Introduction: The Regulatory Landscape in 2026

In 2026, the primary point of failure for financial institutions is the unmonitored communication channel. As regulators trade manual audits for high-speed, automated oversight tools, banks that still function with an outdated communication system find themselves in a dangerous spot. The reality is that old systems simply weren’t built to handle the real-time data transparency that today’s laws demand.

Data reported by Fenergo shows that global fines for non-compliance rose sharply in the first half of 2025, increasing by approximately 417% over the same period. Additionally, the SEC has officially stopped giving warnings for “shadow IT.” As noted by SteelEye, cumulative fines for unmonitored chats have now topped $2 billion.

This aggressive enforcement highlights a critical reality: your communication system is either a defensive asset or a massive liability. To help you evaluate your own infrastructure, here are the 5 compliance risks banks face with outdated communication systems.

Compliance Risk #1: Inadequate Record-Keeping and Data Retrieval

In 2026, saying “I can’t find that file” no longer sounds like an operational issue. In regulatory terms, it signals a compliance failure. Legacy systems were designed primarily to store information, not to retrieve it quickly enough to meet today’s regulatory expectations.

The Issue: Data Silos and Retrieval Latency

Legacy systems typically store information in silos. Your phone logs, emails, and internal chats often live on separate servers with different data formats. When an auditor asks for the full “conversation trail” of a specific transaction, compliance teams have to manually stitch together data from three or four different sources.

This creates retrieval latency. If your system relies on old “batch processing” or unindexed archives, finding a single message can take days. In a modern audit, that’s a red flag.

The Compliance Link: SEC Rule 17a-4 and FINRA Rule 4511

- SEC Rule 17a-4 focuses on record integrity. It requires firms to store business records in a non-rewriteable and non-erasable format, commonly referred to as WORM, so that records cannot be altered after creation.

- FINRA Rule 4511 addresses record retention. It requires firms to preserve business records for a minimum of six years and to keep them readily accessible for regulatory examination when needed.

The Outcome

- Authorities now fine banks for “latency,” the time it takes to retrieve records, which can be days instead of minutes.

- Manual data mining drains hundreds of staff hours.

- Missing or slow logs are increasingly viewed by auditors as evidence of intentional concealment.

Safeguard Your Client Relationships: Mitigate Risks with a Modern Customer Communication Compliance Solution

Compliance Risk #2: Security Gaps and Data Breaches

Old communication stacks are essentially a standing invitation for a breach. Most banks are still running tools that haven’t had a major security overhaul in five years. That’s an eternity in cyber terms. These systems were built for a different world, and today, they are simply failing to keep up with how fast threats move.

The Issue: Outdated Encryption and the MFA Gap

Outdated communication systems rely on obsolete protocols like TLS 1.0. These systems are typically “monolithic,” making them incredibly hard to update without breaking the entire setup. This leaves two major holes:

- The “One Password” Risk: Most of these systems don’t have built-in Multi-Factor Authentication (MFA). If a hacker gets an employee’s password, it’s game over. There is no second wall to stop them.

- Open-Air Data: If your system doesn’t support modern end-to-end encryption (E2EE), your data is effectively being sent as plain text. Anyone who manages to get between your server and your employee’s device can read everything you’re sending.

The Compliance link: GLBA and the FTC Rule

The law doesn’t care if your budget is tight or your systems are old. The Gramm-Leach-Bliley Act (GLBA) and the FTC Safeguards Rule are very clear:

- Prove your encryption: You have to show that customer info is scrambled both while it’s moving and while it’s sitting on a drive.

- Lock down access: You are legally required to use MFA and “least-privilege” access. If your tech makes it easy for an unauthorized person to see a client’s file, you are already out of compliance.

The Outcome

- Fixing a breach costs more than a new system. You’ll be paying for forensic investigators and lawyers for months.

- Customers don’t stay at banks that lose their data. They’ll move their money to the competitor who has a modern, secure setup before you even finish your apology letter.

Compliance Risk #3: Failure to Monitor “Off-Channel” Communications

If your official bank communication tools are difficult to use, your employees will move to personal apps to get work done. For a bank, this creates a “black hole” where business is being conducted entirely outside your control and visibility.

The Issue: The “Shadow IT” Gap

Legacy systems have no native way to capture, archive, or monitor mobile messaging.

- The Supervision Failure: When employees discuss deals or client advice on unmonitored apps, you aren’t just missing records; you are failing your basic duty to supervise. Regulators now view this as a systemic management failure, not just a technical glitch.

- The Seniority Issue: Investigations show that these breaches happen at every level. In many recent cases, the heaviest fines were triggered because senior directors and partners were the ones leading the move to off-channel chats.

The Rules: The SEC “Zero-Tolerance” Standard

The SEC has made it clear that record-keeping rules apply to the content of the message, not the device it was sent on.

- The Capture Mandate: If it’s business-related, it must be recorded. Period.

- Individual Accountability: In 2025 and 2026, regulators began holding individual executives personally liable for conducting business on unapproved channels, often resulting in personal fines or suspensions.

The Outcome

- As of early 2025, over 100 firms have been fined a combined $2.2 billion specifically for off-channel communication failures.

- While enforcement began with global giants, the focus has shifted. Regional banks and smaller investment firms are now being audited and fined for failing to monitor employee chat apps.

- Unlike typical settlements where a firm “neither admits nor denies” wrongdoing, the SEC often requires a public admission of record-keeping failures, causing immediate and lasting reputational damage.

Compliance Risk #4: The Reporting Bottleneck: Delayed Disclosures

Back in the day, banks had weeks to pull together reports for regulators. In 2026, that window has vanished. Today, oversight bodies expect data in days, sometimes even hours. Systems built for a slower era simply can’t keep up with this pace.

The Problem: Stuck in the “Batch” Era

Most legacy software relies on “batch processing,” meaning it only updates itself overnight. If a regulator asks for a live look at your risk exposure, your system is essentially giving them yesterday’s news.

- The Spreadsheet Trap: Because these old tools don’t have modern reporting features, staff often end up exporting data into spreadsheets to fix it manually. This isn’t just slow; it’s dangerous. A single typo in a manual report can lead to a massive fine for “inaccurate filing.”

- Missing the Moment: Many new laws require “event-driven” disclosures. If a specific incident occurs, you have to report it almost immediately. If your system is lagging, you’ve already missed the deadline before you even knew it existed.

The Compliance Link: Moving Toward Live Data

Regulators have stopped asking for quarterly stacks of paper. They want a steady stream of verified information.

- The Speed Requirement: Rules like BCBS 239 demand that banks aggregate risk data quickly and accurately. If it takes your team several days to see what’s happening across your branches, you are failing the “timely” test.

- The API Shift: More and more, authorities want to plug their own tools directly into yours to see data in real-time. Old systems weren’t built with these “plug-and-play” connections (APIs), leaving the bank isolated from the modern regulatory loop.

The Outcome

- Late filing is the easiest mistake to catch. If the data isn’t there on time, the penalty is often triggered automatically.

- If a regulator realizes you can’t report data quickly, they lose confidence in your management. They may force the bank to hold more cash in reserve, which stunts your growth and limits your lending power.

- Repeated delays often lead to “enhanced supervision.” This means regulators might start watching your daily operations much more closely, which is both intrusive and a massive drain on your resources.

Compliance Risk #5: Blind Spots: Surveillance and the Paper Trail

Catching a rule-breaker weeks after the fact isn’t really compliance—it’s just a post-mortem. Regulators expect banks to see red flags as they happen. If your system is still just recording events for a human to review later, you are essentially operating with a massive blind spot.

The Problem: You Can’t Watch What You Can’t See

Most legacy setups are “passive.” They gather data, stick it in a log, and wait. But with the sheer volume of digital chats and trades happening every second, no human team can possibly keep up.

- The Monitoring Gap: Without real-time flagging, things like internal fraud or money laundering can sit in your system for months. By the time a reviewer actually finds the problem, the money is gone, and the damage to the bank’s reputation is permanent.

- The Broken Audit Trail: This is where the outdated communication system really fails. Many of these tools don’t have “version control.” If someone changes a document or deletes a message, there is no record of what the original said or who touched it. Without a timestamped, unchangeable history, you can’t prove the truth during an investigation. It’s your word against the data, and regulators rarely take the bank’s word.

The Compliance Link: AML and the New Standard of Proof

The rules have shifted. It’s no longer enough to just have records; you have to prove those records haven’t been tampered with.

- Active Supervision: Anti-Money Laundering (AML) and Know Your Customer (KYC) laws now require “active” oversight. Regulators want to see that your system can spot and stop a suspicious pattern before it leaves the building.

- Record Integrity: Financial laws demand a “tamper-proof” chain of custody. If your system allows files to be modified without leaving a digital fingerprint, you are failing the basic requirements of modern record-keeping.

The Outcome

- If a regulator finds a gap in your audit trail, they won’t just fine you for the mistake. They’ll likely charge the bank with a “systemic failure of internal controls.” That is a much heavier accusation that often comes with mandatory (and expensive) outside monitors.

- When an audit hits, a lack of version history turns a simple question into a month-long project. You end up paying experts to reconstruct a timeline that a modern system would have handed you in seconds.

- Operating without real-time eyes on your data means you only find out about a crisis when the regulator knocks on the door. At that point, you aren’t managing the risk; you’re just managing the fallout.

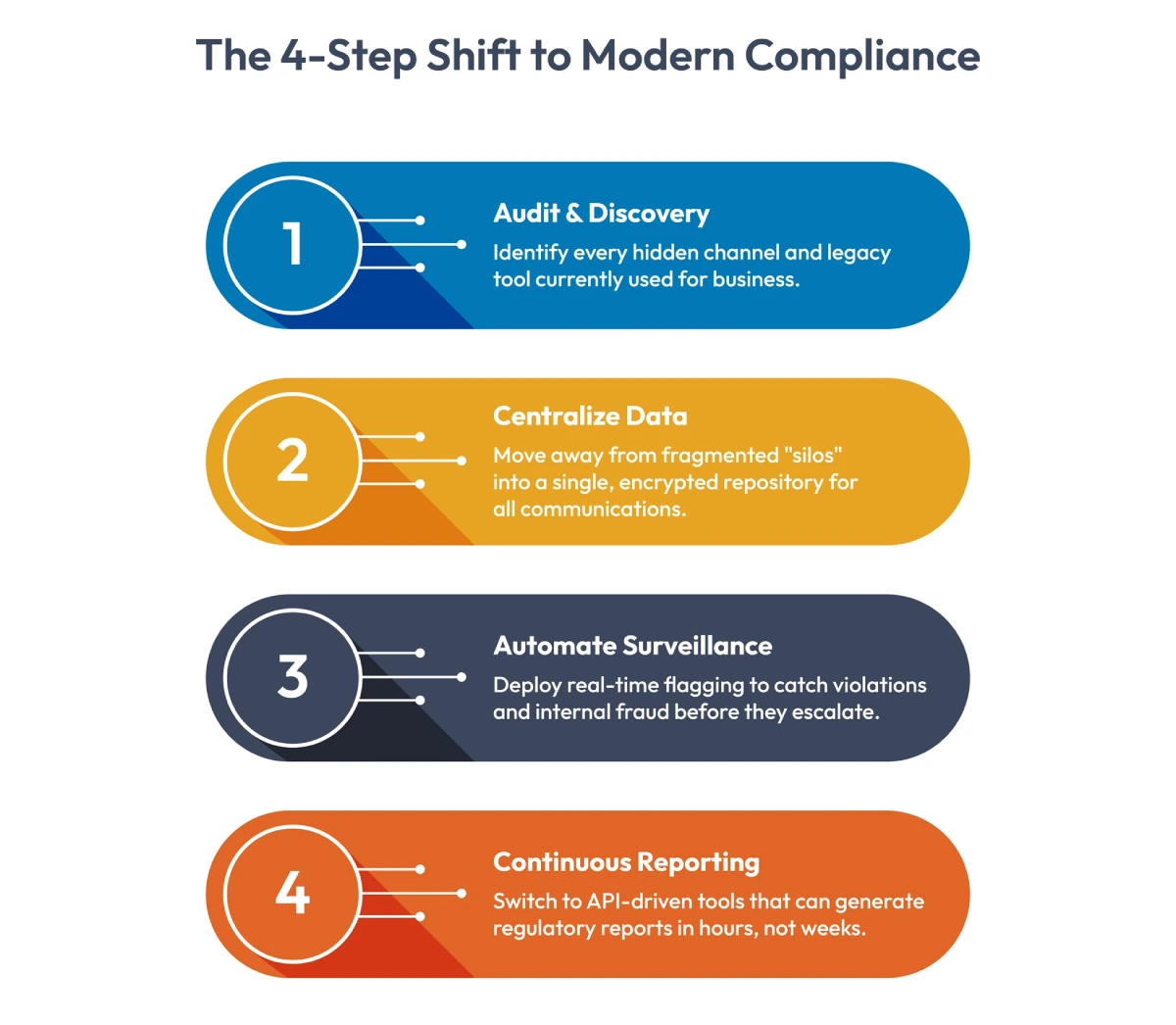

The Roadmap to Compliant Modernization

Transitioning away from outdated communication systems is the only way to maintain a robust framework for governance, risk, and compliance. Modernizing your stack ensures that you stay proactive rather than reactive.

By replacing outdated communication systems, institutions can finally align their daily operations with the strict demands of governance, risk, and compliance. This shift is no longer a luxury but a fundamental requirement for effective compliance and risk management in banking.

How a Web-Based Document Solution Boosted Compliance and Efficiency for a Workers’ Compensation Insurer

Conclusion

In 2026, a bank’s survival depends on its ability to turn data into a defensive shield. As the vault is replaced by the digital channel, the gap between being secure and being sanctioned is measured in seconds.

Modern compliance and risk management in banking require more than just better policies; they need a complete technical overhaul. By integrating advanced customer communication management software, your institution moves from the era of “shadow IT” and manual audits into a future of total visibility.

This shift transforms your communication system from a dangerous liability into a strategic asset, ensuring that every interaction is archived, every risk is flagged, and every regulatory request is met with instant, accurate data.

Stop gambling with outdated systems. Turn your compliance burden into a competitive edge today with Cincom Eloquence.

FAQs

1. Can encryption alone fix the compliance risks of mobile messaging?

No. Encryption secures data from hackers, but compliance and risk management in banking also require “discoverability.” You must be able to archive and retrieve messages for audits, not just hide them from outside eyes.

2. How do outdated communication systems impact a bank’s lending power?

If outdated communication systems prevent clear reporting, regulators may label the bank “high risk.” This often requires the bank to hold more cash in reserve, which directly reduces the money available for loans and growth.

3. What is the main cost of a manual audit trail?

The biggest drain is “forensic latency.” When an audit hits, teams spend months manually piecing together timelines. This leads to massive legal and consulting fees that modern customer communication management software avoids with one click.

4. Why is real-time surveillance better than weekend reviews?

Manual reviews only find problems after the damage is done. Real-time tools catch compliance risks like internal fraud or unauthorized data sharing as they happen, stopping the threat before the money or data leaves the building.

5. Is version control a legal requirement for banks in 2026?

Yes. Regulators now demand a tamper-proof history of documents. If your system cannot show who changed a file and when, you are failing the basic standards of compliance and risk management in banking.