Insurance customers today expect more than just quick quotes and prompt claims. They want the freedom to start a policy on their phone, ask a question over live chat, and finish the process with an agent, without repeating their details. Delivering this kind of seamless, connected experience is what omnichannel customer experience (CX) is all about.

In this article, we’ll explain what omnichannel CX means, how it differs from multichannel and cross-channel approaches, and why it’s becoming a must-have for insurers.

What Is Omnichannel Customer Experience?

Let’s start with the basics.

Omnichannel means delivering a consistent, connected experience across every customer touchpoint—whether it’s your website, mobile app, call center, email, or in-person meeting. Every interaction feels like part of the same conversation, no matter where it happens.

Customer experience (CX) is how your customers perceive every interaction with your brand. In insurance, that could be anything from getting a quote to filing a claim to renewing a policy.

Omnichannel customer experience combines these ideas: it’s the ability to offer seamless, personalized interactions across all channels, so customers don’t have to repeat themselves or start from scratch when they switch from one touchpoint to another.

| Approach | What It Means | Customer Experience Impact |

| Single-Channel | All interactions happen in one place (e.g., phone only). | Limited convenience, no flexibility. |

| Multichannel | Multiple channels are available, but they operate separately. | Customers can choose a channel, but switching between them is frustrating. |

| Cross-Channel | Channels are partially connected; some information carries over. | Better than multichannel, but still gaps in context. |

| Omnichannel | All channels are integrated; context and data flow seamlessly. | Smooth, personalized, and consistent experience across every touchpoint. |

For insurers, omnichannel isn’t just a buzzword—it’s the foundation of a frictionless customer journey.

Omnichannel Customer Journey Mapping

If omnichannel CX is the goal, customer journey mapping is the blueprint.

An omnichannel customer journey map is a visual representation of every step your customer takes when interacting with your company, from the first website visit to the final claim settlement. It shows not only the steps themselves but also the channels used, the emotions felt, and the information exchanged at each stage.

For insurers, journey mapping helps answer key questions:

- Where do customers switch channels—and why?

- Are handoffs between channels smooth, or do they create frustration?

- Which points in the journey risk losing the customer?

- Where can personalization make the biggest impact?

Example:

A policyholder might:

- Compare quotes on your website.

- Chat with an agent via your mobile app.

- Sign documents sent by email.

- Receive a confirmation SMS.

If each step feels connected and relevant—no repeated questions, no missing data—that’s an effective omnichannel journey. If not, the map will reveal the gaps that need closing.

With the right omnichannel customer journey map, insurers can spot pain points, prioritize improvements, and design experiences that feel effortless to the customer.

Omnichannel Communication at Scale: A Guide for CX Leaders

Build a smarter, more resilient omnichannel communication system.

Why Omnichannel Customer Experience Matters for Insurers

Insurance is a promise. Customers trust you to be there when it matters most, during moments of uncertainty, loss, or major life change. However, in today’s world, that promise isn’t judged only by your coverage terms; it’s judged by how quickly, seamlessly, and personally you deliver on it across every channel. Here are the reasons why omnichannel customer experience management matters the most for insurers:

Rising Customer Expectations

Policyholders no longer compare their service experience only to other insurers. They compare it to Amazon’s instant updates, Apple’s seamless device integration, and their bank’s personalized alerts.

This means:

- Faster response times are expected—a customer who can track a pizza in real time wants the same transparency for a claim.

- Consistency is non-negotiable—if they update their address in the mobile app, they expect your call center to already have it.

Omnichannel customer experience management ensures that no matter where customers engage, whether on a website, by phone, via chat, or in person, they feel like they’re picking up exactly where they left off.

Increased Competition from Insurtech

Digital-first insurers have built their businesses around modern CX. They offer instant quotes, app-based claims submission, and proactive alerts for policy renewals.

For traditional insurers, omnichannel is the equalizer:

- Compete on convenience without losing human expertise that insurtech can’t always match.

- Blend digital efficiency with personal reassurance, particularly in complex claims.

Without this, even loyal customers may drift toward providers that make their lives easier.

Operational Efficiency and Cost Reduction

Disconnected systems cause bottlenecks, duplicated work, and errors. These inefficiencies are most damaging during claims, the “moment of truth” for insurers.

Scenario:

A customer files a claim after a severe hailstorm. With an omnichannel setup:

- Photos and details submitted via the app are instantly available to claims adjusters.

- The customer can follow up by phone, and the agent sees the full history—no need to repeat details.

- Adjusters can send status updates via email or SMS, triggered automatically by workflow milestones.

The result:

- Faster claim settlement (lowering handling costs).

- Reduced call volumes (fewer “just checking in” calls).

- Higher accuracy (less manual re-entry).

Multiply this efficiency across underwriting, policy servicing, and renewals, and the cost savings are substantial.

Higher Retention and Loyalty

When customers experience seamless service, especially during stressful or uncertain events, they remember it.

Omnichannel customer experience management allows you to:

- Be proactive (e.g., sending safety tips before a hurricane).

- Be consistent (every department sees the same information).

- Be personal (recognizing their history and preferences).

Retention isn’t just about avoiding churn; it’s about creating moments that make customers want to stay. And the math is simple: retaining a customer is far less expensive than acquiring a new one.

Better Cross-Sell and Upsell Opportunities

In insurance, timing and context are everything. A customer might be open to adding coverage during certain life events, like buying a new home, having a child, or purchasing a vehicle, but only if the offer feels relevant and well-timed.

Omnichannel gives you a complete, real-time view of the customer’s journey, so you can:

- Spot natural upgrade moments, like offering life insurance when a customer adds dependent coverage.

- Deliver offers in the channel they use most, whether that’s an app notification, email, or a quick agent call.

- Personalize messaging with data you already have, such as policy history, location, and recent inquiries.

Measurable Improvements in Key Metrics

Omnichannel customer experience directly impacts performance indicators such as:

- First-contact resolution rate: Issues are solved faster when all agents share the same context.

- Average claim processing time: Integrated workflows cut days off settlement timelines.

- Customer satisfaction (CSAT) and Net Promoter Score (NPS): Customers reward consistency with higher satisfaction and advocacy.

- Customer lifetime value (CLV): Better retention + relevant upselling increases revenue per customer.

In a market where customers have more choices than ever, an omnichannel customer experience is no longer optional. It’s the bridge between customer expectations and insurer capabilities, delivering the right service, on the right channel, at the right time.

Omnichannel in Action: Key Insurance Use Cases

Omnichannel customer experience in insurance is about more than being available on multiple platforms; it’s about ensuring every interaction is connected, consistent, and context-aware, no matter where it begins or ends. These are the high-impact areas where insurers can realize measurable gains.

Onboarding & Policy Purchase

A streamlined, omnichannel onboarding journey ensures customers can start and finish policy purchases across any combination of channels without friction.

Capabilities Involved:

- Centralized Customer Communications Management (CCM) system connected to all sales touchpoints (web, mobile app, branch, call center) to ensure consistent, trackable interactions.

- Real-time data syncing so partially completed applications can be resumed anywhere.

- Digital document submission and instant verification.

Value Delivered:

- Reduced application abandonment rates.

- Faster time-to-policy issuance.

- Improved first impressions that set the tone for long-term relationships.

Claims Processing

Claims are the defining moment in the customer relationship. Seamless omnichannel handling sets insurers apart.

Capabilities Involved:

- First Notice of Loss (FNOL) capture across all channels with real-time status updates.

- Self-service portals and mobile apps for uploading claim documents and photos.

- Integrated back-office systems to avoid duplicate data entry.

- Multi-channel notifications for each claim stage.

Value Delivered:

- Shorter claim cycle times.

- Lower operational costs through process standardization.

- Higher satisfaction by keeping customers informed at every step.

Customer Service & Support

Omnichannel service ensures every interaction is informed by the complete history of customer engagement.

Capabilities Involved:

- Unified contact center with voice, email, chat, and social media support in one interface.

- Seamless handoffs between digital self-service and live agents.

- Central knowledge repository to ensure consistent, accurate responses.

Value Delivered:

- Higher First Contact Resolution (FCR) rates.

- Shorter handling times by eliminating repetition.

- Consistent experience regardless of entry point.

Renewals & Retention Campaigns

A connected approach to renewals uses consistent messaging and channel choice to keep customers engaged.

Capabilities Involved:

- Automated multi-channel renewal reminders (SMS, email, in-app).

- Real-time policy data enabling quick adjustments before renewal.

- Integration between marketing platforms such as CRM, ERP, and more for targeted outreach.

Value Delivered:

- Increased renewal rates.

- Higher lifetime value through well-timed cross-sell offers.

- Reduced churn via early, proactive engagement.

Proactive Risk Communication

Insurers can strengthen customer trust by delivering timely, relevant updates before issues escalate.

Capabilities Involved:

- Integrated communication systems capable of sending alerts via multiple channels.

- Location-based messaging for weather events or local advisories.

- Educational content delivery in-app, via email, or on portals.

Value Delivered:

- Lower claims from preventable losses.

- Improved brand perception as a proactive partner.

- Stronger policyholder engagement outside of transactional events.

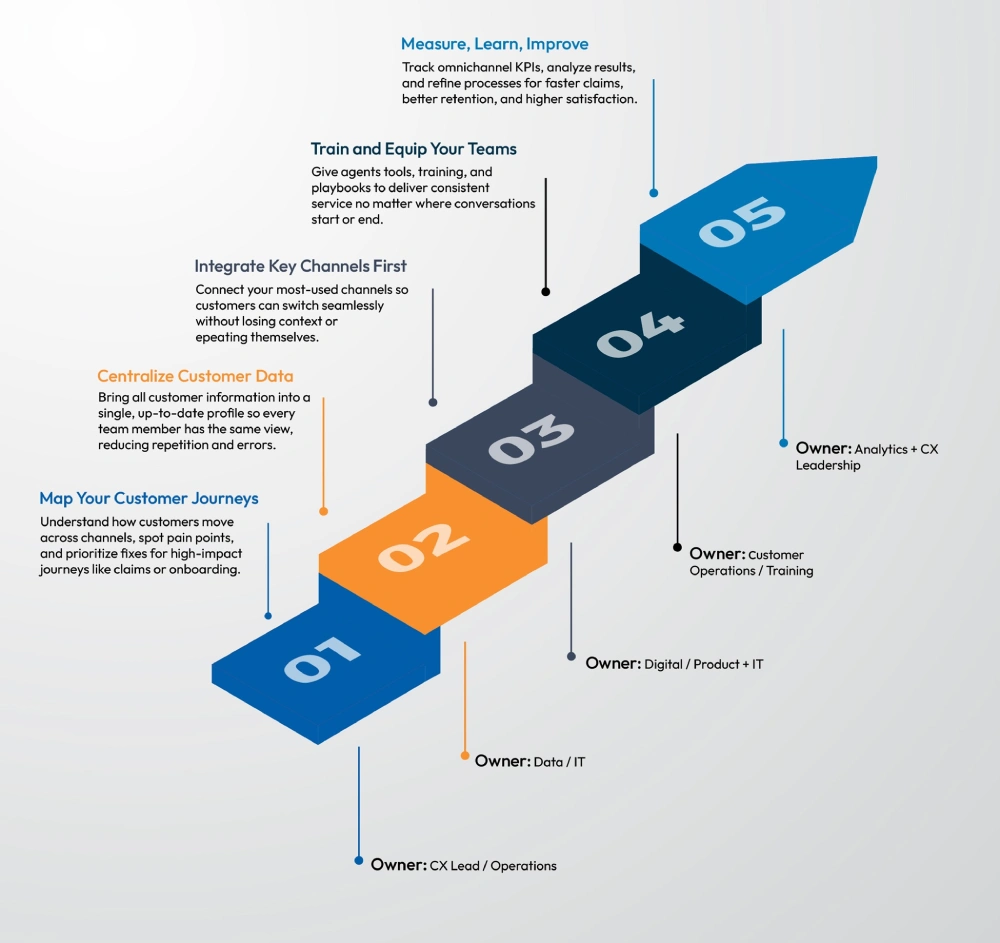

Quick Strategy to Implement Omnichannel in Insurance

You don’t have to overhaul your entire operation in one go. Start small, move fast, and keep the customer at the center. Here’s a practical roadmap:

For a detailed breakdown of what you should be doing to elevate customer experience, check out this: How to Elevate Omnichannel Customer Experience

Conclusion: Building the Omnichannel Insurance Experience Customers Expect

Insurance today is about more than just transactions. Customers want consistent, personalized experiences that meet them where they are, across every channel and every touchpoint. Relevant omnichannel customer experience solutions are all about delivering one seamless, connected journey that respects customer preferences and saves time.

Investing in integrated communication tools is critical for insurers who want to reduce friction, speed up service, and earn lasting trust. Cincom Eloquence stands out as the platform designed to centralize and personalize communications throughout the entire customer lifecycle—from onboarding to claims and renewals—ensuring every interaction feels relevant and effortless.

By choosing Cincom Eloquence, insurers equip their teams with powerful tools that simplify workflows, maintain compliance, and deliver exactly what customers expect: timely, meaningful communication.

The opportunity is in your hands: embrace omnichannel not as a checkbox, but as a mindset and strategy that puts the customer front and center. When you do, you don’t just improve service—you transform relationships and set a new standard for what insurance can be.

FAQs

1- What is omnichannel customer experience (CX)?

Omnichannel customer experience (CX) is the strategy of providing a seamless, connected, and consistent customer journey across all channels, including a company’s website, mobile app, call center, email, and in-person interactions. This ensures that a customer can switch between channels without having to repeat information or start over.

2- How is omnichannel different from multichannel?

Multichannel provides customers with multiple, separate channels that operate independently, leading to a disjointed experience when switching between them. In contrast, omni channel customer experience integrates all channels, so a customer’s journey and data flow seamlessly from one touchpoint to the next, creating a single, continuous conversation.

3- Why is omnichannel customer experience important for insurers?

Omnichannel customer experience management is crucial for insurers because it meets rising customer expectations for convenience and transparency, helps them compete with digital-first insurtech, and increases operational efficiency. It leads to higher customer retention, improved cross-sell opportunities, and measurable gains in key performance indicators like faster claim processing.

4- How can insurers use omnichannel during the claims process?

Insurers can use omnichannel customer experience solutions during the claims process by allowing customers to submit a claim (First Notice of Loss) via a mobile app and then instantly making that information available to claims adjusters and call center agents. Customers can then receive real-time status updates through their preferred channel, such as email or SMS, without having to call in for an update.

5- What is an omnichannel customer journey map?

An omnichannel customer journey map is a visual representation of every step a customer takes, from their first interaction to a final outcome. It helps insurers understand where customers switch channels, identify points of friction, and find opportunities to personalize and improve the experience.

6- What are the key benefits of an omnichannel strategy for an insurance company?

The main benefits of an omnichannel strategy for an insurance company include higher customer retention and loyalty, improved operational efficiency through reduced manual work, better cross-sell and upsell opportunities, and a significant boost in customer satisfaction (CSAT) and Net Promoter Score (NPS).

7- How can insurers get started with an omnichannel strategy?

Insurers can start by first mapping their customer journeys to identify pain points and prioritize high-impact areas like claims or onboarding. The next steps involve centralizing customer data, integrating their most-used channels, training their teams, and continuously measuring results to make ongoing improvements.