The New CX Battleground: Clear Communication

Banks face more rules, changing customer expectations, and competitors who make things simple. Even with big digital investments, trust is slipping. Customers still get confused because messages are inconsistent, unclear, or poorly timed.

Most problems in banking aren’t about the services themselves. They come from how hard it is for customers to understand them. When people struggle to read policies, navigate channels, or make decisions, loyalty drops and costs go up. That’s why managing customer experience well is more important than ever.

Clear communication is becoming a key advantage. Banks that focus on clarity build trust, improve the customer experience, and protect their place in a market that’s only getting more competitive.

What Customer Experience Management Means in a Banking Context

When asked “what is customer experience management in banking”, clear communication is a core pillar: the discipline of ensuring customers receive the right information, at the right time, in a format they can act on and trust.

Core elements include:

- Precision: Accurate, unambiguous information that reduces interpretation risk.

- Timeliness: Proactive guidance delivered at decision points, not retroactively.

- Personalization: Messages tailored to customer profile, product holdings, and behavioral signals.

- Contextual relevance: Content focused on the customer’s immediate task or need.

- Channel alignment: Consistent messaging across branch, contact center, web, and mobile.

- Simplicity: Plain-language explanations; removal of jargon and unnecessary complexity.

These attributes together define how banks should operationalize communication within customer experience management in banking to reduce effort, build trust, and improve outcomes.

Exceptional Customer Experiences Start with Great Customer Communications

Learn how you measure up and uncover areas for improvement in your multi-channel communication.

Clear Communication: Why It Is the Real Differentiator

Banks today operate in markets where products, prices, and digital tools often look the same. What really sets leaders apart isn’t the technology—it’s how clearly they communicate with customers.

Banks that communicate with precision, transparency, and consistency create an experience that feels easier and more trustworthy than the alternatives. As products and channels converge, clarity becomes the attribute customers remember most and the one that effectively strengthens the banking customer experience.

The Executive Imperative: Four Core Ways to Embed Clarity into the CX Strategy

Clear communication becomes operational only when it is designed, governed, and reinforced across the institution. Executives must establish structures and mechanisms that make clarity a consistent output, not an occasional effort.

Integrate Communication Standards into Governance and Journey Design

What to put in place:

- A formal communication framework that defines tone, structure, required elements, and compliance thresholds.

- A central review process to ensure all customer-facing content meets clarity standards.

- Clear ownership within CX or product teams for maintaining and updating communication guidelines.

How to embed it operationally:

- Incorporate communication clarity checkpoints into every stage of journey design (concept → drafting → validation → deployment).

- Add clarity criteria to sign-off procedures for products, policies, and service flows.

- Use a shared template library for emails, notifications, disclosures, and in-app messages to avoid one-off interpretations.

Recommended Governance Structure

| Area | Responsibility |

| CX Governance | Define standards and maintain templates |

| Product Teams | Apply standards in content creation |

| Compliance | Validate alignment with regulatory requirements |

| Customer Insights | Test clarity through customer feedback loops |

Equip Frontline Teams and Digital Channels with Unified Knowledge and Language

Consistency requires that every touchpoint communicate in the same way, using the same explanations and terminology.

How to implement this:

- Develop a single, unified knowledge base that provides approved wording, explanations, and responses for common customer scenarios.

- Standardize terminology across branches, contact centers, chat, and digital interfaces so customers receive identical guidance regardless of channel.

- Train frontline teams not only on products but also on communication clarity principles, including how to simplify complex topics without altering meaning.

- Embed short “communication playbooks” into frontline workflows to guide responses in real time.

Frontline Clarity Checklist (for internal use):

- Is the explanation free of internal jargon?

- Does it answer the customer’s immediate question without adding unnecessary detail?

- Is the instruction sequence clear and linear?

- Has the customer been told exactly what happens next?

Deliver Proactive, Context-Relevant Communication at Scale

Clarity is most effective when customers receive guidance before confusion occurs, not after.

How to operationalize this:

- Map all customer journeys and identify points where customers typically become uncertain or make errors.

- Insert pre-emptive communications, such as messages that appear just before a high-friction moment, to guide the customer through the next step.

- Segment communications by journey stage, product complexity, and service scenario to ensure the message matches the context.

- Build version controls and update cycles so communications stay current with product changes, regulatory updates, and customer feedback.

Example of a Proactive Clarity Layer (Journey Step → Communication Example):

| Journey Step | Embedded Communication |

| Application Start | Clear list of required documents upfront |

| Mid-Process | Real-time status update with next immediate action |

| Completion | Summary of key terms in plain language |

| Post-Onboarding | Short explanation of what customers can expect in the first 30 days |

Strengthen Compliance Alignment to Ensure Clarity Without Risk

Compliance should be an enabler of clarity, not a barrier. When structured correctly, both objectives reinforce each other.

How to Execute:

- Collaborate early with compliance teams during communication drafting rather than seeking approval at the end.

- Translate regulatory requirements into plain-language explanations while preserving accuracy.

- Create side-by-side versions of communications (regulatory text vs. customer-friendly text) to maintain transparency and traceability.

- Embed compliance-approved language in template libraries to avoid repetitive re-review.

- Establish a fast-cycle update process that reflects regulatory changes without disrupting customer understanding.

Compliance Integration Model

| Area | Action |

| Early Collaboration | Compliance joins the drafting stage, not just the final review |

| Regulatory Translation | Convert complex rules into usable customer guidance |

| Template Controls | Pre-approved language to reduce risk and rework |

| Continuous Monitoring | Scheduled reviews tied to regulatory updates |

When governance, frontline execution, proactive communication, and compliance all operate from the same clarity standards, the organization delivers communication that is consistent, reliable, and easy for customers to understand. This is how clarity moves from intention to institutional capability and becomes a foundational driver of primary digital banking CX.

Measuring Communication Quality and Its Business Impact

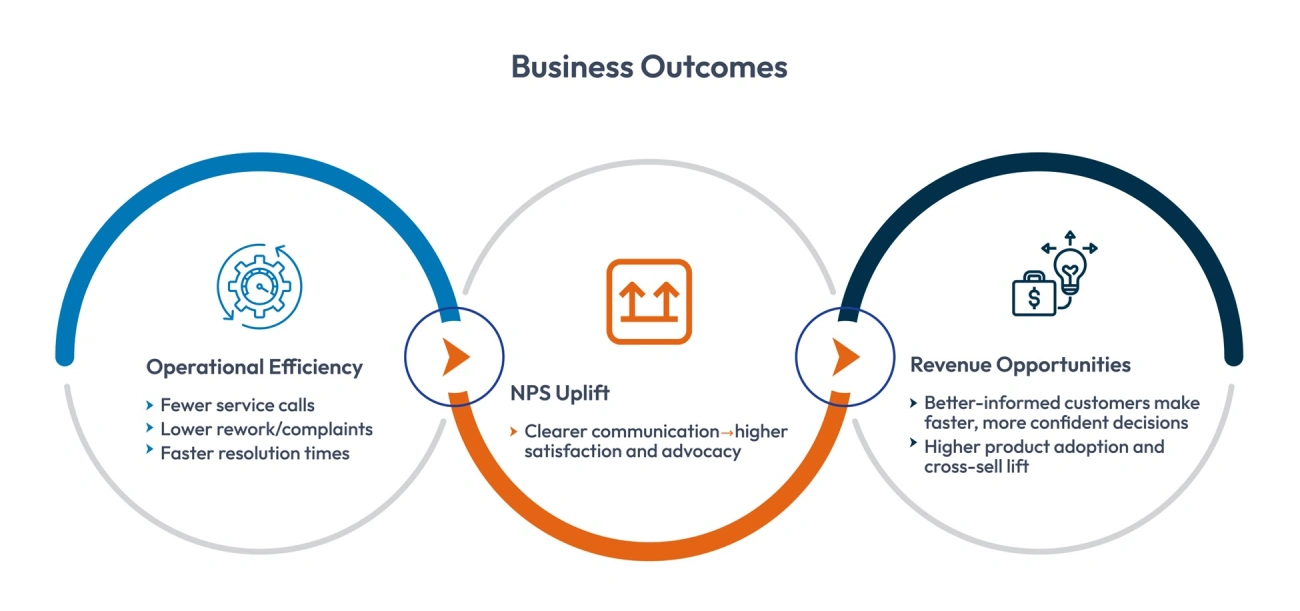

Measuring communication quality helps banks connect clarity with real business outcomes. By tracking how well customers understand information the first time, institutions can reduce effort, improve trust, and unlock meaningful operational gains across the overall banking customer experience.

Core KPIs to Measure:

- Communication Clarity Score – How clear customers perceive messages to be.

- First-Time Understanding (FTU) – % of customers who understand information without follow-up.

- Trust Velocity – How quickly customer confidence grows or erodes during interactions.

- Effort Reduction – Measured decrease in customer actions required to complete tasks.

When banks treat communication as a strategic asset within customer experience management in banking, they shift from improving isolated messages to strengthening the entire operating model. Clarity stops being a soft concept and becomes a measurable driver of experience, efficiency, and growth.

12-Month Implementation Priorities: Step-by-Step

| Priority | Timeline | Core Actions |

| Audit communication pain points | Months 0–2 | Map all customer touchpoints and identify top friction areas using complaints, call logs, and journey data. Produce a concise priority list for action. |

| Execute quick wins | Months 1–3 | Fix high-impact issues such as unclear instructions, missing status updates, or inconsistent messages. Deploy improvements and track reductions in confusion-driven contacts. |

| Create communication standards | Months 2–5 | Define clarity rules, tone guidelines, and required elements. Build a small template library and integrate standards into the journey and product sign-off process. |

| Build a unified knowledge base | Months 3–6 | Consolidate approved explanations, FAQs, and templates into one repository. Launch with a pilot team and refine based on frontline usage. |

| Train frontline teams | Months 4–8 | Provide concise modules on clarity principles and consistent terminology. Embed short playbooks into daily workflows. |

| Launch proactive communications | Months 4–8 | Introduce pre-emptive messages at common friction points in key journeys. Roll out in phases and adjust based on customer effort metrics. |

| Set metrics and accountability | Months 2–12 | Define clarity KPIs, publish a monthly dashboard, and assign ownership to CX, Product, Compliance, and Operations. Monitor progress through steering reviews. |

| Strengthen compliance alignment | Months 3–9 | Involve compliance early in drafting and maintain pre-approved language blocks. Streamline review cycles and track approval timelines. |

| Establish continuous improvement | Months 6–12 | Run small content pilots, gather feedback, and update templates quarterly to reflect product or regulatory changes. |

Execution Notes:

- Start with an executive mandate and a 90-day sprint objective: audit, quick wins, and framework definition.

- Assign a single program lead with a small cross-functional team and clear escalation paths.

- Hold monthly steering reviews that focus on the KPIs in the governance dashboard.

- Treat the first 6 months as capability-building; expect visible operational impact by month 9–12.

Looking Ahead: Turning Clarity into a Long-Term Discipline

For banks committed to leadership in customer experience management in banking, clarity must evolve from a project mindset to an ongoing discipline. Sustaining this discipline also requires alignment beyond CX teams. Communication clarity cuts across product, compliance, risk, and distribution, so cross-functional groups with real authority and visible C-suite backing become essential. When these teams operate on a recurring cadence, clarity embeds into the organization instead of slipping behind other priorities.

The next wave of industry differentiation will favor banks that make experiences feel simple, intuitive, and trustworthy. Those that systematize clarity today will be the ones setting the standard tomorrow.

Turning Clarity into a System: Why Banks Use Cincom Eloquence

Clarity doesn’t scale on its own; it needs infrastructure. Cincom Eloquence, a modern Customer Communication Management (CCM) platform, gives banks that foundation. It centralizes how communications are created, approved, personalized, and delivered across every channel, eliminating the fragmentation that undermines CX.

With one governed CCM system, banks can align documentation, disclosures, service messages, and digital interactions around the same standards of clarity and compliance.

For leaders committed to raising the bar in customer experience management in banking, Eloquence provides the operational backbone that makes consistent, customer-ready communication achievable from day one.

FAQs

1. How does clear communication strengthen a bank customer retention strategy?

Clear communication reduces uncertainty, prevents service friction, and builds trust during important interactions. When customers fully understand products, fees, and next steps, they are far more likely to stay with the bank long term.

2. What role does clear communication play in primary digital banking CX?

In digital environments, clarity determines whether customers can complete tasks independently. Straightforward language and consistent instructions lower abandonment rates and improve overall satisfaction.

3. Why is clarity important for primary financial services CXM programs?

Clarity ensures that every product team, service channel, and compliance function communicates with the same standards. This creates a unified experience and strengthens the foundation of enterprise-level CXM.

4. How does communication clarity support customer experience management in banking during complex journeys?

Transparent updates, simple explanations, and predictable steps guide customers through processes like lending, onboarding, or dispute resolution. This reduces stress and improves perceived service quality.

5. Can clarity improve banking customer experience without large-scale technology changes?

Yes. Banks can see quick gains by improving content, simplifying templates, and creating consistent communication guidelines before investing in larger transformation efforts.