strategies. Often, these customers feel their preference for closeness isn’t being reciprocated. To win them over, it’s crucial to create messaging that consistently emphasizes your company’s strengths and commitment to service.

The Highly Loyal & Low-Contact Seekers

This group is highly loyal to their insurer but prefers minimal contact. It’s important to respect their preference by limiting communication points to avoid annoying them. Treat them appropriately by providing clear, but infrequent, communications.

The Low-Loyalty & Low-Contact Seekers

Comprising the second-largest group (about 29%), these customers have low loyalty and prefer a low level of closeness. The researchers found that customer inertia is a significant factor for this segment. The recommended approach is to emphasize the insurer’s high-quality services through a low frequency of communications.

Differentiate Between Customer Attitudes

One of the biggest takeaways from this research is the necessity for insurers to differentiate between attitudes among customers. As customer service continues to increase in importance for today’s businesses, understanding these nuances is key to building true customer loyalty in the insurance industry.

Insurance Communications Made Simple: To Build or Buy?

Rethink your organization’s approach to insurance communication and stay ahead of the competition.

The Role of CCM Tools in Implementing Customer Loyalty Strategies

Another equally important takeaway from this research is that to build true customer loyalty in the insurance industry, you need more than just a diagnosis. You also need the right tools to deliver the treatment plan. This arrangement mirrors what happens in modern medicine: first comes the diagnosis, then the treatment plan follows.

Customer Communication Management (CCM) tools are the essential technology that allows a treatment plan for customer loyalty to be fully implemented.

For example, a single customer communications solution must be flexible enough to execute all four strategies from the research matrix. This means it needs to produce multi-channel choices for delivery based on every customer’s preference—be it a letter, an e-mail, or a text.

An effective CCM solution also needs to break down “communications silos” within your company. The entire communication stream should be managed cohesively to consistently meet customer expectations. This also allows you to “right-channel” messages, directing customers to the most effective and cost-efficient communication channel.

To meet these high standards, a system needs to be well-conceived. It should be both cost-effective and business-effective, offering advantages like empowering front-end users to manage communication with less reliance on IT. Such a solution also needs to make your content library flexible and easy to use across multiple settings and formats.

Achieving total alignment with all these factors is key to making customer communications a part of your business success. By matching the right functionality with a properly targeted messaging strategy, you’re not just improving efficiency; you’re reinforcing customer loyalty in the insurance industry and putting your company in an ideal position to retain customers for the long term.

The CCM Checklist: What to Look For

Now that we know CCM is essential for building customer loyalty in the insurance industry, a crucial question arises: Can we simply opt for any CCM solution? The answer is a definitive no. Just as the research shows that customers are not all the same, CCM tools are built with different strengths. Selecting the right one is paramount to successfully implementing your loyalty strategy.

So, what should you look for when choosing a CCM tool?

Is It a True Omnichannel Solution?

A top-tier CCM solution must go beyond simple multi-channel delivery; it must provide a unified, omnichannel experience. This means the ability to produce and deliver communications seamlessly across every customer’s preferred channel—be it a letter, an email, a text message, or a mobile app notification—all from a single, integrated platform. The tool must adapt to the customer, not the other way around.

Does It Integrate and Centralize Your Data?

A key feature to look for is the ability to break down “communications silos” by integrating with your existing enterprise systems, such as CRM, ERP, and policy administration systems. This allows for a holistic view of the customer and ensures the entire communications stream is managed cohesively. An effective CCM tool should also serve as a centralized content repository, providing a single source of truth for all templates, assets, and messaging, which is vital for a consistent, unified voice.

Is the User Interface Intuitive and Easy to Use?

Even the most advanced CCM tool is useless if your teams can’t use it properly. The user interface (UI) and user experience (UX) are critical for successful execution. Look for a solution that is easy for business users to adopt, configure, and manage with minimal reliance on IT. This empowers your teams to create and send targeted communications quickly, ensuring your messaging strategy can be executed efficiently.

Does It Ensure Regulatory Compliance?

In the insurance industry, regulatory compliance is non-negotiable. Your CCM solution must be capable of adhering to a wide range of state, national, and international regulations. This includes features like robust access controls to protect sensitive customer data, detailed version tracking to maintain an audit trail of all documents, and the ability to apply legal holds or record retention policies automatically.

Can It Handle Both On-Demand and Batch Document Generation?

Insurance communications aren’t always predictable. A high-quality CCM system must offer flexibility for both scheduled, high-volume batch jobs (like policy renewals) and on-demand document generation for individual customer inquiries. The solution should be able to generate these documents with speed and accuracy, regardless of the volume or complexity.

Is It Scalable and Flexible for Future Growth?

Finally, choose a CCM solution that can grow with your business. It should be easily scalable to handle increasing customer volumes and transaction loads without a drop in performance. The platform should also be flexible enough to integrate new channels, add new products, and adapt to evolving customer expectations as your business expands and your communication needs change.

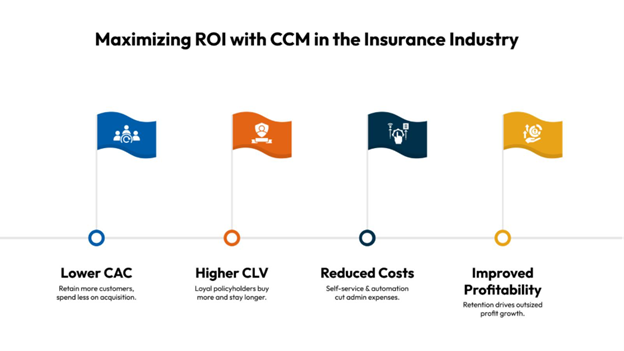

The ROI of Loyalty: Why Investing in a CCM Tool Pays Off

While the qualitative benefits of an omnichannel CCM platform are clear, the financial return is what truly justifies the investment. Investing in a solution that enhances customer loyalty in the insurance industry isn’t a cost; it’s a strategic move that delivers measurable ROI.

Lower Customer Acquisition Costs (CAC)

Insurance has some of the highest customer acquisition costs, often five to seven times higher than retention. By using a CCM tool to proactively manage customer relationships and reduce churn, insurers can significantly lower their CAC. Every customer you retain is a new customer you don’t have to spend money acquiring, which directly improves your bottom line.

Increased Customer Lifetime Value (CLV)

A loyal customer is a more profitable customer. A well-executed customer loyalty insurance strategy can lead to a substantial increase in a customer’s lifetime value (CLV). Satisfied, long-term policyholders are more likely to purchase additional products (e.g., cross-selling auto insurance to a homeowner policyholder) and are less sensitive to price changes. By delivering personalized communications, a CCM platform makes cross-selling more effective, maximizing long-term customer value.

Reduced Operational Costs

A robust CCM platform helps to streamline operations. By offering self-service portals and a centralized content library, you can significantly decrease the volume of inbound calls and the time spent on manual processes. This efficiency translates to lower administrative expenses and frees up agents to focus on more complex, high-value customer interactions.

Improved Profitability

Ultimately, the combination of reduced acquisition costs, increased customer lifetime value, and lower service costs directly impacts profitability. Studies have shown that even a small increase in customer retention, such as 5%, can lead to a 25% to 95% increase in profit. A CCM tool that reinforces positive customer behavior and loyalty in insurance acts as a catalyst for this profitability.

By aligning your communications strategy with a powerful CCM solution, you are not just implementing a new technology; you are building a more sustainable and profitable future for your insurance business.

Conclusion: A Strategic Path to Loyalty and Growth

The academic research is clear: a one-size-fits-all approach to customer loyalty in the insurance industry is a thing of the past. By understanding the unique attitudes of different customer segments and leveraging a powerful omnichannel CCM tool, insurers can move beyond guesswork. A well-chosen CCM solution isn’t just about sending messages; it’s about executing a precise, data-driven strategy that deepens relationships, reduces costs, and builds a more profitable and sustainable business for the future.

This is where a solution like Cincom Eloquence comes in. By providing a unified platform that delivers on-demand and batch communications, supports seamless integrations, and ensures regulatory compliance, Cincom Eloquence empowers insurers to turn their communication strategy into a powerful asset. It allows your business to reinforce customer loyalty and secure long-term growth in a competitive landscape.

FAQs

1- What is customer loyalty in the insurance industry?

Customer loyalty in the insurance industry refers to a policyholder’s long-term commitment to a specific insurer. It’s measured by a customer’s willingness to renew their policy, purchase additional products, and recommend the company to others, all of which are vital for business growth.

2- How do you improve customer loyalty in insurance?

Improving customer loyalty in insurance requires a data-driven approach. The key is to understand a customer’s communication preferences and loyalty level, then use the right tools, like an omnichannel CCM platform, to deliver personalized and consistent messaging.

3- What are the benefits of a CCM tool for insurers?

A CCM tool helps insurers enhance customer loyalty insurance strategy by personalizing communications, managing them across multiple channels, and centralizing content. This leads to higher retention, increased customer lifetime value, reduced operational costs, and overall improved profitability.

4- What is an omnichannel CCM solution?

An omnichannel CCM solution is a single, unified platform that allows insurers to manage and deliver customer communications seamlessly across all channels—including email, text, print, and mobile—ensuring a consistent experience from one touchpoint to the next.

5- How does Cincom Eloquence help with customer loyalty?

Cincom Eloquence helps insurers reinforce customer loyalty by providing a unified, omnichannel platform. It allows for personalized, on-demand, and batch document generation while ensuring regulatory compliance, enabling insurers to execute a precise, data-driven communication strategy.