Introduction

Last quarter, a mid-sized bank sent a regulatory update to its branches late on a Friday. By Monday morning, tellers were giving clients conflicting instructions on new compliance checks. Meanwhile, the wealth management team fielded panicked calls from investors who didn’t understand the implications for their portfolios.

This isn’t hypothetical. Misaligned communications ripple quickly, affecting operations, client trust, and even regulatory standing. The challenge isn’t the volume of information. It’s clarity, timing, and knowing who needs to hear what and when.

In this article, we break down six challenges that consistently disrupt financial services communication. For each, we offer concrete steps executives can take to fix the gaps, ensuring employees act decisively, clients stay informed, and regulators remain confident in your controls.

Challenge 1: Aligning Internal and External Communications

In large financial institutions, communication rarely flows as intended. It’s not a matter of incompetence; the organization itself creates friction points. Teams operate in parallel lanes—front office, risk, compliance, and operations—each moving at different speeds and prioritizing different signals. The result is narrative drift. Messages scatter, meaning gets lost, and employees are left guessing which signals demand immediate attention.

Here’s the way to fix this narrative drift

- Treat communication as a directional beacon. Map critical decision nodes, anticipate friction zones, and highlight the signals that actually drive behavior. Consider where cognitive load might overwhelm employees or clients and adjust accordingly.

- Focus on narrative fidelity, not just volume. Centralized platforms help only if the core story is shared and understood. Fix what must remain consistent while allowing local adaptations. This reduces distortion without stifling initiative.

- Anchor messages in action, not information alone. Each memo, alert, or briefing conveys which behaviors matter and which risks need attention. Employees respond to signals, not words alone.

- Measure resonance, not delivery. Pulse surveys, micro-forums, or interactive briefings surface gaps before they echo through operations or reach clients inconsistently.

Is Your Financial Customer Communications Solution Delivering Tangible ROI and Efficiency Gains?

Challenge 2: Maintaining Customers’ Trust Amid Regulatory Complexity

Regulatory updates arrive constantly. Not all are game-changing, but some can subtly shift risk perceptions. Here’s the problem: customers don’t see the nuance. They see uncertainty, ambiguity, and sometimes conflicting messages. And once doubt seeps in, it spreads faster than a formal memo can correct it.

It’s not just about compliance; it’s psychology and perception. Senior executives may read the same regulatory bulletin differently. One sees opportunity, another sees risk. Investors and clients absorb signals filtered through their own lens. Misalignment isn’t a failure of intent; it’s a failure of signal clarity.

Here’s a micro-framework leaders can use:

| Signal Type | Purpose | Execution Tip |

| Regulatory Alerts | Immediate awareness | Short, focused, sent to key decision-makers first |

| Impact Notes | Translate rules into implications | Focus on decisions and behaviors, not just information |

| Narrative Summaries | Shape perception and context | Reinforce why actions matter, and connect dots across teams |

Some practical moves:

- Anchor messages to action, not words. A memo is only as useful as the behavior it triggers. If investors or employees aren’t reacting in line with your intent, it means your financial compliance communication has failed.

- Use layered visibility. Not every customer needs every detail, but every decision point should have an unbroken line of sight. This prevents “regulatory blind spots” where trust erodes silently.

- Measure resonance, not just delivery. Pulse surveys, interactive briefings, or scenario-based simulations reveal where perception diverges from reality.

Challenge 3: Navigating Cybersecurity and Data Sensitivity in Customer Communications

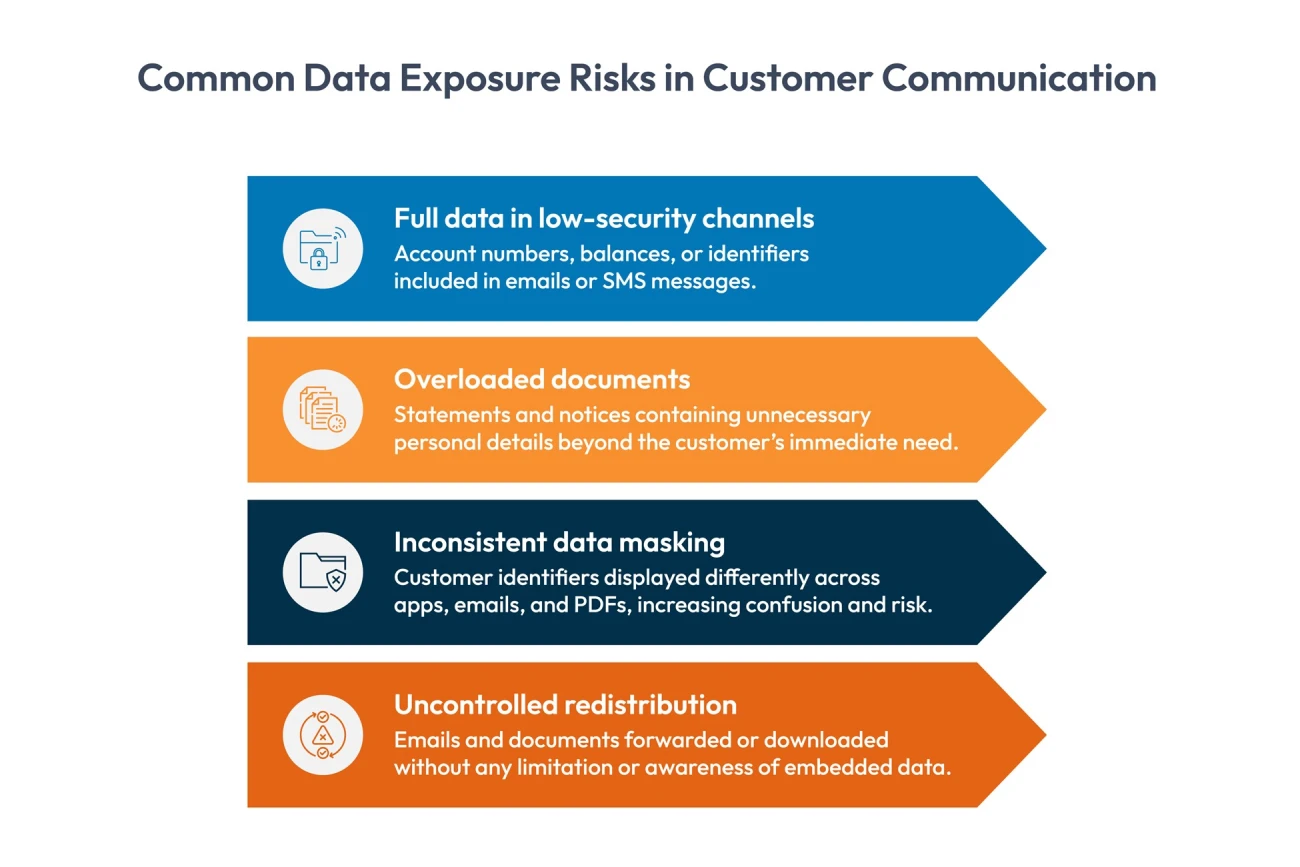

Financial services communications are one of the most frequent points where sensitive data is exposed. Not through hacking, but through everyday operations. Statements, alerts, emails, notifications, and service messages. Each one carries personal or financial information, and each one represents a potential risk if handled poorly.

This is a severe financial services communication challenge. Communication teams are tasked with clarity and responsiveness. Security teams are tasked with protection. Compliance teams are tasked with regulation. When these functions operate in parallel rather than together, customer data becomes vulnerable in plain sight.

Regulations such as GDPR are explicit on this point. Personal data must be limited, protected, and purpose-driven, including when it is communicated to the customer. Yet many institutions still rely on legacy templates and default data fields that expose more information than necessary.

How to Fix It

Effective institutions treat financial services communication as an extension of their data protection strategy.

- Define data thresholds by channel. Decide clearly what information can appear in email, mobile notifications, secure portals, and physical mail. Enforce this consistently.

- Apply data minimization deliberately. If a customer only needs confirmation of an action, do not include balances, transaction histories, or full identifiers.

- Standardize masking and formatting. Partial identifiers should look the same everywhere, so customers recognize legitimate messages and spot anomalies quickly.

- Review communication templates through a security lens. Templates should be audited regularly for data exposure, not just legal accuracy or brand tone.

Challenge 4: Leveraging Technology Without Losing Human Leadership

Modern communication platforms make it easy to move fast. Messages can be scheduled, segmented, and distributed at scale. But speed can blur intent. When updates feel automated or overly polished, customers sense distance, not direction, especially in moments tied to financial compliance communication or regulatory change.

How to fix it

Use technology as infrastructure, not authority. Let it support timing, consistency, and financial document risk mitigation. Keep judgment, tone, and accountability with leadership. When executives remain visible and deliberate about what is communicated and why, tools reinforce trust instead of eroding it.

Challenge 5: Measuring Communication Impact and ROI

One of the most underestimated financial services communication challenges is the assumption that distribution equals effectiveness. In financial services communications, the cost of a blind spot is not abstract. It shows up as compliance friction, delayed execution, and erosion of confidence. Leaders are often left with a familiar question: Was the message unclear, or was it simply unheard? Without evidence, the answer remains speculative.

How to fix it

Effective communication must be observable. That means moving beyond open rates and attendance counts. Start by defining what communication is meant to influence. A decision. A behavior. A risk posture. Then measure against that intent.

Use a mix of tools, not a single lens:

- Engagement metrics are tied to critical content, not volume.

- Short, targeted pulse surveys that test understanding, not satisfaction.

- Qualitative feedback loops from frontline leaders who see how messages land in practice.

- Periodic reviews that connect communication outcomes to operational or regulatory results.

When these signals are examined together, patterns emerge. Gaps surface, which helps in refining before misalignment reaches clients, regulators, or investors. Over time, financial services communication evolves from a supporting function into a discipline with measurable return, one that informs leadership decisions rather than trailing behind them.

Challenge 6: Meeting Evolving Customer Expectations

Customer expectations in financial services rarely shift all at once. They drift. Quietly. A client starts on mobile, pauses, calls a relationship manager, and then follows up by email. When those touchpoints feel disconnected, confidence weakens. Not dramatically at first. But enough to matter.

What customers are really reacting to is not channel quality, but coherence. When product language, service responses, and marketing promises diverge, loyalty erodes. Not because the institution failed technically, but because it sounded unsure of itself.

Where misalignment typically appears

| Customer Moment | What Customers Expect | Where Communication Breaks Down |

| Product discovery | Clear value and relevance | Marketing promises exceed delivery |

| Onboarding | Guidance and reassurance | Overloaded instructions, mixed tone |

| Service interactions | Context and continuity | Repetition, channel resets |

| Issue resolution | Accountability and clarity | Vague updates or delayed follow-up |

How organizations can fix it

- Treat customer communication as a single system and not a web of departments, as it only creates confusion rather than simplifying it.

- Line up your marketing, service, and product teams around shared language, decision rules, and escalation paths.

- Map the customer journey from the client’s perspective, not the org chart.

- Personalization should sharpen relevance, not fracture identity. When messages sound consistent across moments, customers feel understood, and institutions earn trust without asking for it.

Faith-Based Financial Group Simplifies Customer Communication Processes with Cincom Eloquence

CCM: The Enabler Behind Consistent, Compliant Communication

After unpacking these challenges, a pattern becomes hard to ignore. Most breakdowns are not caused by poor intent or weak messaging. They stem from fragmentation. Messages live in too many places. Ownership is unclear. Context is lost between teams, channels, and moments. This is where customer communication management software earns its place, not as a shortcut, but as structural support.

When used well, customer communication management software does not replace leadership judgment. It reinforces it. It creates the conditions for financial compliance communication to remain clear under pressure, consistent at scale, and credible in the moments that matter most. At that point, communication stops being reactive. It becomes a governed, strategic capability.

Final Thoughts

After walking through these eight challenges, here’s the lens to hold on to. Communication in financial services isn’t just a process; it is a strategic ecosystem. Each email, statement, or client touchpoint carries weight. Missteps can ripple from internal confusion to lost client trust.

Technology, like Customer Communication Management software, doesn’t replace judgment. It amplifies it. It organizes complexity, tracks engagement, and ensures regulatory alignment, including GDPR and other frameworks. But tools alone are not enough. Leaders must still shape narratives, interpret signals, and decide what matters most.

The takeaway is clear. Effective financial communications live at the intersection of precision, insight, and human judgment. Get the architecture right, measure what resonates, and empower teams to act on clarity. That is how financial institutions do not just meet expectations; they anticipate them.

Want your financial communications to be simple, secure, and spot-on? Check out Cincom Eloquence today.

FAQs

1. What role does financial services communications play in building client trust?

Financial services communications are more than updates or alerts—they shape client perception and confidence. Clear, timely, and accurate messaging reassures clients that their financial information is handled responsibly.

2. How can firms address common financial services communication challenges effectively?

By identifying bottlenecks, aligning teams, and leveraging modern platforms, organizations can reduce miscommunication and ensure their messaging resonates with both employees and clients.

3. How does financial compliance communication help prevent regulatory issues?

Financial compliance communication ensures all internal and external messages meet legal and regulatory requirements, reducing the risk of penalties and reinforcing trust with stakeholders.

4. Why is financial document risk mitigation critical in customer communications?

Financial document risk mitigation protects sensitive client information, prevents data breaches, and ensures that every communication, from statements to alerts, adheres to security and compliance standards.