Insurance Big Data – FST Media The Future of Insurance 2016 Post Event Blog

I recently attended FST Media’s Future of Insurance Conference in Sydney. While the format experienced a minor shake up; single day, increased vendors on stage, less exhibition, the event had a sense of familiarity to it. It was still jam-packed with great presenters talking about the some interesting topics; Customer Experience, leveraging insurance Big Data, and devices however, what was most insightful to me was hearing insurers responses to ‘the dark side of Big Data’ discussion.

We are now at a time when the industry’s ethics is being questioned and challenged it was evident that industry players themselves are starting to reflect on the dangers and “creepiness” technological advances are bringing and not just focusing on all the benefits to the insurers.

Technology has infiltrated itself at the atomic level according to Anastasia Cammaroto, BT. The explosion of data caused by the Internet Of Things (IoT) has only just started and it’s the tip of the iceberg; Andrew Parton from EY pointed out that only 20% of the available customer data is actually used.

Social Data has made its entry, not only when looking for signals of frauds but also to provide further insight into the customers’ lifecycles. According to Lee Morgan of Metlife, analysts will be able to predict a customer’s lifestyle with 95% accuracy. Leveraging behavioural economics, insurance big data, gamification (ref Alexis George, ANZ Wealth), and wearable devices, the industry is now gearing itself up to guide the disengaged millennials as to what decisions to make and when.

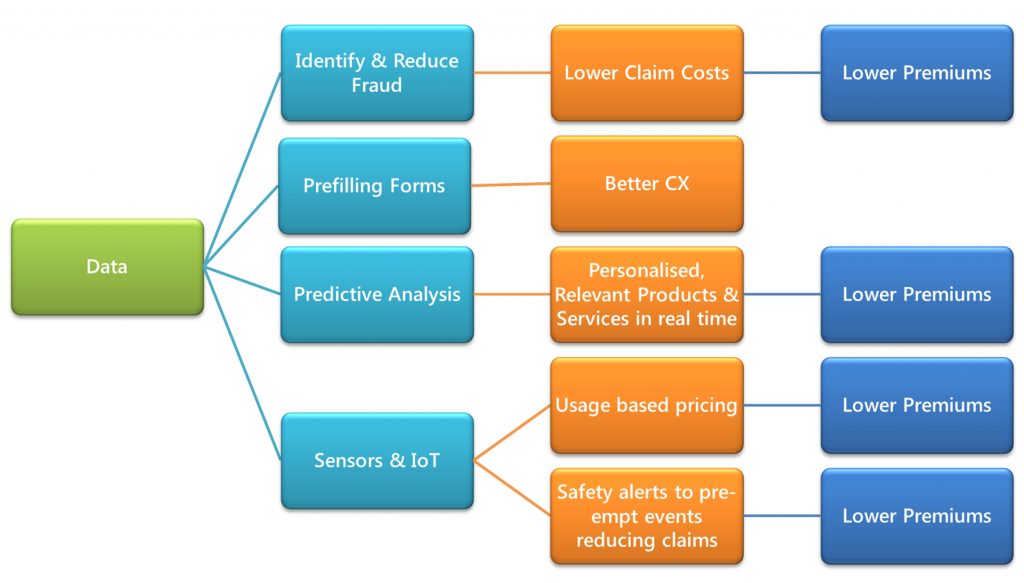

There is no doubt that leveraging insurance big data, social data, and analytics can bring some significant benefits in areas such as:

Opt–In Data

At the conference, both ANZ Wealth and MLC mentioned having data gathering initiatives using wearable devices, based on opt-in. The stated intent is to help and encourage their customers to have a healthier lifestyle by rewarding them for “healthy” activities such as doing the recommended daily 10,000 steps. The rewards range from premium discounts, to shopping vouchers or charity donations.

There are tremendous benefits of course in encouraging “healthy” lifestyles; however, one could argue that the benchmarks defined around “healthy” have a tendency to shift. It wasn’t so long ago that our recommended food pyramid was promoting a high carbohydrate intake. Even the commonly used BMI is being challenged and deemed outdated. Can insurance providers be trusted to set customers health KPIs that are based on up to date benchmark?

The danger here is that by drilling into such personal details the industry is going to segment the customer base at an even more granular level: the individual. What will happen to the premium if the customer is unable to meet those KPIs over a period of time? Or will this create a new industry: the FitBit Walker where for an affordable price, a reliable fit person will take your FitBit out each day to make sure you qualify for the rewards?

While so far, those initiatives have been based on an opt-in basis, would not opting-in flag you as someone who might have something to hide and should pay a higher premium?

Sensors & Devices

Going by what Andrew Parton from EY prediction that the prevalence and range of sensors will be the biggest disruptor to the insurance sector, then as consumers we need to set some boundaries as to how far we are willing to share and under what circumstances.

While we can’t argue against the benefits leveraging insurance big data to provide personalised products, services and pricing, the industry, so far, has lost the trust of the consumer.

While leveraging the technology and data can significantly help the industry to regain the confidence of the market, it can equally further deepen the chasm.

As the industry knows, consumers will easily express their opinions on social media, and the consequences can be dire.