Introduction

In 2026, many insurers are hitting a wall with their digital transformation. The primary reason? They are trying to force their core systems to behave like communication platforms. While the debate of core systems vs. CCM for customer documents is an old one, the stakes have shifted. Your core system is designed to be a “System of Record”; it is excellent at calculating premiums and storing policy data. It is not, however, designed to be a “System of Engagement.”

Relying solely on a core system’s document module creates a massive bottleneck. These modules often produce static, rigid documents that look like they belong in 1998. In a market where policyholders expect instant, mobile-friendly, and highly personalized interactions, a basic PDF is a failure of service. If your business users have to wait for an IT sprint just to update a logo or change a regulatory clause in a form, your architecture is holding you back.

True intellectual leadership in insurance operations means recognizing that data management and document experience are two different disciplines. To compete today, you need a dedicated CCM layer that pulls the “truth” from your core but delivers the “experience” through a specialized engine.

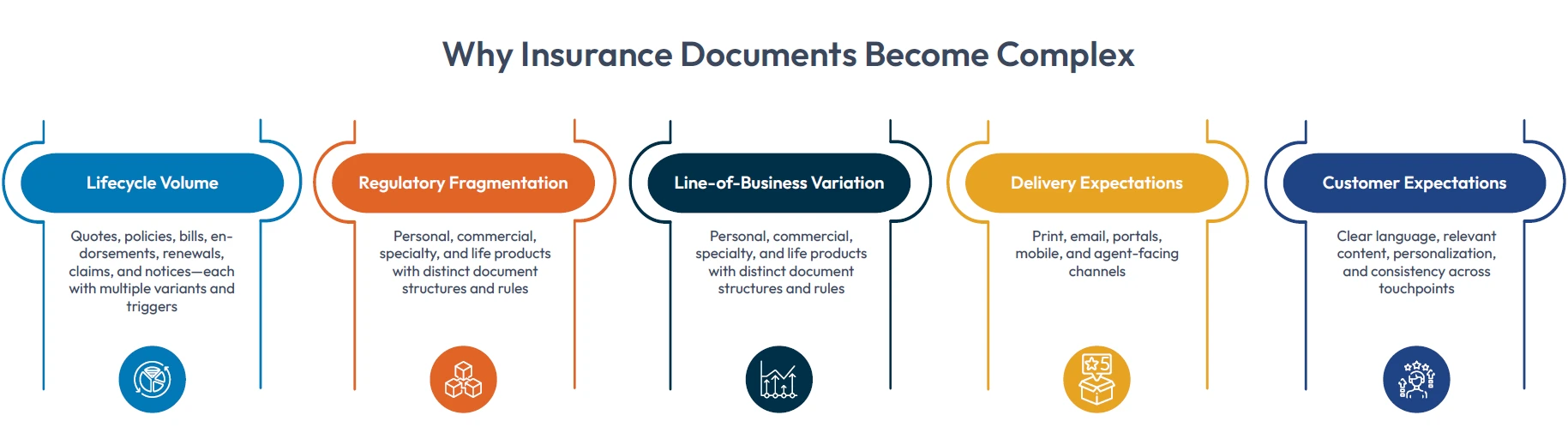

The Reality of Insurance Document Complexity

Insurance documents do not exist in isolation. They accumulate quotes, bonds, endorsements, renewals, claims, and cancellations. What begins as a compliance requirement quickly becomes an operational ecosystem. Over time, this ecosystem defines an insurer’s insurance document generation strategy, whether intentionally or by default.

Regulatory obligations further intensify the challenge. Requirements vary by jurisdiction and by line of business, creating layers of content that must remain accurate, auditable, and timely. Complexity is not an exception in insurance documentation. It is the operating condition.

At scale, documents are no longer just outputs. They are evaluated and remembered. Inconsistency creates friction, and unclear messaging creates cost. In a digital environment, policy document production and brand consistency influence customer perception as much as product and price.

How Strong Is Your Insurance Customer Communications Strategy? Evaluate Now

The “System of Record” vs. “System of Engagement”

Intellectual clarity in insurance operations starts with a simple distinction: your core system is the brain (holding the data), but your CCM is the voice (communicating the value).

Core Systems are built for transactional integrity. They ensure that a claim is processed and a premium is calculated. However, their document modules are essentially “afterthoughts.” They operate on a rigid, code-heavy architecture where even a simple change to a footer requires an IT ticket and a multi-week deployment cycle.

CCM Platforms are built for the “Last Mile.” They treat the document as a dynamic asset. By decoupling the content from the core data, CCM allows business users to pivot instantly, launching a new digital-first policy or updating a state-mandated disclosure in minutes.

Core Systems vs. CCM for Customer Documents

| Strategic Capability | Core System Document Modules | Dedicated CCM Platform |

| Ownership | IT-Centric: Requires developers to change templates. | Business-Centric: Low-code tools for marketing/legal teams. |

| Agility | Slow: Bound to core release cycles and “sprints.” | Instant: Update one “logic block” and sync across 50 states. |

| Format | Static: Produces fixed-width PDFs (paper-first). | Liquid: Responsive HTML, SMS, and secure app delivery. |

| Intelligence | Linear: Simple “if/then” data merging. | Contextual: Data-driven content assembly based on behavior. |

| Compliance | Fragmented: Hard-coded rules across multiple systems. | Centralized: Single “source of truth” for legal clauses. |

This expanded structure provides a deep, intellectual dive into the operational advantages of a CCM. By grouping these four pillars, you position your product as a comprehensive governance and experience layer that legacy systems simply cannot match.

The Four Pillars of Strategic Document Orchestration

The divide between core systems vs. CCM for customer documents is the difference between a static back office and a high-velocity digital brand. To bridge this gap, your insurance document generation strategy must rest on four pillars that turn documents from operational costs into customer assets.

#Pillar 1: Agile Content Control and IT Decoupling

The single greatest bottleneck in insurance today is the deployment lag. When document logic is hard-coded into your core system, a simple change to a logo or a legal disclosure becomes a three-month IT project.

- Business User Empowerment: Move template ownership from IT to marketing and legal teams through a low-code visual editor.

- Decoupled Release Cycles: Update and deploy communication templates instantly without waiting for the next core system maintenance window.

- Effective Dating: Schedule future document changes to go live at a precise second, ensuring perfect alignment with new product launches.

- Conditional Logic Blocks: Use a single template that automatically swaps content based on policy data, reducing the total number of templates to maintain.

#Pillar 2: Omnichannel Delivery to Policyholders

Policyholders today have digital overwhelm. They delete emails and ignore mail. Your documents must be liquid and able to flow into whatever channel the customer is actually using.

- Responsive HTML Conversion: Automatically transform flat PDF data into mobile-optimized web views that don’t require zooming or scrolling.

- Digital-First Triggers: Push real-time alerts via SMS or WhatsApp with secure links directly to the policyholder’s personalized document.

- Interactive Portals: Allow customers to engage with their documents, such as clicking a “Pay Now” button directly within a digital billing statement.

- Preference Management: Respect customer choices by automatically routing documents to their preferred channel—print, email, or app—from a single source.

#Pillar 3: Policy Document Production and Brand Consistency

Using a dedicated CCM ensures policy document production and brand consistency across every department, from underwriting to claims.

- Global Style Sheets: Apply branding, fonts, and logos across thousands of forms simultaneously to ensure a unified professional look.

- Standardized Clause Libraries: Create a “single source of truth” for frequently used paragraphs, ensuring that every department uses the same approved language.

- Dynamic Data Mapping: Seamlessly pull complex data from multiple core systems (Billing, Claims, and Policy) into a single, cohesive customer communication.

- Quality Assurance Workflows: Implement built-in approval routing so that no document goes live without being vetted by the brand and legal teams.

#Pillar 4: Regulatory Compliance and Audit Readiness

In a heavily regulated industry, your documents are your primary legal defense. A CCM acts as a compliance firewall that legacy core systems are not equipped to provide.

- Automated Accessibility: Ensure every digital document is born “accessible” with automatic tagging for screen readers, shielding your firm from ADA/EAA-related lawsuits.

- Tamper-Proof Audit Trails: Maintain a complete history of who edited a document, who approved it, and exactly when it was delivered to the customer.

- State-Specific Variance Management: Automatically insert the correct state-mandated disclosures based on the risk location, eliminating the risk of “wrong form” penalties.

- Post-Delivery Tracking: Track exactly when a customer opened a digital document, providing definitive proof of delivery for critical legal notices.

Why CCM Is Becoming a Strategic Requirement

Insurance organizations are being forced to rethink how they speak, not just what they sell. The operating model has shifted, and communication has moved closer to the center of the enterprise.

In this environment, communication cannot remain an operational afterthought. It becomes a structural capability, one that determines whether an insurer can respond with speed, clarity, and intent.

The Integration Framework: A 4-Step Roadmap

We know that you cannot simply replace a core system that handles your entire book of business. The most effective insurance document generation strategy is to treat the core system as the engine and the CCM as the high-definition dashboard.

To achieve this, we recommend a phased integration framework that minimizes risk while maximizing policy document production and brand consistency.

Step 1: Identify the “Data Payload”

Before any technical work begins, you must define what data the CCM needs to consume. Instead of a messy “dump” of all policy information, identify the specific fields required for communication.

- Customer Identifiers: Names, addresses, and preferred contact channels.

- Policy Specifics: Coverage limits, deductibles, and effective dates.

- Variable Triggers: Claims status updates or billing amounts.

- Strategic Outcome: By defining this “data payload” early, you ensure the integration is lean and fast, reducing the processing load on your core system.

Step 2: Establish the Connection Architecture

Modern methods for integrating core systems and CCM solutions generally follow one of two paths, depending on your organization’s technical maturity:

- The API-First Path (Recommended): Your core system pushes data to the CCM via RESTful APIs the moment a transaction occurs. This allows for real-time delivery, such as sending a digital ID card seconds after a policy is bound.

- The Shared Data Folder Path: For legacy systems that lack robust APIs, the core system can drop data files (like XML or JSON) into a secure “watch folder” that the CCM automatically monitors and processes.

Step 3: Implement “Global Component” Mapping

Once the connection is live, you map that data to your “Global Components.” This is where you solve the brand consistency problem.

- Reusable Blocks: Map the “State Code” data from your core to a specific “Legal Disclosure” block in the CCM.

- Brand Rules: Ensure that regardless of whether data comes from the Claims system or the Billing system, it always flows into a template with the same fonts, logos, and headers.

- Strategic Outcome: You create a “single source of truth” for your brand while the core system remains the “single source of truth” for your data.

Step 4: The “Feedback Loop” and Archive

Integration should never be a one-way street. A sophisticated CCM should send data back to your core system to keep the “System of Record” updated.

- Proof of Delivery: The CCM notifies the core system exactly when an email was opened or an SMS link was clicked.

- Automated Archiving: The final generated document is automatically pushed back into your enterprise content management (ECM) or the core system’s “attachments” tab for easy retrieval by adjusters and agents.

- Strategic Outcome: Your staff never has to leave the core system to see what was sent to the customer, even though the document was generated elsewhere.

Final Thoughts

The debate over core systems vs. CCM for customer documents is moving toward a clear consensus. The future of insurance belongs to companies that can pivot from static processing to dynamic engagement. Your documents are not just paperwork. They are the primary interface of your brand and the most frequent touchpoint you have with your policyholders. A modern insurance document generation strategy recognizes that while your core system is the foundation, a dedicated CCM is the architect of your customer experience.

By integrating core systems and CCM solutions, you ensure that your technical infrastructure supports your business goals rather than hinders them.

If you are ready to bridge the gap between your back office data and front office experience, Cincom Eloquence is the specialized engine you need.

FAQs

1. Why shouldn’t we use our Core System for all customer documents?

Core systems are built for data integrity but lack communication flexibility. Using them for document creation often creates an IT bottleneck where simple changes take months. A CCM gives business teams the agility to update documents without touching core code.

2. Is integrating a CCM with my current systems high risk?

No. Integrating core systems and CCM solutions is a layering process rather than a replacement. Modern platforms like Cincom Eloquence connect via APIs to pull live data. This allows you to upgrade your insurance document generation strategy without disrupting existing back office operations.

3. How does a CCM ensure brand consistency?

A CCM uses a centralized library to manage policy document production and brand consistency. When you update a logo or disclosure once, it automatically syncs across every department and document type. This ensures a unified professional image for every customer touchpoint.

4. Can a CCM help with regulatory compliance and audits?

Yes. Dedicated CCMs provide tamper-proof audit trails and locked legal content blocks. This ensures every document sent is compliant with current state laws. It also provides a clear history for regulators during an audit, proving exactly what was sent and when.

5. What makes Cincom Eloquence different from standard core modules?

Cincom Eloquence offers a low-code environment specifically for business users. While core modules produce static PDFs, Eloquence delivers liquid content optimized for mobile and SMS. It ensures your communications meet modern expectations while reducing the burden on your IT staff.