B2B selling is a high-stakes game and relying on assumptions is the fastest way to lose revenue. Deals stall, pipelines underperform, and opportunities slip away when sales teams trust instincts instead of data.

Think about it: your team invests weeks chasing a prospect with the perfect pitch deck and a polished demo, only to discover the buyer wanted something simpler, faster, and more budget-friendly. The result? A lost deal, a frustrated customer, and wasted resources.

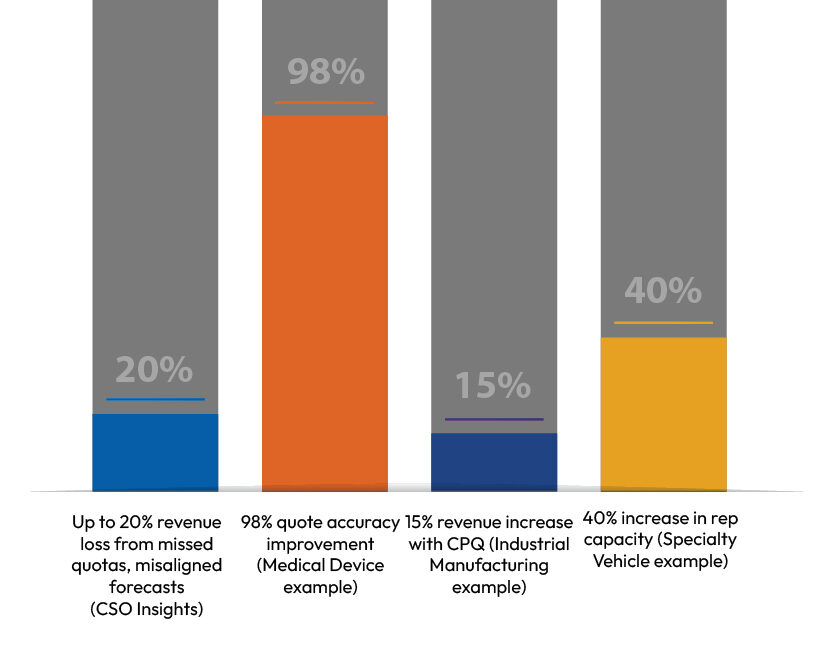

This is the reality for many organizations. In fact, studies show that misaligned sales strategies and inaccurate forecasts can drain up to 20% of annual revenue, a cost no business can afford to ignore.

The solution to this problem is sales insights. With real-time, data-driven intelligence, your team knows exactly who to approach, what to offer, and when to act.

In this blog, we’ll uncover why relying on assumptions is so costly in B2B sales and how sales insights turn missed chances into closed deals.

The True Price of Guesswork in B2B Sales

Operating without data-driven selling insights in B2B sales leads to inefficiencies that go far beyond missed quotas. Here’s what guesswork is really costing your business:

- Low Conversion Rates: Reps waste time chasing poor-fit leads, leading to fewer closed deals.

- Inaccurate Forecasts: Without reliable data, pipeline predictions fall short, undermining planning and resource allocation.

- Wasted Effort: Sales teams waste hours on deals that never had a chance to close, draining productivity.

- Missed Revenue: A blind eye to buyer’s behavior results in lost opportunities for upselling and cross-selling.

- Operational Inefficiencies: Isolated tools and manual workflows slow down quoting, approvals, and deal development.

- Sales Team Burnout: Frequent failure through avoidable mistakes leads to frustration, high turnover, and low confidence.

- Strategic Blind Spots: Leadership struggles to make informed decisions when data is fragmented or does not exist.

According to McKinsey, companies using data-driven sales approaches see up to 85% more growth than those that rely on intuition.

Sales Automation with CPQ: A Playbook for Scaling Revenue Operations

Download the whitepaper now to start transforming your sales enablement approach.

How Do Data Blindspots Disable Revenue?

What are Data Blindspots?

Data blindspots refer to the inability to see into key areas such as buyer behavior, deal advancement, and changing market conditions. They occur when data is dispersed across disconnected tools and platforms.

Sales Impact

- Reps fail to recognize when deals become cold or know when to reach out to prospects again.

- Inability to customize outreach due to lacking insights into buyer preferences, engagement history, or price expectations.

- Follow-ups are inappropriately timed, resulting in lost opportunities.

Leadership Impact

- Forecasts are made from incomplete or outdated data.

- Poor pipeline visibility makes it difficult to allocate resources or set realistic goals.

- Strategic decisions turn reactive rather than proactive.

How Siloed Systems Make It Worse

- CRM, marketing, and quoting tools operate in isolation.

- Data doesn’t flow freely between teams or tools.

- There are delays, duplication, and mistakes caused by manual workarounds.

The Revenue Cost

- Lost follow-ups and generic outreach at reduced conversion rates.

- Inaccurate pricing and wrong timing result in missed deals.

These problems collectively cause a lot of revenue leakage.

The Solution

Implementing integrated platforms such as CPQ centralizes data, provides sales insights in real-time, and empowers teams to quickly close blind spots and drive long-term revenue growth.

Sales Insights vs. Intuition: A Data Comparison

Sales success often relies on a rep’s instinct—but in today’s competitive environment, experience alone isn’t enough. Here’s how intuition compares to data-driven selling insights:

| Selling with Intuition | Selling with Data-Driven Insights |

| Relies on gut feeling and personal judgment | Informed by real-time buyer intent signals |

| Decisions based on past wins or anecdotal evidence | Backed by win/loss analysis across segments and cycles |

| Risks outdated assumptions about customer behavior | Reflects up-to-date market trends and account engagement |

| Inconsistent performance across deals and reps | Consistent execution with AI-powered recommendations |

| Difficult to scale across teams | Easy to replicate success by sharing proven data patterns |

Intuition draws from valuable experience—but when combined with actionable insights, it becomes a competitive advantage.

Key Metrics That Transform Sales Strategies

To develop a high-performance sales strategy, data-driven selling is not optional. The following six metrics provide insightful details of performance and potential adjustments:

- Lead-to-Close Ratio: Indicates how successfully your team closes prospects. A low ratio indicates a need to improve qualifications or messaging.

- Length of Sales Cycle: Monitors the duration to close a sale. Longer cycles can be an indicator of buyer’s journey friction or the necessity for improved automation.

- Win/Loss Reasons: Determining the reasons behind winning or losing deals refines product positioning, handling objections, and sales scripts.

- Deal Velocity: Monitors how quickly opportunities move through the pipeline. Increased speed tends to create more revenue turnover.

- Customer Lifetime Value (CLTV): Helps focus on high-value customers and create customized retention efforts.

- Buyer Engagement: Clicks, downloads, and email opens indicate which leads are warm and where they are in the decision-making process.

How These Metrics Help

- Prioritize high-intent leads based on engagement metrics.

- Coach sales reps based on win/loss insights and conversion rates.

- Adjust pricing, demos, or messaging based on cycle bottlenecks and lost deals.

Implementing Sales Intelligence Tools

Sales intelligence solutions enable organizations to derive key sales insights, automate processes, and enhance decision-making throughout the sales cycle. They come in five main categories:

- CRM Systems (e.g., Salesforce, HubSpot): Consolidate customer information and monitor interactions to facilitate individualized, data-driven selling

- CPQ Solutions (e.g., Cincom CPQ): Provide guided selling, automating complex pricing, and generating accurate quotes instantly.

- Sales Enablement Platforms (e.g., Highspot, Showpad): Provide reps with content and training to enhance buyer engagement and conversion.

- Conversational Intelligence Tools (e.g., Gong, Chorus): Analyze sales calls to discover deal risks, coaching opportunities, and customer sentiment.

- BI/Analytics Platforms (e.g., Power BI, Tableau): Visualize performance metrics and trends to inform sales strategies and decisions.

The Implementation Journey

- Integrate data sources: Integrate CRM, CPQ, enablement, and analytics solutions for a unified view. This supports actionable sales insights.

- Ensure rep adoption: Deliver hands-on training, map tools to daily activities, and highlight quick wins to drive usage.

- Sync with sales operations: Align with ops teams to establish KPIs, tailor dashboards, and automate reporting.

Discover how Helmer Scientific cut quote time by 88% and scaled operations without adding headcount.

Impact of Data-Driven Selling

| Impact Area | Description |

| Increased Revenue | Leverage buyer insights and historical data to optimize upselling and cross-selling—leading to higher average deal sizes and faster revenue growth. |

| Improved Quote Accuracy | Reduce errors from manual inputs and outdated tools. Accurate configurations ensure compliance, protect margins, and build customer trust. |

| Faster Sales Cycles | Automate proposal generation and eliminate bottlenecks. Sales teams can respond to opportunities in minutes instead of days. |

| Higher Rep Productivity | Guided selling and AI-driven recommendations empower reps to work more independently, boosting capacity and reducing reliance on technical teams. |

| Consistent Customer Experience | Deliver professional, on-brand proposals consistently across teams, regions, and sales channels. |

| Smarter Decision-Making | Real-time analytics reveal what’s working, what’s not, and where to improve—enabling continuous optimization. |

| Stronger Forecasting & Pipeline Health | Better data means more accurate forecasts, healthier pipelines, and more strategic resource planning. |

Conclusion

Guesswork is quietly draining revenue, time, and customer trust from B2B sales teams. Without clear sales insights, even the most excellent sales strategies can fall short, resulting in lost business and degrading performance.

Sales insights transform that uncertainty into strategic strength. With the correct data, teams can sell more quickly, quote with greater precision, and develop stronger customer relationships based on actual needs—not assumptions. It’s the secret to beating the competition, adjusting to buyer patterns, and closing sales with confidence.

Now it’s your turn to take a close look at your sales process and identify the gaps. If guesswork is costing you deals and revenue, it’s high time you invest in sales intelligence tools.

FAQs

1- How do sales insights differ from traditional reporting tools?

While traditional reports show what has happened (e.g., monthly sales totals), sales insights reveal what’s happening now and what’s likely to happen next. They provide real-time data on buyer behavior, deal progression, and engagement—allowing sales teams to act quickly and strategically rather than reactively.

2- What’s the ROI of investing in sales intelligence tools?

Companies using sales intelligence tools typically experience shorter sales cycles, higher closing rates, and improved forecasting accuracy. According to McKinsey, data-driven sales teams see up to 85% faster growth compared to those relying on intuition—leading to a high and measurable ROI.

3- How can sales insights improve account-based selling strategies?

Sales insights help reps tailor outreach by identifying key decision-makers, tracking engagement across stakeholders, and understanding account readiness. This targeted approach increases relevance and significantly boosts the effectiveness of account-based selling efforts.

4- What are some early indicators that your sales process lacks data-driven insights?

Red flags include:

- Low rep productivity

- Inconsistent forecasting

- High lead attrition rates

- Long, unpredictable sales cycles

- Difficulty identifying why deals are won or lost

These are all signs that better data-driven selling strategies and tools are needed.

5- Are sales insights only useful for new customer acquisition?

Not at all. Sales insights are equally valuable for upselling, cross-selling, and retention. They help reps understand customer needs over time, identify usage patterns, and respond to shifting expectations—creating more value throughout the customer lifecycle.