Every insurer today is involved in paper to digital transformation for offering convenience, transparency, and instant communication to their customers. Some have dedicated digital projects, while others are digitizing communications gradually across various initiatives. Either way, the shift is underway.

However, making this transformation work isn’t about switching off printers. It is more about understanding what to digitize first, who should be involved, and how to deliver valuable communication to customers.

Here’s a closer look at how insurers can create a smooth digital transition for paper to digital transformation.

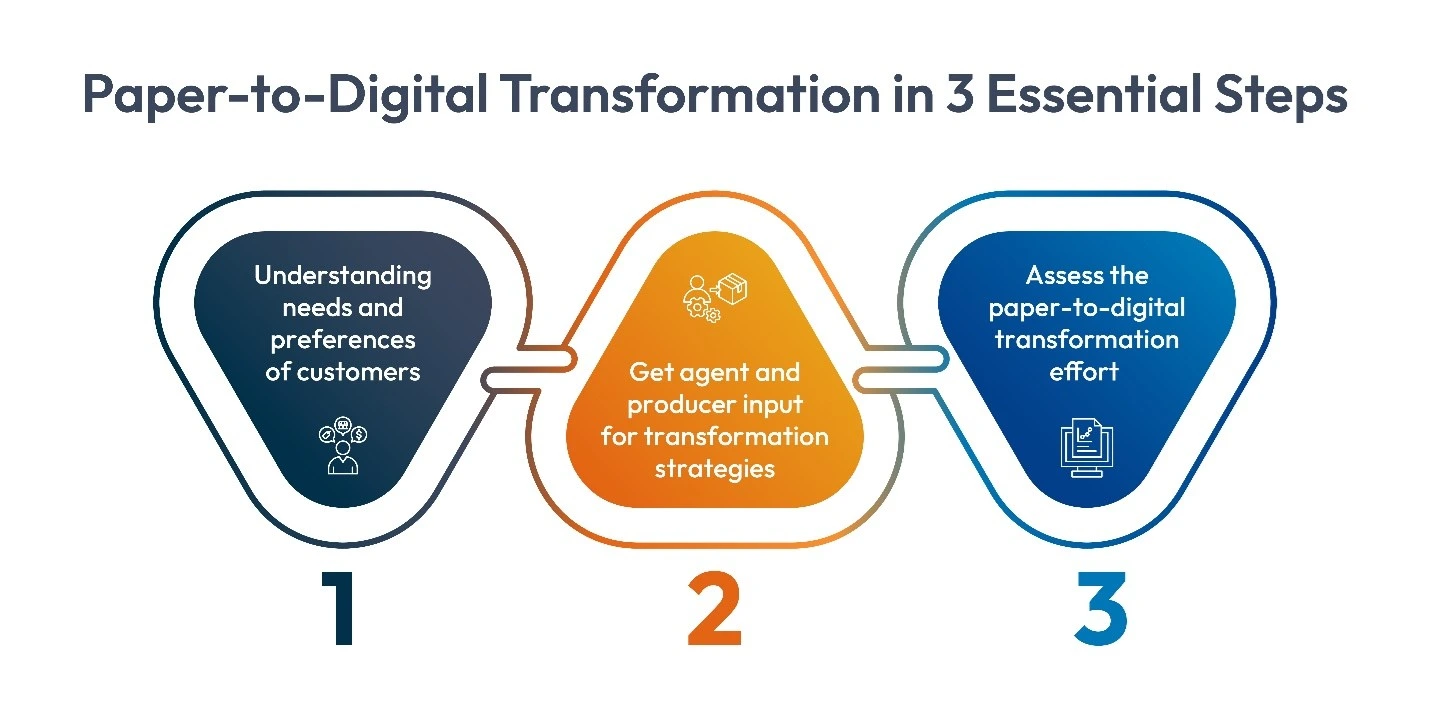

The 3 Essential Steps to Prioritize Paper-to-Digital Transformation

Step 1: Start with Customers

The success of any digital transformation for insurance communications starts with understanding what policyholders actually want.

Every customer interacts with their insurer differently. Some check updates through mobile apps. Others prefer an email with a PDF attachment. A few still rely on printed letters because they trust something tangible.

The best approach is to ask, not assume. Customer surveys, pilot programs, or simple feedback forms can reveal what kind of communication format each group prefers.

For instance, an insurer may build an online portal for downloading policies. However, after launch, they discover that very few customers log in. When asked why, most say they’d rather receive their documents directly in their inbox.

That’s a classic example of how assumptions can lead to misplaced investments. Understanding customer habits early helps design digital options that people actually use.

Also, it is important to note that not all communications should be made digitally. Certain documents, such as cancellation notices, disclosures, or specific notifications, might still require physical copies, so that organizations stay compliant.

Step 2: Get Agent and Producer Input About Transforming from Paper to Digital

Agents and producers are vital links between insurers and policyholders. Their feedback can help shape realistic strategies for digital customer communication rollout.

Agents and other producers should also have an important voice in the paper-to-digital transformation planning process. First, they talk to policyholders every day and have a good pulse on requirements and desires. Second, they have their own preferences for how content should be delivered to them.

An agent may want to get an electronic copy of all the claim correspondence sent to the policyholder, even if some of those letters are printed and mailed.

Conversely, some agents may want to receive printed copies of every policy declaration because they still store them in filing cabinets.

Finally, agents also play an intermediary role in communications, adding personalization and content before the document is delivered to the policyholder.

Playbook for insurers to reduce regulatory risk, improve governance, and build lasting customer trust.

Step 3: Assess the Paper-to-Digital Transformation Effort

The final step is to assess the effort and funding required for creating and delivering certain communications electronically to certain channels and devices.

As an example, it may be that an insurer is contemplating sending a first notice of loss acknowledgement letter via mobile app to a tablet device, or e-mailing the letter, or providing a link to a website.

The tablet option may be the “coolest” and most advanced option, but it might also be the most expensive. And it may turn out that it is prohibited by state regulations, or that a few claimants really want the letter that way – an e-mailed PDF would be just fine, thank you. So, before you begin, get a quick reading on the effort and costs.

These quick steps provide sensible trade-offs when prioritizing plans to convert communications from paper to digital. A full treatment of this topic is more involved but suffice to say that long nights and spreadsheets will probably be involved in mapping out the best combinations of communications to create and deliver through digital channels.

It’s not about digitizing everything—it’s about digitizing what makes sense for customers, agents, and compliance teams alike.

The Real Challenges of Paper-to-Digital Communication

The journey from paper to digital isn’t just about technology—it’s about transformation in mindset and method.

The biggest hurdle is the regulatory complexity. In some regions, insurers still must mail certain notices by law. Rules differ by product, state, and even document type. It’s a moving target, and staying compliant requires constant monitoring.

Legacy systems pose another obstacle. Many insurers run decades-old platforms built long before digital communication existed. Integrating them with modern CCM solutions can be difficult, often leading to duplicate workflows that drain time and resources.

Then there’s data privacy, a concern that grows with every click. Customers trust insurers with sensitive financial and personal data. Each new channel must meet security standards like GDPR, HIPAA, or local data protection laws.

Finally, the human factor matters most. Some customers, especially older policyholders, prefer a gradual transition. Forcing everyone into digital-only communication can alienate loyal clients. A flexible approach, offering both digital and paper options, often delivers better adoption.

The path isn’t without friction, but understanding these challenges early helps insurers plan a transformation that’s realistic, compliant, and sustainable.

How Cincom Eloquence Simplifies the Transformation

The paper-to-digital journey doesn’t have to feel overwhelming. With Cincom Eloquence®, insurers can modernize communication one step at a time—without losing control, compliance, or connection.

Eloquence brings everything—content creation, document generation, and delivery—into one smart platform. It helps insurers deliver messages consistently across print, email, mobile, and portal channels.

What sets Eloquence apart is its balance of structure and flexibility. It’s designed for insurance complexity but simple enough for everyday use.

Here’s how it makes a difference:

- Regulation-ready content: Eloquence keeps templates compliant across jurisdictions, so every document meets required standards automatically.

- Unified communication: Whether it’s a claims update or a renewal notice, the same approved message goes through any chosen channel.

- Automated accuracy: Routine documents are generated instantly with built-in business rules, cutting manual errors and delays.

- Adaptable rollout: Insurers can digitize in phases—starting small, learning fast, and scaling confidently.

Eloquence doesn’t replace human judgment. It enhances it. It allows insurers to focus on what matters most—clear, timely, and personalized communication that builds trust.

Conclusion

Digital communication is shaping the next era of insurance. The paper-to-digital transformation in CCM isn’t about abandoning tradition—it’s about adapting to how people live and communicate today. By listening to customers, partnering with agents, and assessing each step with care, insurers can create digital experiences that feel effortless, not forced.

With a solution like Cincom Eloquence, this transformation becomes achievable. It brings clarity to complexity, turning everyday communication into a strategic advantage.

The result isn’t just fewer papers but also stronger connections, faster service, and a smarter, more responsive way to engage every policyholder.

FAQs

1. How can insurers make digital communication more personalized?

Digital communication can be personalized by addressing customers by name and sending information that aligns with their policy type, which builds stronger engagement.

2. How do insurers decide which documents to digitize first?

They often begin with documents that are simple and frequent, like billing or renewal notices. Complex and regulated documents follow once compliance checks are complete.

3. How can agents and producers help with paper-to-digital transformation?

Agents understand customer preferences. Their input helps insurers decide which communications can go digital and which still need to be printed.

4. How does Cincom Eloquence support digital transformation?

Cincom Eloquence lets insurers design, manage, and deliver communications across digital and paper channels from one platform.